Management’s Report on Financial Position and Operating Results

For the year ended December 31, 2018

Exhibit 99.3

Management’s Report on Financial Position and Operating Results

For the year ended December 31, 2018

LETTER TO SHAREHOLDERS

Dear Fellow Shareholders,

IMV made significant advancements in 2018. Foundational changes, including shifting the name of the corporation to IMV and listing on Nasdaq, are enabling us to access to a larger pool of investors and allow us to better communicate our value proposition globally. However, the evolution of our clinical program is an even more important accomplishment: we entered into a collaboration with Merck across five tumor types; opted, based on DeCidE clinical data, to pursue DPX-Survivac as a monotherapy in ovarian cancer; and published studies clearly demarcating the T cell-activating novel mechanism of action of our DPX platform. With these milestones achieved, we are looking forward to a strong 2019 in which we will continue to advance our pipeline, drive value for investors, and support unmet patient needs.

IMV anticipates continued progress on several important milestones over the next year, which include:

Topline data from the corporation-sponsored phase 2 monotherapy trial in ovarian cancer;

Topline data from the combination phase 2 trial with Merck in diffuse large B-cell lymphoma (DLBCL); and

Preliminary data from the phase 2 basket trial collaboration with Merck.

2018 Highlights

Clinical Programs - DeCidE1/2

Updated phase 1b data shared via an oral presentation at the 2018 ASCO Meeting and topline data from the first two phase 1b dosing cohorts highlighted at the 2018 ESMO-IO Meeting.

Based on these data, IMV opted to develop DPX-Survivac as a monotherapy in certain ovarian cancer patients defined by BTB (baseline tumor burden), an indication of tumour size.

Additional analyses were conducted that correlated DPX-Survivac’s novel MOA - the level of T cell infiltration - with clinical response.

Met with the U.S. Food and Drug Administration (FDA) and submitted an updated DECIDE trial protocol. In addition, IMV discussed with the Agency the need for accelerated approvals in advanced ovarian cancer and received guidance on clinical design considerations for different lines of therapy and platinum-sensitive and resistant patients.

Additional Clinical Highlights

First clinical data obtained from the combination of DPX-Survivac and mCPA with Keytruda® (SPiReL trial), which came from an investigator-sponsored phase 2 trial in patients with persistent or recurrent/refractory DLBCL; data from the combination signaled significant anti-cancer activity in three of the first four evaluable patients as well as a tolerable safety profile.

Announced a collaboration with Merck in a phase 2 basket trial evaluating the safety and efficacy of DPX-Survivac, low- dose cyclophosphamide, and Keytruda® (pembrolizumab) in patients with select advanced or recurrent solid tumors across five different indications: bladder, liver (hepatocellular carcinoma), ovarian, or non-small cell lung (NSCLC) cancers as well as tumors with the microsatellite instability high (MSI-H) biomarker.

R&D Milestones

Research published in the Journal of Biomedical Science demonstrated the association between IMV’s proprietary immune- targeted delivery technology and enhanced efficacy in slowing tumor progression.

New data presented at the 2018 AACR Meeting highlighted the novel MOA underscoring the Corporation’s T cell-activating DPX technology and the potential for heightened anti-cancer activity of combination therapies based on IMV’s proprietary delivery platform.

Operational Highlights:

Completion of two public offerings: In February 2018 and in March 2019 for a total of approximately $43.9 million.

Nasdaq listing and share consolidation: IMV’s common shares commenced trading on the Nasdaq Stock Market LLC on June 1, 2018.

Corporate name change: Because the MOA of DPX-based candidates signals a new class of immunotherapies that is differentiated from vaccines, IMV leadership changed the Corporation’s name from Immunovaccine to IMV to better reflect the true potential of its therapeutic candidates.

Addition of Julia P. Gregory and Dr. Markus Warmuth to the Corporation’s Board of Directors: Ms. Gregory is a seasoned biotechnology executive, having served as Chief Executive Officer and of ContraFect Corporation and the immuno- oncology company Five Prime. Dr. Warmuth brings to the Board more than 20 years of drug discovery experience with a strong focus on targeted therapy and immuno-oncology programs.

Expansion of management team: IMV named Joseph Sullivan as the Corporation’s first Senior Vice-President, Business Development. Mr. Sullivan brings with him over 25 years of global pharmaceutical experience with Merck & Co. Inc. to IMV.

Opening of new facility in Dartmouth, Nova Scotia: Nearly tripling the functional workspace, the new premises features upgraded facilities and equipment as well as increased laboratory size to support long-term growth.

We are still making great progress and are grateful for the continued support of our partner Merck, as well as our shareholders and our employees, and look forward to the opportunities throughout 2019, and beyond.

Frederic Ors

Chief Executive Officer

3

MANAGEMENT DISCUSSION AND ANALYSIS (“MD&A”)

The following analysis provides a review of the audited annual consolidated results of operations, financial condition, and cash flows for the year ended December 31, 2018 (“Fiscal 2018”), with information compared to the year ended December 31, 2017 (“Fiscal 2017”), for IMV Inc. (“IMV” or the “Corporation”). This analysis should also be read in conjunction with the information contained in the audited consolidated financial statements and related notes for the years ended December 31, 2018 and December 31, 2017.

The Corporation prepares its audited annual consolidated financial statements in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (IASB). Management is responsible for the preparation of the consolidated financial statements and other financial information relating to the Corporation included in this report. The Board of Directors is responsible for ensuring that management fulfills its responsibilities for financial reporting. In furtherance of the foregoing, the Board of Directors has appointed an Audit Committee comprised of independent directors. The Audit Committee meets with management and the auditors in order to discuss the results of operations and the financial condition of the Corporation prior to making recommendations and submitting the consolidated financial statements to the Board of Directors for its consideration and approval for issuance to shareholders. The information included in this MD&A is as of March 21, 2019, the date when the Board of Directors approved the Corporation’s audited annual consolidated financial statements for the year ended December 31, 2018, on the recommendation of the Audit Committee.

Amounts presented in this MD&A are approximate and have been rounded to the nearest thousand except for per share data. Unless specified otherwise, all amounts are presented in Canadian dollars.

Additional information regarding the business of the Corporation, including the Annual Information Form of the Corporation for the year ended December 31, 2018 (the “AIF”) and included in the Corporation’s registration statement on Form 40-F filed with the U.S. Securities and Exchange Commission, is available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov/edgar.

FORWARD-LOOKING STATEMENTS

Certain statements in this MD&A may constitute “forward-looking” statements which involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance, or achievements of the Corporation, or industry results, to be materially different from any future results, performance, or achievements expressed or implied by such forward-looking statements. When used in this MD&A, such statements use such words as “will”, “may”, “could”, “intends”, “potential”, “plans”, “believes”, “expects”, “projects”, “estimates”, “anticipates”, “continue”, “potential”, “predicts” or “should” and other similar terminology. These statements reflect current expectations of management regarding future events and operating performance and speak only as of the date of this MD&A. Forward-looking statements include, among others:

The Corporation’s business strategy;

Statements with respect to the sufficiency of the Corporation’s financial resources to support its activities;

Potential sources of funding;

The Corporation’s ability to obtain necessary funding on favorable terms or at all;

The Corporation’s expected expenditures and accumulated deficit level;

The Corporation’s expected outcomes from its ongoing and future research and research collaborations;

The Corporation’s exploration of opportunities to maximize shareholder value as part of the ordinary course of its business through collaborations, strategic partnerships, and other transactions with third parties;

The Corporation’s plans for the research and development of certain product candidates;

The Corporation’s strategy for protecting its intellectual property;

The Corporation’s ability to identify licensable products or research suitable for licensing and commercialization;

The Corporation’s ability to obtain licences on commercially reasonable terms;

The Corporation’s plans for generating revenue;

The Corporation’s plans for future clinical trials; and

The Corporation’s hiring and retention of skilled staff.

Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not such results will be achieved. A number of factors could

4

cause actual results to differ materially from the results discussed in the forward-looking statements, including, but not limited to, the factors discussed in the AIF, under the heading “Risk Factors and Uncertainties.” Although the forward-looking statements contained in this MD&A are based upon what management of the Corporation believes are reasonable assumptions, the Corporation cannot provide any assurance to investors that actual results will be consistent with these forward-looking statements and should not be unduly relied upon by investors.

Actual results, performance and achievements are likely to differ, and may differ materially, from those expressed or implied by the forward-looking statements contained in this MD&A. Such statements are based on a number of assumptions which may prove to be incorrect, including, but not limited to, assumptions about:

Obtaining additional funding on reasonable terms when necessary;

Positive results of pre-clinical studies and clinical trials;

The Corporation’s ability to successfully develop existing and new products;

The Corporation’s ability to hire and retain skilled staff;

The products and technology offered by the Corporation’s competitors;

General business and economic conditions;

The Corporation’s ability to protect its intellectual property;

The Corporation’s ability to manufacture its products and to meet demand; and

Regulatory approvals.

These statements reflect management’s current views and beliefs and are based on estimates, assumptions, and information currently available to, and considered reasonable by, management. The information contained herein is dated as of March 21, 2019, the date of the Board’s approval of the Fiscal 2018 audited annual consolidated financial statements and of the MD&A. For additional information on risks, uncertainties, and assumptions, including a more detailed assessment of the risks that could cause actual results to materially differ from current expectations, please refer to the AIF of IMV filed on SEDAR at www.sedar.com and included in the registration statement on Form 40-F filed on EDGAR at www.sec.gov/edgar.

CORPORATE OVERVIEW

IMV is a clinical-stage biopharmaceutical company dedicated to making immunotherapy more effective, more broadly applicable, and more widely available to people facing cancer and other serious diseases. IMV is headquartered in Dartmouth, Nova Scotia and had 51 full time employees as at December 31, 2018. IMV is pioneering a new class of immunotherapies based on the Corporation’s proprietary drug delivery platform (“DPX”). This patented technology leverages a novel mechanism of action (“MOA”) discovered by the Corporation. This MOA does not release the active ingredients at the site of injection but forces an active uptake and delivery of active ingredients into immune cells and lymph nodes. It enables the programming of immune cells in vivo, which are aimed at generating powerful new synthetic therapeutic capabilities. DPX no-release MOA can be leveraged to generate “first-in-class” T cell therapies with the potential to be transformative in the treatment of cancer.

DPX also has multiple manufacturing advantages: it is fully synthetic; can accommodate hydrophilic and hydrophobic compounds; is amenable to a wide-range of applications (for example, peptides, small-molecules, RNA/DNA and antibodies); and provides long term stability as well as low cost of goods. The Corporation’s first cancer immunotherapy uses survivin-based peptides licensed from Merck KGaA, on a world-wide exclusive basis, formulated in DPX (“DPX-Survivac”). DPX-Survivac leverages the MOA of DPX to generate a constant flow of T cells in the blood that are targeted against survivin expressed on cancer cells. It is comprised of five minimal MHC class I peptides to activate naïve T cells against survivin.

Survivin is a well characterized and recognized tumour associated antigen known to be expressed during fetal development and across most tumour cell types, but it is rarely present in normal non-malignant adult cells. Survivin controls key cancer processes (apoptosis, cell division, and metastasis) and has been associated with chemoresistance and cancer progression. It has been shown that survivin was expressed in all 60 different human tumour lines used in the National Cancer Institute’s cancer drug screening program and documented in the literature to be overexpressed in more than 20 indications.

Foremost, the Corporation’s clinical strategy is to establish monotherapy activity of DPX-Survivac in order to increase value, de-risk clinical development, and to target late stage unmet medical needs for a shorter path to clinical demonstration and first regulatory approval. In addition we are evaluating DPX Survivac in combination with Merck's KEYTRUDA® checkpoint inhibitor in multiple oncology targets.

The Corporation is focusing on a fast path to market in ovarian and diffuse large B cell lymphoma (“DLBCL”) cancers and on repeating its clinical demonstrations of activity in other indications.

5

DPX-Survivac is currently being tested in:

A phase 2 clinical trial that evaluates DPX-Survivac in an open label safety and efficacy study in ovarian cancer patients with advanced platinum-sensitive and resistant ovarian cancer with sum of base line target lesions per Response Evaluation Criteria in Solid Tumours (“Recist criteria”) less than five centimeters;

Two investigator-sponsored phase 2 clinical trials in combination with the checkpoint inhibitor Keytruda® (pembrolizumab) of Merck & Co Inc. (“Merck”) in patients with recurrent, platinum-resistant, and sensitive ovarian cancer and in patients with measurable or recurrent diffuse large B cell lymphoma (“DLBCL”); and

A phase 2 basket trial in combination with Merck’s Keytruda® (pembrolizumab) in patients with select advanced or recurrent solid tumours in bladder, liver (hepatocellular carcinoma), ovarian, or non-small-cell lung (NSCLC) cancers, as well as tumours shown to be positive for the microsatellite instability high (MSI-H) biomarker.

In infectious disease vaccine applications, the Corporation has completed a demonstration phase 1 clinical trial with a target against the respiratory syncytial virus (“RSV”). The Corporation also has a commercial licensing agreement with Zoetis for the development of two cattle vaccines and is also conducting several research and clinical collaborations, including a collaboration with the Dana-Farber Cancer Institute (“Dana-Farber”) for Human Papillomavirus (“HPV”) related cancers and with Leidos, Inc. (“Leidos”) in the United States for the development of vaccine candidates for malaria and the Zika virus.

The common shares of the Corporation are listed on the Nasdaq Stock Market LLC and on the Toronto Stock Exchange under the symbol “IMV.”

BUSINESS MODEL AND STRATEGY

IMV is dedicated to making immunotherapy more effective, more broadly applicable, and more widely available to people facing cancer. The Corporation’s lead product candidate, DPX-Survivac, has demonstrated the ability to induce prolonged T cell activation leading to tumour regressions in advanced ovarian cancer and is currently being used in clinical trials as a monotherapy and in combination with Merck’s KEYTRUDA® checkpoint inhibitor.

Foremost, the Corporation’s clinical strategy is to establish monotherapy activity of DPX-Survivac in order to increase value, de-risk clinical development, and to target late stage unmet medical needs for a shorter path to clinical demonstration and first regulatory approval, and to establish strategic partnerships to support further development and commercialization. In addition, we are evaluating DPX Survivac in combination with Merck's KEYTRUDA® checkpoint inhibitor in multiple oncology targets.

The Corporation is focusing on a fast path to market in ovarian and diffuse large DLBCL cancers and on repeating its clinical demonstrations of activity in other indications.

In collaboration with commercial and academic partners, the Corporation is also expanding the application of DPX as a delivery platform for other applications. Pre-clinical and clinical studies have indicated that the platform may allow for the development of enhanced vaccines for a wide range of infectious diseases by generating a stronger and more durable immune response than is possible with existing delivery methods.

The Corporation intends to be opportunistic in the development of products by exploring a variety of avenues, including co-development through potential collaborations, strategic partnerships or other transactions with third parties. The Corporation may seek additional equity and non-dilutive funding and partnerships to advance the development of its product candidates.

PLATFORM AND PRODUCTS IN DEVELOPMENT

Delivery Platform

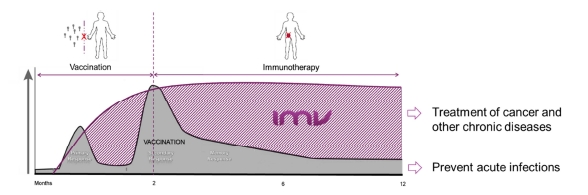

The DPX platform is a unique and patented formulation discovered by the Corporation that provides a new way to deliver active ingredients to the immune system using a novel MOA. This MOA does not release the active ingredients at the site of injection but forces an active uptake and delivery of active ingredients into immune cells and lymph nodes. IMV is exploiting this MOA to pioneer a new class of immunotherapies that represents a paradigm shift from current approaches. By not releasing the active ingredients at the site of injection, it bypasses the steps involved in conventional immune “native responses,” such as vaccines, and enables access and programming of immune cells in-vivo to generate new “synthetic” therapeutic capabilities. The DPX no-release MOA can be leveraged to generate “first-in-class” T cell therapies with the potential to be transformative in the treatment of cancer. The Corporation believes that the novel MOA of DPX makes the platform uniquely suitable for cancer

6

immunotherapies, which are designed to target tumour cells. DPX can induce prolonged, target-specific, and polyfunctional T cell activation, which are postulated to be required for effective tumour control.

Figure 1: Illustrative representation of IMV’s DPX new MOA

The DPX platform is based on active ingredients formulated in lipid nanoparticles and, after freeze drying, suspended directly into oil. DPX-based products are stored in the dry format, which provides the added benefit of an extended shelf life. The formulation is designed to be easy to re-suspend and administer to patients.

DPX also has multiple manufacturing advantages: it is fully synthetic; can accommodate hydrophilic and hydrophobic compounds; is amenable to a wide-range of applications (for example, peptides, small-molecules, RNA/DNA, or antibodies); and provides long term stability as well as low cost of goods.

The DPX platform forms the basis of all of IMV’s product development programs.

DPX-Survivac

Product Candidate Overview

DPX-Survivac, the Corporation’s first cancer immunotherapy candidate, uses survivin-based peptides licensed from Merck KGaA on a world-wide exclusive basis that are formulated in DPX. DPX-Survivac leverages the MOA of DPX to generate a constant flow of T cells in the blood that are targeted against survivin expressed on cancer cells, and it is comprised of five minimal MHC class I peptides to activate naïve T cells against survivin.

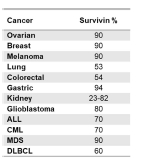

Survivin is a well characterized and recognized tumour associated antigen known to be expressed during fetal development and across most tumour cell types, but it is rarely present in normal non-malignant adult cells. Survivin controls key cancer processes (apoptosis, cell division, and metastasis) and has been associated with chemoresistance and cancer progression. It has been shown that survivin was expressed in all 60 different human tumour lines used in the National Cancer Institute’s cancer drug screening program and is documented in the literature to be overexpressed in more than 20 indications.

Figure 2: Examples of % of patients with survivin expression in different indications

IMMUNO-ONCOLOGY

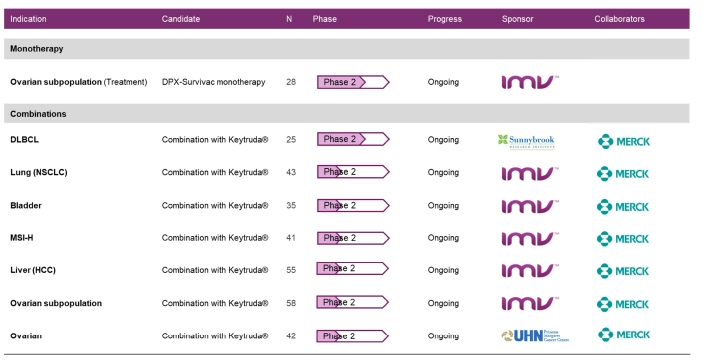

DPX-Survivac is being tested in 6 different cancer indications through multiple phase 2 clinical trials.

7

Ongoing Clinical Trials

DPX- Survivac - Ongoing Clinical Trials

Monotherapy

Ovarian subpopulation - DeCidE1 phase 2

The DeCidE1 (DPX-Survivac with low dose intermittent cyclophosphamide) phase 2 study is an open label safety and efficacy study for individuals with advanced platinum-sensitive and resistant ovarian cancer with sum of base line target lesions per Recist criteria less than five centimeters. Primary and secondary end points include:

Safety profile;

Objective Response Rate (ORR) and Duration of Response (DOR) using Recist 1.1 criteria;

Induction of systemic survivin-specific T-cells in the blood; and

Induction of T-cell infiltration into tumours.

The objective is to enroll up to 28 patients in this study.

In December, 2018, IMV met with the U.S. Food and Drug Administration (FDA) in a Type B meeting to discuss the results to date of its DeCidE1 clinical trial and continuing development plan, as well as to obtain agency guidance on a potential accelerated regulatory pathway for DPX-Survivac as a T-cell immunotherapy for the treatment of advanced ovarian cancer in patients with progressing disease.

The purpose of IMV's Type B meeting with the FDA was to request feedback on the design of the clinical program for DPX-Survivac. This program includes the continuing DeCidE1 phase 2 clinical study and a potential future registration trial for accelerated approval in a subset of ovarian cancer patients.

8

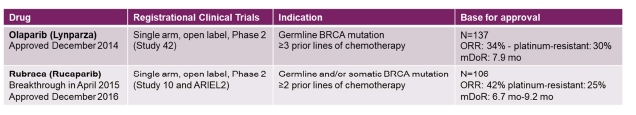

The FDA reviewed the Corporation’s proposed clinical development plan and acknowledged the potential for accelerated approvals in advanced ovarian cancer based on objective response rate (ORR) according to Recist 1.1 criteria with reported median duration of response (DOR). In addition, the FDA provided important guidance on clinical design considerations for different lines of therapy and platinum-sensitive and resistant patient populations.

Figure 3: Examples of previous US FDA accelerated approvals in ovarian cancer (source: FDA website)

In addition, IMV submitted a protocol amendment for a predictive enrichment approach to the phase 2 DeCidE1 trial, and further discussed those details with the FDA during the Type B meeting. The phase 2 primary end point, based on objective response rate (ORR) per Recist 1.1 criteria, is intended to confirm the high response rate and duration of clinical benefits observed in previously announced results in a patient population defined by a clinical biomarker based on baseline tumour burden (BTB).

The Corporation believes that there is still an urgent medical need in advanced recurrent ovarian cancer (Sources: 1. NCCN Guidelines Ovarian Cancer V2.2018; SEER Ovarian Cancer; JCO, vol 33; 32 Nov 2015, Gyn Onc 133(2014) 624-631):

Nearly 70% of ovarian cancers are diagnosed in advanced stage;

The overall 5-year survival rate is 46.5%, and only 29% for advanced disease;

Most patients develop advanced, platinum-resistant, poor prognosis disease; and

Limited options exist with current single-agents at 6-30% response rates and mPFS of 2.1 - 4.2 months.

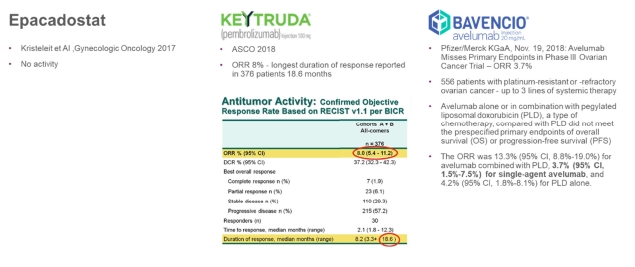

The Corporation believes that it has the potential to be “best-in-class” in the competitive landscape of recurrent ovarian cancer as other immunotherapeutic treatments tested in this patient population (Incyte’s epacadostat, Merck’s Keytruda, and Pfizer/Merck KGaA’s Bavencio) are unlikely to proceed into registration trials based on the published results available:

Figure 4: Recurrent ovarian cancer immunotherapy competitive landscape

Multiple clinical sites are now open for enrolment in the DeCidE1 phase 2 trial. Subject to phase 2 results, IMV plans to schedule a follow-up meeting with FDA to finalize the design of a potential pivotal trial based on ORR and DOR.

9

IMV expects to provide a clinical update at ASCO and investigators are also planning to submit the study findings for scientific publication.

The Corporation’s clinical strategy with this trial is to establish monotherapy activity in order to increase value and de-risk clinical development, and to target late stage unmet medical needs for a shorter path to clinical demonstration and first regulatory approval.

The Corporation currently anticipates that, in addition to general clinical expenses, which are distributed amongst the various clinical projects, the costs to complete this phase 2 clinical trial are estimated at $2,500,000 of which $1,000,000 is expected to occur in 2019.

Combinations

Phase 2 clinical trial in Diffuse large B-cell lymphoma (“DLBCL”) with Merck (investigator-sponsored)

This phase 2 study is a triple-combination immunotherapy in patients with measurable or recurrent diffuse large B-cell lymphoma led by Sunnybrook Research Institute. This investigator sponsored trial, announced initially in May 2017, is designed to evaluate the safety and efficacy of DPX-Survivac, Merck’s pembrolizumab, and low-dose cyclophosphamide. Primary and secondary end points include:

Safety profile; and

ORR and DOR using Recist 1.1 criteria.

The non-randomized, open label study is expected to enroll 25 evaluable participants at five centers in Canada.

Researchers conducting the investigator sponsored study are testing the novel immunotherapy combination in patients whose DLBCL expresses survivin, a tumour antigen highly expressed in 60 percent of DLBCL patients. DPX Survivac stimulates the immune system to produce T cell responses targeting survivin.

On November 8, 2017, the Corporation announced that Health Canada had granted Sunnybrook Research Institute regulatory clearance to begin recruiting patients. On March 28, 2018, the Corporation announced that the first patient had been treated.

On September 18, 2018, IMV announced details of the initial data from this clinical trial. The preliminary data included assessments of safety and clinical activity (based on modified Cheson criteriai) for the first four evaluable patients who have completed their first CT scan after the start of treatment. The data showed that:

Two of the first four evaluable participants showed tumour regressions at the first on-treatment CT scan:

The first enrolled participant demonstrated a tumour regression of 48% at first on-treatment scan; and

The second participant demonstrated a partial response (PR) via a tumour regression of 66% at first on- treatment scan.

Preliminary data from the third participant demonstrated stable disease.

The other participant had early disease progression less than two months following treatment initiation and was discontinued from the study.

The combination therapy appears to demonstrate an acceptable safety profile, with no serious adverse events reported to date.

i Cheson, B.D.,, Pfistner, B., Juweid, M.E., Gascoyne, R.D., Specht, L., Horning, S.J. and Diehl, V. (2007). Revised Response Criteria for Malignant Lymphoma. Journal of Clinical Oncology, 25(5) DOI: 10.1200/JCO.2006.09.2403

The Corporation expects to disclose topline results around the end of the second quarter of 2019 once provided by the investigator. The Corporation currently anticipates that, in addition to general clinical expenses, which are distributed amongst the

10

various clinical projects, its share of the cost to complete this study will be approximately $1,500,000, of which $1,000,000 is expected to be spent in 2019.

Phase 2 basket trial in 5 indications with Merck

On September 11, 2018, the Corporation announced the expansion of its clinical program with a phase 2 basket trial in collaboration with Merck evaluating its lead candidate, DPX-Survivac, in combination with low dose cyclophosphamide, and Merck’s anti-PD-1 therapy, KEYTRUDA® (pembrolizumab), in patients with select advanced or recurrent solid tumours.

The open-label, multicenter, phase 2 basket study will evaluate the safety and efficacy of the immunotherapeutic combination in patients with bladder, liver (hepatocellular carcinoma), ovarian, or non-small cell lung (NSCLC) cancers, as well as tumours shown to be positive for the microsatellite instability high (MSI-H) biomarker. Investigators plan to enroll more than 200 patients across five indications at multiple medical centers in Canada and the United States.

The American Society of Clinical Oncology (ASCO) defines a basket clinical study as a trial that investigates the effects of a drug regimen in multiple tumour types that share a common molecular target, regardless of where the disease originated.

This is the third clinical trial evaluating the combination of DPX-Survivac, low dose cyclophosphamide, and pembrolizumab in advanced recurrent cancers.

The Corporation expects to disclose preliminary data in the second half of 2019 and currently anticipates that, in addition to general clinical expenses, which are distributed amongst the various clinical projects, $5,000,000 is estimated to be spent in 2019 with a total of $12,600,000 for the safety lead-in for this trial.

Phase 2 clinical trial in ovarian cancer with Merck (investigator-sponsored)

In February 2017, the Corporation announced an investigator-sponsored phase 2 clinical trial in ovarian cancer in combination with Merck’s checkpoint inhibitor pembrolizumab in patients with recurrent, platinum-resistant ovarian cancer. University Health Network’s (“UHN”) Princess Margaret Cancer Centre will conduct the phase 2 non-randomized, open-label trial designed to evaluate the potential anti-tumour activity of the combination of pembrolizumab, DPX-Survivac, and low-dose cyclophosphamide. It is expected to enroll 42 subjects with advanced epithelial ovarian, fallopian tube, or primary peritoneal cancer. The study’s primary objective is to assess overall response rate. Secondary study objectives include progression free survival rate, overall survival rate, and potential side effects, over a five-year period. At this stage, the Corporation has no specific plan on the next steps after this trial as it will have to be assessed with its partner based on the clinical trial results.

The Corporation will disclose results once provided by the UHN Princess Margaret Cancer Centre and currently anticipates that, in addition to general clinical expenses, which are distributed amongst the various clinical projects, its share of the costs to complete this study, expected to be spent in 2019, are estimated at $400,000.

Clinical Trial Development - Completed Trials

Phase 1b Clinical trial in ovarian cancer with Incyte Corporation (“Incyte”)

In June 2015, the Corporation announced it had entered into a non-exclusive clinical trial collaboration with Incyte to evaluate the combination of DPX-Survivac with Incyte’s investigational oral IDO1 inhibitor epacadostat. This trial was an open-label, phase 1b study to evaluate the safety, tolerability, and efficacy of the combination in platinum resistant or sensitive ovarian cancer patients who are at high risk of recurrence. All patients enrolled in the trial had recurrent ovarian cancer with evidence of progressive disease. The investigational new drug (“IND”) application for the study was approved by the FDA and Health Canada in January 2016. The study was initiated on September 8, 2016 and the Corporation announced in March 2017 the first interim data analysis from this clinical study. Based on the interim analysis, the combination therapy appears to have an acceptable safety profile with a single grade 3 and single grade 4 event reported and no SAEs. At the time of the interim analysis, three of four patients exhibited stable disease, while a fourth patient progressed and exited the trial. In addition, researchers observed increased T cell activity in tumours in three of the four patients based on RNA sequencing and indications of early tumour shrinkage in the patient who has been in trial for the longest duration thus far (based on CT scan at day 140).

In December 2017, the Corporation provided positive topline clinical data. Initial results from 10 evaluable patients in the DPX-Survivac plus-100 milligrams epacadostat dosing cohort demonstrated a disease control rate of 70 per cent, including partial responses (PR, defined as equal to 30 percent decrease in tumour lesion size) in 30 percent of the patients (three out of 10). To date, the combination also exhibited a well-tolerated safety profile, with the majority of adverse events (AEs) reported as Grade 1 and Grade 2AE.

11

Blood tests indicated that the majority of treated patients exhibited targeted T cell activation. Tumour biopsies and analyses thus far have supported the reported MOA of this immunotherapy combination, with DPX-Survivac triggering T cell infiltration into the tumour. This T cell activation was also correlated with tumour regression.

Investigators completed enrolment of 10 evaluable patients for the study's first dosing cohort, which consisted of 100 mg epacadostat twice daily (BID), DPX-Survivac, and low-dose cyclophosphamide.

In the first dosing cohort, investigators observed:

A 30 percent overall response rate, with three out of 10 PRs;

Two of the patients exhibiting PRs had completed one year of treatment with responses continuing at 12 and 14 months, respectively;

Four patients (40 percent) had stable disease;

Two of the patients exhibiting stable disease were still enrolled in the trial, with one of those patients showing a 21 percent tumour reduction; and

A 70 percent disease control rate (defined as the total number of patients achieving complete response, partial response, and stable disease).

At the time of data cut-off, there were also preliminary data on the first three evaluable patients in the second dosing cohort evaluating the combination of 300 mg BID epacadostat, DPX-Survivac, and low-dose cyclophosphamide. From the first three evaluable patients, two showed stable disease, with one patient showing tumour regression of approximately 25 percent.

On April 24, 2018, the Corporation announced that it entered into an agreement with Incyte Corporation to expand the ongoing clinical trial collaboration. The Companies added a phase 2 component to their ongoing phase 1b combination study.

The phase 2 component was a randomized, open label, efficacy study that would include up to 32 additional evaluable subjects. It would evaluate DPX-Survivac and low dose cyclophosphamide with, or without, epacadostat in patients with advanced recurrent ovarian cancer. In accordance with regulatory guidelines for combination trials, the goal of this portion of the program was to evaluate the clinical contribution of each investigational drug in the combination regimen.

On November 20, 2018, the Corporation announced an amendment to its phase 1b/2 clinical trial evaluating the safety and efficacy of IMV’s lead candidate, DPX-Survivac, in combination with either 100 mg or 300 mg of epacadostat in patients with recurrent ovarian cancer.

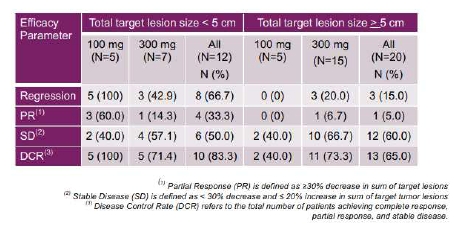

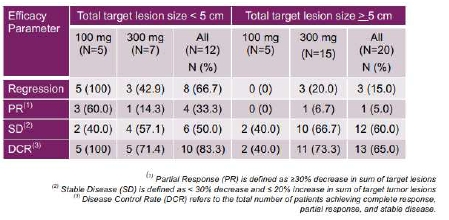

Review of new data from the phase 1b portion of that clinical trial demonstrate a high response rate and a durable clinical benefit in a subpopulation of patients with a clinical marker predictive of a response to DPX-Survivac and correlated to its novel MOA. New data include:

Efficacy signals in the subpopulation of patients who received 100 mg dose epacadostat (n=5) included 100% tumour regressions and 100% disease control rate; and 60% of these patients (3/5) reached a best response of a partial response (“PR”);

12

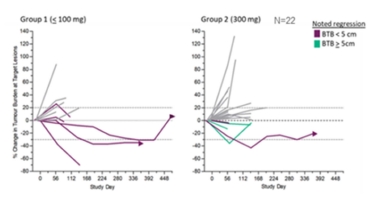

Figure 5: Phase 1b tumour regressions (ESMO-IO 2018)

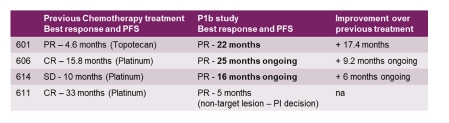

Long duration of clinical benefit observed in responders that lasted beyond treatment duration (1 year), median duration of 590 days, including one patient that has passed the two-year mark without disease progression, and prolonged tumour control observed in 3 out 4 PRs in that subpopulation.

Figure 6: Longer progression-free Survival (PFS) than previous chemotherapy treatment (ESMO IO 2018)

Clinical benefit correlated to DPX-Survivac’s MOA and the primary endpoints of survivin specific T cells in the blood and T cell infiltration into tumours; and

The safety profile of DPX-Survivac is consistent with the profile observed in the Corporation’s previously reported studies.

Based on 300 mg cohort results, IMV and Incyte have agreed to stop dosing patients with epacadostat. IMV will continue the phase 1b/2 trial as a monotherapy study evaluating DPX-Survivac in the recurrent ovarian cancer subpopulation. IMV will inform and work with investigators to appropriately modify the study in a manner consistent with the best interests of each patient.

IMV and Incyte will continue to explore the potential of additional combination studies.

On December 13, 2018, the Corporation announced that investigators shared new positive data from the Corporation’s ongoing DeCidE1 (DPX-Survivac with low dose Cyclophosphamide and Epacadostat) clinical trial at the 2018 ESMO Immuno-Oncology Congress. The phase 1b/2 study was evaluating the safety and efficacy of the combination of IMV’s lead candidate DPX-Survivac, low dose cyclophosphamide, and 100 mg or 300mg of Incyte’s IDO1 enzyme inhibitor epacadostat in patients with advanced recurrent ovarian cancer.

Key findings included:

Evidence of a clinical marker based on Baseline Tumour Burden (“BTB”), a measure of tumour size predictive of patient response to DPX-Survivac:

37.5% (12/32) of evaluable study subjects began treatment with a non-bulky disease defined as BTB < 5 cm; and

73% (8/11) of tumour regressions and 80% of clinical responses (4/5) observed in subset of patients with BTB < 5 cm.

Responders showing prolonged duration of clinical benefits reaching up to more than two years, surpassing the progression- free interval from their previous chemotherapy treatment.

13

Robust systemic survivin-specific T cell responses and evidence of survivin-specific T cells tumour infiltration correlated with clinical benefits:

100% of durable clinical responses correlated with T cell infiltration.

Epacadostat triggered inhibition of the conversion of tryptophan into kynurenine that was dose dependent; and

Cohort demographics were balanced and the combination yielded a tolerable safety profile.

At the time of data cut-off, 53 patients were enrolled in the phase 1b clinical trial, including 14 from the 100 mg epacadostat dosing cohort and 39 from 300 mg epacadostat cohort. Based on 300 mg cohort results, IMV and Incyte agreed to stop dosing patients with epacadostat before completion of the study. Patients who completed at least one CT scan, as required per the trial protocol, were evaluable for response analysis.

71% of patients were evaluable for responses in the 100 mg cohort and 56% in the 300mg dose cohort. At time of data cut-off, 8 participants remained on treatment and were being evaluated for clinical responses.

Orphan Drug Status and Fast Track Designation

The Corporation announced, in November 2016, that the European Medicines Agency (EMA) had granted orphan drug designation status to IMV’s DPX-Survivac in ovarian cancer. In July 2015, the FDA also granted orphan drug status to DPX-Survivac for the treatment of ovarian cancer. This designation is valid for all applications of DPX-Survivac in ovarian cancer without restriction to a specific stage of disease.

IMV had previously received FDA fast track designation for DPX-Survivac. The designation is intended for patients with no measurable disease after their initial surgery and chemotherapy.

14

Other Programs

Oncology

DPX-NEO

On January 17, 2019, treatment of the first patient occurred in the phase 1 trial evaluating neoepitopes formulated in the Corporation's proprietary DPX delivery platform in patients with ovarian cancer. The study is part of the Corporation's DPX-NEO program, which is a continuing collaboration between UConn Health and IMV to develop neoepitope-based anti-cancer therapies.

Investigators will assess the safety and efficacy of using patient-specific neoepitopes discovered at UConn Health and formulated in IMV's proprietary DPX-based delivery technology in women with ovarian cancer. Investigators plan to enroll up to 15 patients in the phase 1 study. UConn Health is financing the trial with IMV providing materials and advice.

The Corporation expects to disclose results when provided by UConn Health.

DPX-E7

On April 17, 2017, the Corporation announced that the first study participant has been treated in a phase 1b/2 clinical study evaluating an investigational cancer target for HPV (E7) formulated in DPX and in combination with low-dose cyclophosphamide in patients with incurable oropharyngeal, cervical, and anal cancers related to HPV.

Dana-Farber is leading the DPX -E7 study through a $1.5 million research grant from Stand Up To Cancer and the Farrah Fawcett Foundation to clinically evaluate collaborative translational research that addresses critical problems in HPV-related cancers. The Dana-Farber study is a single center, open label, non-randomized clinical trial that will investigate the safety and clinical efficacy in a total of 44 treated participants. Its primary objectives are to evaluate changes in CD8+ T cells in peripheral blood and tumour tissue, and to evaluate the safety in HLA-A2 positive patients with incurable HPV-related head and neck, cervical, or anal cancers. IMV has the option to produce the DPX -E7 vaccine if it proves successful in the clinical trials.

The Corporation expects to disclose results when provided by Dana-Farber.

Other Applications

Product Overview

A component of the Corporation’s business strategy is partnering the DPX platform within infectious and other diseases. The DPX platform has the potential to generate a rapid and robust immune response, often in a single dose. The unique single-dose capability could prove to be beneficial in targeting difficult infectious and other disease candidates.

RSV

The Corporation has performed preclinical research activities for a vaccine targeting RSV, which is the second leading cause of respiratory illness in infants, the elderly, and the immunosuppressed. Currently, there is no vaccine available for this virus and IMV is seeking to develop a novel vaccine formulation to be used in elderly and healthy adults, including women of child-bearing age. IMV has in-licensed the RSV antigen exclusively from VIB VZW (“VIB”), a non-profit life sciences research institute funded by the Flemish government, to expand its pipeline of vaccine candidates. The novel RSV antigen being evaluated in DPX is based on the short hydrophobic protein present at low levels on the surface of the RSV virion. But, more importantly, it is also present on the surface of RSV-infected cells. This vaccine has a unique mechanism of action in which the resultant antibodies bind to and destroy infected cells rather than directly bind to and neutralize the free virus.

Phase 1 clinical trial in RSV

A phase 1 clinical study has been conducted in Canada with the Corporation’s RSV vaccine candidate in healthy adults. The RSV vaccine is formulated in IMV’s proprietary DPX platform and is initially being developed to protect the elderly population from infection. The phase 1 study, which was the first clinical trial of a DPX-based vaccine in an infectious disease indication, evaluated the safety and immune response profile of the RSV vaccine candidate in 40 healthy older adult volunteers (age 50-64 years) and two dose cohorts, with 20 subjects in each cohort.

15

In July 2016, the Corporation announced positive interim results from this trial. Investigators analyzed the safety and immune response data of all participants up to study day 84. The safety analysis indicates that DPX-RSV was well tolerated among all study participants, with no SAEs recorded. Furthermore, immunogenicity data supported DPX-RSV’s ability to generate a relevant immune response: the vaccine candidate obtained antigen-specific antibody responses in 75 percent of subjects vaccinated with the lower dose and 100 percent of those vaccinated with the higher dose.

In October 2016, the Corporation announced positive topline results from this trial. The report outlined that more than nine months after the last vaccination, 15 of 16 participants (93%) who received DPX-RSV demonstrated antigen-specific immune responses. The vaccine candidate also continued to have a positive safety profile and was well tolerated with no SAEs among all study participants.

On April 12, 2017, the Corporation announced additional positive data from an extended evaluation of patients in this trial. An amendment had been submitted to Health Canada to test subjects who received the higher dose of vaccine out to one year after the booster vaccination. In the 25µg dose cohort, which was the only dose tested out to one year, 100 percent of older adults (7/7 immune responders) vaccinated with DPX-RSV maintained the antigen-specific immune responses one year after receiving the booster dose. At one year, the antibody levels measured were still at peak with no sign of decrease.

On September 27, 2018, IMV announced results of ongoing research to further explore the novel MOA of its vaccine candidate. New data from a preclinical study highlighted the effects of two potential approaches to preventing RSV, comparing a single dose bovine version of DPX-RSV to a two-dose conventional investigational bovine RSV vaccine. Researchers found that IMV’s vaccine candidate yielded strong antigen-specific immune responses and a protective effect on disease pathology. The degree of protection was comparable between the two vaccine candidates.

In this study, researchers compared the effects of both the IMV and conventional RSV vaccine approaches among bovines with known RSV infections (the bovine animal model is considered an optimal model of RSV infection). Researchers administered one dose of DPX-bRSV to one cohort; the second received two doses of a subunit RSV bovine vaccine. Researchers measured immune response with an antibody titer test and assessed disease pathology with a lung lesion score and other clinical parameters (such as body temperature changes).

They found SH antibodies in 14 of the 15 subjects that received DPX-bRSV, and the improvements observed in disease pathology were comparable between the two cohorts. These were the first bovine animal health data to directly correlate the vaccine-induced immune response against IMV’s novel RSV target - the SH viral protein- with measures of disease protection.

Conventional RSV vaccine candidates target either the F or G proteins of the virus and provide protection by neutralizing the RSV virus. Clinical measures of efficacy focus on the amount of neutralizing antibodies in the bloodstream. DPX-RSV works differently; it targets the SH viral ectodomain of the RSV virus and, instead of neutralizing the virus, it enables the immune system to recognize and destroy infected cells. Because there are no neutralizing antibodies resulting from the DPX-RSV MOA, a different clinical assessment is required to determine the vaccine candidate’s protective effect. IMV has exclusive worldwide licenses on applications that target the SH ectodomain antigen in RSV. The Corporation intends to explore opportunities to out-license this product to potential partners.

Malaria

In 2016, IMV Inc. was awarded a subcontract by Leidos, a health, national security, and infrastructure solutions Corporation, to evaluate IMV’s DPX platform for the development of peptide-based malaria vaccine targets. The subcontract is funded through Leidos’ prime contract from the USAID to provide vaccine evaluations in the preclinical, clinical, and field stages of malaria vaccine development. Leidos and IMV are working together to identify adjuvant and antigen combinations that can be used to protect against malaria and, with the DPX delivery system, formulate promising vaccine candidates for potential clinical testing.

In November, 2017, an expansion of this collaboration was announced. Following the achievement of several preclinical milestones in the collaboration with USAID, Leidos and USAID selected the DPX-based platform as one of the preferred formulations for further development under a new contract extension. Under the new subcontract, the collaborators will conduct additional research that focuses on identifying the most promising target-formulation combinations.

Zoetis Collaboration

On August 31, 2017, the Corporation announced the achievement of several milestones in its ongoing collaboration with global animal health company Zoetis to develop cattle vaccines. In recent controlled studies, the IMV formulations met efficacy and

16

duration of immunity endpoints against two disease targets. These results will enable Zoetis to advance two IMV-formulated vaccine candidates into late-stage testing.

Licensing Agreements

While the Corporation is focused on developing a pipeline of cancer immunotherapies, it is also pursuing opportunities to license its platform technology to other parties interested in creating enhanced vaccines on an application-by-application basis.

In April 2018, IMV signed a licensing agreement and granted SpayVac-for-Wildlife (SFW Inc.) a license to two of its proprietary delivery platforms. SFW Inc. has global exclusive rights to use both of these platforms to develop humane, immuno-contraceptive vaccines for control of overabundant, feral and invasive wildlife populations against royalties on sales.

MARKET OVERVIEW

Cancer Immunotherapies

Cancer is considered one of the most widespread and prevalent diseases globally. According to Global Cancer Facts & Figures, 4th edition (released in 2018 by the American Cancer Society), it is predicted that new cancer cases will rise to 27.5 million and the number of cancer deaths to 16.3 million by 2040 simply due to the growth of the aging population. Conventional cancer treatment involves surgery to remove the tumour whenever possible, as well as chemotherapy and radiation. Chemotherapies are widely used, despite their associated toxicities, because they interfere with the ability of cancer cells to grow and spread. However, tumours often develop resistance to chemotherapies, thus limiting their efficacy in preventing tumour recurrence. Despite recent advances, independent sources note a high unmet medical need in cancer therapy, noting the median survival rate remains poor. Cancer immunotherapies, may provide new and effective treatments. According to a Market & Markets report released in January 2017, the global immunotherapy drug market is projected to reach USD$201.52 billion by 2021 from USD$108.41 billion in 2016, growing at a compound annual growth rate (“CAGR”) of 13.5% during the forecast period of 2016 to 2021. The major players operating in the immunotherapy drug market include F. Hoffmann-La Roche AG (Switzerland), GlaxoSmithKline (U.K.), AbbVie, Inc. (U.S.), Amgen, Inc. (U.S.), Merck & Co., Inc. (U.S.), Bristol-Myers Squibb (U.S.), Novartis International AG (Switzerland), Eli Lilly and Corporation (U.S.), Johnson & Johnson (U.S.), and AstraZeneca plc (U.K.).

Cancer immunotherapy seeks to harness the immune system to assist in the destruction of tumours and to prevent their recurrence. There has been significant interest in the field of cancer immunotherapy stemming from recent clinical success in prolonging patient survival with novel compounds. The ability to apply these appropriately has resulted from a greater understanding of the immune dysfunction that is characteristic of cancer. One area in which there have been breakthroughs has been in the area of checkpoint inhibitors, which are compounds that target key regulatory molecules of the immune system. Yervoy® (anti CTLA 4, or ipilumumab, developed by Bristol Myers Squibb) was the first compound in this class to be approved for use in advanced metastatic melanoma. In cancer, these regulators (CTLA 4, PD 1 and its ligand PD L1) act to inhibit CD8 T cell-mediated anti-tumour immune responses that are crucial for tumour control. Monoclonal antibodies that target PD 1 and PD L1 have shown unusual efficacy in cancer patients, with a significant percentage of patients experiencing durable response to these therapies. Several of these compounds are in advanced clinical trials, with one compound, Merck’s KEYTRUDA® (pembrolizumab), having received FDA approval in September of 2014 for advanced melanoma patients who have stopped responding to other therapies. Bristol Myers Squibb’s compound nivolumab (Opdivo®) has also been approved in the United States and Japan. These therapies have recently been approved for use in other advanced cancers including bladder cancer, non-small cell lung cancer, Hodgkin’s Lymphoma, squamous cell carcinoma of the head and neck and stomach cancer. In addition, KEYTRUDA® in particular has been approved for use in cancers with a specific molecular indication irrelevant of cancer type, having been approved in May for use to treat solid tumours having a biomarker for microsatellite instability (MSI-H), which is a defect in the DNA repair pathway. This represents about 5% of a number of different tumour types, including colorectal, breast, prostate, and thyroid cancers. Key opinion leaders in the field have indicated that the ideal combination, with checkpoint inhibitors, is likely to be a therapy that drives tumour specific immune responses. These include novel T cell-based therapies. These therapies fit well with checkpoint inhibition therapy because they simultaneously activate strong tumour-specific T cell activation, while also releasing the brakes on immune suppression. The success of such combinations should allow pharmaceutical companies to significantly expand the market of their checkpoint inhibitors.

The Corporation believes that T cell therapies will become an important component of these novel combination immunotherapies, with the potential of synergistic benefits to become an essential part of a multi-pronged approach for the treatment of cancer.

INTELLECTUAL PROPERTY

17

The Corporation strives to protect its intellectual property in established, as well as emerging, markets around the world. The Corporation’s intellectual property portfolio relating to its platform technology includes 17 patent families, the first of which contains eight patents issued in five jurisdictions (United States, Europe, Canada, Japan, and Australia). The 16 other families collectively contain 34 patents issued in 10 jurisdictions (United States, Europe, Canada, Australia, Japan, India, Israel, Singapore, China, and, separately. Hong Kong) and 47 pending patent applications in 9 jurisdictions. Taking into account the validations of the European patents, the Corporation’s intellectual property portfolio includes 87 patents. More details on the Corporation’s intellectual property strategy and patents can be found in the AIF filed on SEDAR at www.sedar.com.

The Corporation owns registered trademarks in the United States, Canada, and Europe.

RECENT AND ANNUAL DEVELOPMENTS

Key developments and achievements

The Corporation announced:

On March 6, 2019, that it has completed a public offering of common shares of the Corporation. An aggregate of 4,900,000 common shares was issued at a price of $5.45 per common share, raising gross proceeds of $26.7 million (the “March 2019 Public Offering”) and on March 11, 2019, that the underwriters have partially exercised their over- allotment option to purchase additional common shares, resulting in the issuance of an additional 504,855 common shares of the Corporation at a price of C$5.45 per share for additional gross proceeds of approximately C$2.75 million.

As a result of the exercise of this option, the Corporation has raised total gross proceeds of approximately C$29.46 million before deducting the underwriting commissions and offering expenses. The Corporation intends to use the net proceeds of the Offering to accelerate the development of DPX-Survivac in combination with Keytruda as part of the phase 2 basket trial with Merck in patients with select advanced or recurrent solid tumours in bladder, liver (hepatocellular carcinoma), ovarian, or non-small-cell lung cancers, as well as tumours shown to be positive for the microsatellite instability high biomarker and for general corporate purposes.

On January 30, 2019, an update on its clinical program for its lead investigational treatment, DPX-Survivac, as a potential monotherapy in advanced recurrent ovarian cancer. In December, 2018, IMV met with the U.S. Food and Drug Administration (FDA) in a Type B meeting to discuss the results to date of its DeCidE1 clinical trial and continuing development plan, as well as to obtain agency guidance on a potential accelerated regulatory pathway for DPX-Survivac as a T-cell immunotherapy for the treatment of advanced ovarian cancer in patients with progressing disease.

FDA meeting highlights include:

The purpose of IMV's Type B meeting with the FDA was to request feedback on the design of the clinical program for DPX-Survivac. This program includes the continuing DeCidE1 phase 2 clinical study and a potential future registration trial for accelerated approval in a subset of ovarian cancer patients.

The FDA reviewed the Corporation's proposed clinical development plan and acknowledged the potential for accelerated approvals in advanced ovarian cancer based on objective response rate (ORR) according to Recist 1.1 criteria with reported median duration of response (DOR). In addition, the FDA provided important guidance on clinical design considerations for different lines of therapy and platinum-sensitive and resistant patient populations.

In addition, IMV submitted a protocol amendment for a predictive enrichment approach to the phase 2 DeCidE1 trial, and further discussed those details with the FDA during the Type B meeting. The phase 2 primary endpoint, based on objective response rate (ORR) per Recist 1.1 criteria, is intended to confirm the high response rate and duration of clinical benefits observed in previously announced results in a patient population defined by a clinical biomarker based on baseline tumour burden (BTB).

Multiple clinical sites are now open for enrolment in the DeCidE1 phase 2 trial. Subject to phase 2 results, IMV plans to schedule a follow-up meeting with the FDA to finalize the design of a potential pivotal trial based on ORR and DOR.

18

On January 17, 2019, treatment of the first patient in its phase 1 trial evaluating neoepitopes formulated in the Corporation's proprietary DPX delivery platform in patients with ovarian cancer. The study is part of the Corporation's DPX-NEO program, which is a continuing collaboration between UConn Health and IMV to develop neoepitope-based anti-cancer therapies.

Investigators will assess the safety and efficacy of using patient-specific neoepitopes discovered at UConn Health and formulated in IMV's proprietary DPX-based delivery technology in women with ovarian cancer. Investigators plan to enroll up to 15 patients in the phase 1 study. UConn Health is financing the trial with IMV providing materials and counsel.

On December 13, 2018, investigators shared new positive data from IMV Inc.'s continuing DeCidE1 (DPX-Survivac with low-dose cyclophosphamide and epacadostat) clinical trial at the 2018 ESMO Immuno-Oncology Congress. The phase 1b/2 study is evaluating the safety and efficacy of the combination of IMV's lead candidate DPX-Survivac, low- dose cyclophosphamide, and 100 milligrams or 300 mg of Incyte's IDO1 enzyme inhibitor epacadostat in patients with advanced recurrent ovarian cancer.

In a poster presentation, Dr. Oliver Dorigo, MD, PhD, associate professor of obstetrics and gynecology (oncology), Stanford University Medical Center, who served as the trial's lead investigator and author on the poster, shared topline safety results from 53 enrolled patients and efficacy data from the 32 participants evaluable for immune-related and clinical responses, as well as blood sample and tumour biopsy analyses.

Key findings included:

Evidence of a clinical marker based on baseline tumour burden (BTB), a measure of tumour size predictive of patient response to DPX-Survivac;

37.5 pe cent (12/32) of evaluable study subjects began treatment with a non-bulky disease defined as BTB under five centimeters;

73 per cent (8/11) of tumour regressions and 80 percent of clinical responses (4/5) observed in subset of patients with BTB less than five centimeters;

Responders thus far showing prolonged duration of clinical benefits reaching up to more than two years, surpassing the progression-free interval from their previous chemotherapy treatment;

Robust systemic survivin-specific T-cell responses and evidence of survivin-specific T cells tumour infiltration correlated with clinical benefits;

100 per cent of durable clinical responses correlated with T-cell infiltration;

Epacadostat triggered inhibition of the conversion of tryptophan into kynurenine that was dose dependent; and

Cohort demographics were balanced and the combination yielded a tolerable safety profile.

At the time of data cut-off, 53 patients were enrolled in the phase 1b clinical trial, including 14 from the 100 mg epacadostat dosing cohort and 39 from 300 mg epacadostat cohort. Based on 300 mg cohort results, IMV and Incyte agreed to stop dosing patients with epacadostat before completion of the study. Patients who completed at least one CT scan, as required per the trial protocol, were evaluable for response analysis.

Seventy-one percent of patients were evaluable for responses in the 100 mg cohort and 56 percent in the 300 mg dose cohort. At time of data cut-off, eight participants remained on treatment and were being evaluated for clinical responses.

19

On November 20, 2018, an amendment of its phase 1b/2 clinical trial evaluating the safety and efficacy of IMV's lead candidate, DPX-Survivac, in combination with either 100 milligrams or 300 mg of epacadostat in patients with recurrent ovarian cancer.

Review of new data from the phase 1b portion of the clinical trial demonstrate a high response rate and a durable clinical benefit in a subpopulation of patients with a clinical marker predictive of a response to DPX-Survivac and correlated to its novel MOA. New data included:

Efficacy signals in the subpopulation of patients who received 100 mg dose epacadostat (n = 5) included 100 percent tumour regressions and 100 percent disease control rate; and 60 percent of these patients (3/5) reached a best response of a partial response (PR);

Long duration of clinical benefit observed in responders with a median duration of 590 days, including one patient that has passed the two-year mark without disease progression;

Clinical benefit correlated to DPX-Survivac's MOA and clinical study primary end points: survivin-specific T cells in the blood and T cell infiltration into tumours; and

The safety profile of DPX-Survivac is consistent with the profile observed in the Corporation's previously reported studies.

Based on 300 mg cohort results, IMV and Incyte have agreed to stop dosing patients with epacadostat. IMV will continue the phase 1b/2 trial as a monotherapy study evaluating DPX-Survivac in the recurrent ovarian cancer subpopulation. IMV will inform and work with investigators to appropriately modify the study in a manner consistent with the best interests of each patient.

IMV and Incyte will continue to explore the potential of additional combination studies.

On November 6, 2018, the appointment of Dr. Markus Warmuth, MD, a seasoned biopharmaceutical executive, to its board of directors. Dr. Warmuth currently serves as an entrepreneur in residence at the life science venture capital firm Third Rock Ventures. He brings more than 20 years of drug discovery experience and scientific acumen, with a strong focus on developing targeted therapy and immuno-oncology programs, to his new role on IMV's board.

On September 27, 2018, results of ongoing research to further explore the novel MOA of its RSV vaccine candidate. New data from a preclinical study highlighted the effects of two potential approaches to preventing RSV, comparing a single dose of the bovine version of DPX-RSV to a two-dose conventional investigational bovine RSV vaccine.

Researchers found that IMV’s vaccine candidate yielded strong antigen-specific immune responses and a protective effect on disease pathology. The degree of protection was comparable between the two vaccine candidates.

In this study, researchers compared the effects of both the IMV and conventional RSV vaccine approaches among bovines with known RSV infections (the bovine animal model is considered an optimal model of RSV infection). Researchers administered one dose of DPX-bRSV to one cohort; the second received two doses of a subunit RSV bovine vaccine. Researchers measured immune response with an antibody titer test, and assessed disease pathology with a lung lesion score and other clinical parameters (such as body temperature changes).

They found SH antibodies in 14 of the 15 animals that received DPX-bRSV, and the improvements observed in disease pathology were comparable between the two cohorts. These were the first bovine animal health data to directly correlate the vaccine-induced immune response against IMV’s novel RSV target - the SH viral protein- with measures of disease protection.

On September 18, 2018, details of the initial data from its ongoing investigator-sponsored phase 2 clinical trial in DLBCL. In the study, investigators are evaluating IMV’s lead candidate, DPX-Survivac, in combination with low dose cyclophosphamide and Merck’s checkpoint inhibitor Keytruda® (pembrolizumab), in patients with persistent or recurrent/refractory DLBCL.

The preliminary data included assessments of safety and clinical activity (based on modified Cheson criteriai) for the first four evaluable patients who have completed their first CT scan after the start of treatment. The data showed that:

Two of the first four evaluable participants showed tumour regressions at the first on-treatment CT scan:

20

The first enrolled participant demonstrated a tumour regression of 48% at the first on-treatment scan; and

The second participant demonstrated a partial response (PR) via a tumour regression of 66% at the first on- treatment scan.

Preliminary data from the third participant demonstrated stable disease;

The other participant had early disease progression less than two months following treatment initiation and was discontinued from the study; and

The combination therapy appears to demonstrate an acceptable safety profile, with no serious adverse events reported to date.

i Cheson, B.D.,, Pfistner, B., Juweid, M.E., Gascoyne, R.D., Specht, L., Horning, S.J. and Diehl, V. (2007). Revised Response Criteria for Malignant Lymphoma. Journal of Clinical Oncology, 25(5) DOI: 10.1200/JCO.2006.09.2403

On September 11, 2018, an expansion of its clinical program with a phase 2 basket trial in collaboration with Merck evaluating its lead candidate, DPX-Survivac, in combination with low-dose cyclophosphamide and Merck’s anti-PD-1 therapy, Keytruda (pembrolizumab), in patients with select advanced or recurrent solid tumours across five indications.

The open-label, multicentre, phase 2 basket study will evaluate the safety and efficacy of the immunotherapeutic combination agents in patients with bladder, liver (hepatocellular carcinoma), ovarian or non-small-cell lung (NSCLC) cancers, as well as tumours shown to be positive for the microsatellite instability high (MSI-H) biomarker. Investigators plan to enroll more than 200 patients across five indications at multiple medical centres in Canada and the United States.

On August 9, 2018, IMV reached two important milestones in its continuing clinical trial collaboration with Incyte Corp. Investigators completed enrolment for both phase 1b dosing cohorts and treated the first patient in the phase 2 component of the combination trial, which was evaluating the safety and efficacy of IMV’s lead candidate, DPX- Survivac, and low-dose cyclophosphamide with (and without) epacadostat in patients with advanced ovarian cancer.

Investigators completed enrolment in the phase 1b cohorts of the study, with a total of 50 patients across the two dosing groups. The phase 1b study focused on evaluating the safety and efficacy of combining DPX-Survivac, 100 milligrams or 300 milligrams of epacadostat, and low-dose cyclophosphamide in individuals with advanced, platinum-sensitive and resistant ovarian cancer.

On June 7, 2018, that Julia P. Gregory joined the Corporation’s Board of Directors. Ms. Gregory is a seasoned biotechnology executive with Chief Executive Officer, Chief Financial Officer, board, and investment banking experience. She recently served as Chief Executive Officer and board member of ContraFect Corporation, a public biotechnology Corporation developing innovative anti-infectives. She also served as the Chief Executive Officer and board member of the immuno-oncology Corporation Five Prime Therapeutics.

On June 3, 2018, that investigators shared new positive data in an oral presentation for its DeCidE1 (DPX-Survivac with low dose Cyclophosphamide and Epacadostat) clinical study at the 2018 American Society for Clinical Oncology (ASCO) annual meeting. This data from the ongoing phase 1b/2 trial evaluated the safety and efficacy of the combination of IMV’s lead candidate, DPX-Survivac, and low dose cyclophosphamide, with Incyte’s IDO1 enzyme inhibitor epacadostat, in patients with advanced recurrent ovarian cancer.

At the time of data cut-off, 39 patients were enrolled (including 25 new participants in the 300mg cohort with 8 evaluable from day 56 first CT scan). Data from the first 18 evaluable patients across both dosing cohorts showed:

7 tumour regressions, including 4 Partial Responses (PR) reported so far (PR, defined as ≥30% decrease in tumour lesion size); and

Study participants were generally tolerating treatments well, with no related SAEs reported.

Data from the first 8 evaluable participants in the 300mg epacadostat dosing cohort at first CT scan included:

6 patients demonstrated stable disease (SD) at day 56, with 4 of these SDs still on trial at data cut-off; and

2 patients with tumour regressions observed so far, including one PR with a tumour regression ongoing for more than 9 months.

Researchers also analyzed patient data to study the combination’s MOA. They examined blood samples and tumour biopsies for the 10 evaluable patients treated in the first dosing cohort. This data showed:

21

Survivin-specific T cell responses detected in 100% (10/10) of patients;

Increase in T cell infiltration post treatment in 37% (3/8) of the analyzable tumour biopsies based on two complementary testing methodologies (RNA sequencing and immunohistochemistry);

2 of the 3 patients with T cell infiltration showed PRs with significant and durable tumour regressions lasting more than one year; and

The third patient with T cell infiltration exhibited Progressive Disease (PD) with evidence of down regulation of the major histocompatibility (MHC) presentation pathway and significant increases in suppressive markers, both indicative of mechanisms of resistance.

On May 31, 2018, that its common shares have been approved for listing on the Nasdaq under the symbol ‘‘IMV.’’ Trading commenced on, June 1, 2018 and the common shares concurrently ceased to be traded on OTCQX. The Corporation retained its listing on the Toronto Stock Exchange under the symbol ‘‘IMV.’’

On May 3, 2018, that it applied to list its common shares on the Nasdaq Stock Market LLC (“Nasdaq”). In connection with the planned U.S. listing, and as previously authorized by its shareholders at more than 99%, the Corporation implemented a consolidation of its outstanding common shares, and changed the Corporation name to IMV Inc.

The consolidation was done on the basis of one new common share for every 3.2 outstanding common shares. The consolidation took effect on May 2, 2018, and the Corporation's common shares commenced trading on the Toronto Stock Exchange under the name IMV Inc. on a post-consolidation basis on May 10, 2018. There were 137,383,353 common shares issued and outstanding before the consolidation, and it was expected that there will be 42,932,315 common shares issued and outstanding following the consolidation, subject to rounding for any fractional shares. No fractional shares were issued as a result of the share consolidation. Fractional interests of 0.5 or greater were rounded up to the nearest whole number of shares and fractional interests of less than 0.5 were rounded down to the nearest whole number of common shares.

Concurrently with the consolidation and as previously authorized by its shareholders, the Corporation changed its name from “Immunovaccine Inc.” to “IMV Inc.” This change has been implemented in an effort to ensure that its corporate denomination does not convey any ambiguities as to the nature of the activities and technologies of the Corporation, which are not limited to vaccines.

On April 24, 2018, that it entered into an agreement with Incyte Corporation to expand their ongoing clinical trial collaboration. The Companies planned to add a phase 2 component to their ongoing phase 1b combination study evaluating the safety and efficacy of IMV’s lead candidate, DPX-Survivac, in combination with Incyte’s IDO1 enzyme inhibitor epacadostat, and low dose cyclophosphamide in advanced ovarian cancer patients.

The phase 2 component is a randomized, open label, efficacy study that would include up to 32 additional evaluable subjects. It aimed to evaluate DPX-Survivac and low dose cyclophosphamide with, or without, epacadostat in patients with advanced recurrent ovarian cancer. In accordance with regulatory guidelines for combination trials, the goal of this portion of the program would be to evaluate the clinical contribution of each investigational drug in the combination regimen.

On April 16, 2018, the presentation of new research on its T cell activating platform at the American Association for Cancer Research (AACR) annual meeting 2018. In collaboration with Incyte Corp., researchers presented a poster supporting the enhanced anti-cancer immune responses from the combination of IMV's proprietary T cell activating technology and Incyte's IDO1 inhibitor program. A second poster analyzed the novel capability, as compared with other formulation technologies, of IMV's delivery technology to combine a large range of anti-cancer peptides into a single formulation.

In the poster titled, "Combination of a T cell activating immunotherapy with immune modulators alters the tumour microenvironment and promotes more effective tumour control in preclinical models," researchers presented new preclinical analysis on the combination of IMV's DPX-based therapies, Incyte's epacadostat and low-dose cyclophosphamide in tumour models. As part of the analysis, researchers also examined the potential for heightened tumour response from T cell infiltration in the tumour microenvironment. The study indicated that the triple combination immunotherapy demonstrated a significant delay in tumour progression. Analysis of the T cells suggested that other immune modulating therapies, such as checkpoint inhibitors, could additionally enhance tumour control.

22

Related to IMV's neoepitope program, researchers presented the poster, "A novel delivery platform containing up to 25 neoantigens can induce robust immune responses in a single formulation." This study investigated the effects on immune response when formulating a broad range of peptides across multiple delivery technologies, including the Corporation’s proprietary formulation. The study indicated that IMV's novel technology could incorporate at least 25 neoantigens into a single formulation, which generated strong CD8 and T cell responses, in excess of those induced by other formulations.