Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the United States Securities Exchange Commission. This preliminary prospectus supplement and the accompanying base shelf prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any state of the United States in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state of the United States.

Filed Pursuant to General Instruction II.L of Form F-10

File No. 333-225326

Subject to Completion, dated February 28, 2019

A copy of this preliminary prospectus supplement has been filed with the securities regulatory authorities in the provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Québec, Nova Scotia and Newfoundland and Labrador but has not yet become final for the purposes of the sale of securities. Information contained in this preliminary prospectus supplement may not be complete and may have to be amended.

No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This prospectus supplement, together with the short form base shelf prospectus dated June 5, 2018 to which it relates, as amended or supplemented, and each document incorporated or deemed to be incorporated by reference in this prospectus supplement and in the short form base shelf prospectus dated June 5, 2018 to which it relates, constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities. See “Plan of Distribution”.

Information has been incorporated by reference in this prospectus supplement, and in the short form base shelf prospectus dated June 5, 2018 to which it relates from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of IMV Inc. at 130 Eileen Stubbs Avenue, Suite 19, Dartmouth, Nova Scotia, Canada, B3B 2C4 (telephone (902) 492-1819), and are also available electronically at www.sedar.com.

PRELIMINARY PROSPECTUS SUPPLEMENT

TO THE SHORT FORM BASE SHELF PROSPECTUS DATED JUNE 5, 2018

| New Issue |

IMV INC.

$

Common Shares

This prospectus supplement (the “Prospectus Supplement”) to the short form base shelf prospectus of IMV Inc. (“IMV” or the “Corporation”) dated June 5, 2018 (the “Base Shelf Prospectus”) qualifies the distribution (the “Offering”) of common shares (the “Offered Shares”) at a price of $ per Offered Share (the “Offering Price”).

The Offering is being made concurrently in Canada under the terms of this Prospectus Supplement and in the United States under the terms of the Corporation’s registration statement on Form F-10 (File No. 333-225326) (as amended, the “U.S. Registration Statement”) filed with the United States Securities and Exchange Commission (the “SEC”) under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”).

All dollar amounts in this Prospectus Supplement are in Canadian dollars, unless otherwise indicated. See”Exchange Rate Information”.

The Offered Shares are issued and sold in Canada by Wells Fargo Securities Canada, Ltd. and Raymond James Ltd. (the “Canadian Underwriters”) and in the United States by Wells Fargo Securities, LLC, Raymond James (USA) Ltd. and B. Riley FBR, Inc. (the “U.S. Underwriters”, and together with the Canadian Underwriters, the “Underwriters”) pursuant to an underwriting agreement (the “Underwriting Agreement”) dated as of , 2019. B. Riley FBR, Inc. is not registered to sell securities in any Canadian jurisdiction and, accordingly, will only sell the Offered Shares outside of Canada. The Offering Price has been determined by negotiation between IMV and the Underwriters. See “Plan of Distribution”.

Price: $ per Offered Share

| Price to the Public | Underwriters’ Commission(1) | Net Proceeds to the Corporation(2) | ||||||||||

| Per Offered Share | $ | $ | $ | |||||||||

| Total(3) | $ | $ | $ | |||||||||

Notes:

| (1) | The Underwriters will receive a commission (the “Underwriters’ Commission”) equal to % of the gross proceeds of the Offering. |

| (2) | After deducting the Underwriters’ Commission but before deducting the expenses of the Offering, estimated to be $ . |

| (3) | The Corporation has also granted the Underwriters an option (the “Option”), exercisable in whole or in part in the sole discretion of the Underwriters for a period of 30 days from the closing of the Offering, to purchase up to an additional Offered Shares (the “Additional Offered Shares”) at the Offering Price. If the Option is exercised in full, the total price to the public will be $ , the total Underwriters’ Commission will be $ , and the net proceeds to the Corporation, after deducting the Underwriters’ Commission but before deducting the estimated expenses of the Offering, will be $ . |

This Prospectus Supplement qualifies the grant of the Option and the distribution of the Additional Offered Shares:

Underwriters’ Position |

Maximum Size or Number of Securities Available |

Exercise Period or Acquisition Date |

Exercise Price or Average Acquisition Price | |||

| Option | Additional Offered Shares | 30 days from the date of this Prospectus Supplement | $ per Additional Offered Share |

All references to “Offered Shares” in this Prospectus Supplement include the Additional Offered Shares and all references

to the “Offering” shall include the Option, as the context permits or requires.

Subject to applicable laws, the Underwriters may, in connection with the Offering, over-allocate, over-allot or effect transactions which stabilize or maintain the market price of the Common Shares at levels other than those which might otherwise prevail in the open market. Such transactions, if commenced, may be discontinued at any time. See “Plan of Distribution”.

A purchaser who acquires Additional Offered Shares acquires those securities under this Prospectus Supplement, regardless of whether the Underwriters exercise the Option or acquire such shares on the open market.

An investment in the Offered Shares involves a high degree of risk. Prospective investors should carefully consider the risk factors described in and/or incorporated by reference in this Prospectus Supplement and the Base Shelf Prospectus. See “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors”.

The common shares of the Corporation (the “Common Shares”) are listed on the Toronto Stock Exchange (the “TSX”) under the symbol “IMV” and on the Nasdaq Capital Market (“NASDAQ”) under the symbol “IMV”. On February 27, 2019, the last trading day of the Common Shares on the TSX and NASDAQ before the date hereof, the closing price of the Common Shares was C$6.80 and US$4.80, respectively. An application has been made to list the Offered Shares on the TSX and NASDAQ. Listing of the Offered Shares will be subject to the Corporation fulfilling the respective listing requirements of each of the TSX and NASDAQ. Closing of the Offering is subject to usual closing conditions.

The Underwriters conditionally offer the Offered Shares on behalf of the Corporation, as principals, and, subject to prior sale, if, as and when issued by the Corporation and delivered and accepted by the Underwriters in accordance with the conditions contained in the Underwriting Agreement referred to under “Plan of Distribution” and subject to approval of certain legal matters relating to the Offering relating to Canadian law on behalf of the Corporation by McCarthy Tétrault LLP. Certain legal matters in connection with the Offering relating to U.S. law will be passed upon for the Corporation by Troutman Sanders LLP. Certain legal matters in connection with the Offering will be passed upon for the Underwriters by Blake, Cassels & Graydon LLP, with respect to Canadian Law, and by Cooley LLP, with respect to U.S. law.

| ii |

The Underwriters propose to offer the Offered Shares initially at the Offering Price. After the Underwriters have made a reasonable effort to sell all of the Offered Shares at the Offering Price, the Offering Price may be decreased and may be further changed from time to time to an amount not greater than the Offering Price, and the compensation realized by the Underwriters in respect of the Offered Shares will be decreased by the amount that the aggregate price paid by purchasers for the Offered Shares is less than the gross proceeds paid by the Underwriters to the Corporation. See “Plan of Distribution”.

Subscriptions for Offered Shares will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. It is expected that closing of the Offering will occur on or about March , 2019 or such other date as the Corporation and the Underwriters may agree upon (the “Closing Date”).

We expect that delivery of the Offered Shares will be made to investors on or about the Closing Date, which is the third business day following the date of pricing of the Offered Shares (such settlement being referred to as “T+3”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Offered Shares on the date of pricing of the Offered Shares or the next succeeding business days will be required, by virtue of the fact that the Offered Shares initially will settle in T+3, to specify an alternate settlement cycle at the time of any such trade to prevent failed settlement and should consult their own advisers.

It is anticipated that an electronic position representing the Offered Shares will be issued, registered and deposited in electronic form with CDS Clearing and Depositary Services Inc. (“CDS”) or its nominee pursuant to the book-based system. Except in limited circumstances, no beneficial holder of Offered Shares will receive definitive certificates representing their interest in the Offered Shares. Further, except in limited circumstances, beneficial holders of Offered Shares will receive only a customer confirmation from the Underwriters or other registered dealer who is a CDS participant and from or through whom a beneficial interest in the Offered Shares is acquired.

The offering of Securities hereunder is made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system (“MJDS”) adopted by the United States and Canada, to prepare this Prospectus Supplement and the Base Shelf Prospectus in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those of the United States. Annual financial statements for the year ended December 31, 2017 included or incorporated herein have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”) and are subject to Canadian auditing and auditor independence standards and thus may not be comparable to financial statements of United States companies.

The enforcement by investors of civil liabilities under the United States federal securities laws may be affected adversely by the fact that the Corporation is incorporated or organized under the laws of a foreign country, that some or all of its officers and directors may be residents of a foreign country, that some or all of the Underwriters or experts named in this Prospectus Supplement and the Base Shelf Prospectus may by residents of a foreign country and that all or a substantial portion of the assets of the Corporation and said persons may be located outside the United States.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC, THE SECURITIES COMMISSION OF ANY STATE OF THE UNITED STATES OR ANY CANADIAN SECURITIES REGULATOR NOR HAVE ANY OF THE FOREGOING PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT AND THE BASE SHELF PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| iii |

Prospective investors should be aware that the acquisition, holding or disposition of the Offered Shares described herein may have tax consequences both in the United States and in Canada. Such consequences for investors who are resident in, or citizens of, the United States and Canada may not be described fully herein. You should read the tax discussion contained in this Prospectus Supplement and consult your own tax advisor with respect to your own particular circumstances. See the sections titled “Certain Canadian Federal Income Tax Considerations”, “Certain U.S. Federal Income Tax Considerations” and “Risk Factors”.

The Offered Shares may only be sold in those jurisdictions where offers and sales are permitted. This Prospectus Supplement is not an offer to sell or a solicitation of an offer to buy the Offered Shares in any jurisdiction in which it is unlawful. Prospective investors should be aware that the acquisition or disposition of the Offered Shares described in this Prospectus Supplement may have tax consequences in Canada or elsewhere, depending on each particular existing or prospective investor’s specific circumstances.

Julia Gregory, Wayne Pisano, Albert Scardino and Markus Warmuth, members of the board of directors of the Corporation, all reside outside of Canada and have appointed IMV Inc., 130 Eileen Stubbs Avenue, Suite 19, Dartmouth, Nova Scotia, Canada, B3B 2C4, as agent for service of process. Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process.

On May 2, 2018, the Corporation filed articles of amendment to give effect to a consolidation of its Common Shares on the basis of 1 post-consolidation Common Share for each 3.2 pre-consolidation Common Shares. The post-consolidation Common Shares began trading on TSX on May 10, 2018. Historical trading prices and volumes have been amended to reflect the 3.2 for 1 consolidation.

The Corporation’s head office and registered office is located at 130 Eileen Stubbs Avenue, Suite 19, Dartmouth, Nova Scotia, Canada, B3B 2C4.

| Wells Fargo Securities | Raymond James |

B. Riley FBR

Prospectus dated , 2019

| iv |

TABLE OF CONTENTS

Preliminary Prospectus Supplement

TABLE OF CONTENTS

Base Shelf Prospectus

| ii |

This document is in two parts. The first part is this Prospectus Supplement, which describes the terms of the Offering and adds to and updates information in the accompanying Base Shelf Prospectus and the documents incorporated by reference therein. The second part is the accompanying Base Shelf Prospectus, which gives more general information, some of which may not apply to the Offering. This Prospectus Supplement is deemed to be incorporated by reference into the accompanying Base Shelf Prospectus solely for the purposes of this Offering. This Prospectus Supplement may add, update or change information contained in the accompanying Base Shelf Prospectus. Before investing, you should carefully read both this Prospectus Supplement and the accompanying Base Shelf Prospectus together with the additional information about the Corporation to which you are referred in the sections of this Prospectus Supplement and the Base Shelf Prospectus entitled “Documents Incorporated by Reference”.

Purchasers of Offered Shares should rely only on the information contained in or incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus. The Corporation has not authorized anyone to provide purchasers with different or additional information. If information in this Prospectus Supplement is inconsistent with the Base Shelf Prospectus or the information incorporated by reference, you should rely on this Prospectus Supplement. If anyone provides purchasers with different or additional information, purchasers should not rely on it. Neither the Corporation nor the Underwriters are making an offer to sell or seeking an offer to buy the Offered Shares in any jurisdiction where the offer or sale is not permitted. Purchasers should assume that the information contained in this Prospectus Supplement and the Base Shelf Prospectus is accurate only as of the date on the front of those documents and that information contained in any document incorporated by reference is accurate only as of the date of that document, regardless of the time of delivery of this Prospectus Supplement and the Base Shelf Prospectus or of any sale of the Offered Shares. The Corporation’s business, financial condition, results of operations and prospects may have changed since those dates.

This Prospectus Supplement and the Base Shelf Prospectus include references to trade names and trademarks of other companies, which trade names and trademarks are the properties of their respective owners.

The corporate website of the Corporation is www.imv-inc.com. The information on the Corporation’s website is not intended to be included or incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus and prospective purchasers should not rely on such information when deciding whether or not to invest in the Offered Shares.

Statistical information and other data relating to the pharmaceutical and biotechnology industry included in this Prospectus Supplement and the Base Shelf Prospectus are derived from recognized industry reports published by industry analysts, industry associations and/or independent consulting and data compilation organizations. Market data and industry forecasts used throughout this Prospectus Supplement and the Base Shelf Prospectus were obtained from various publicly available sources. Although the Corporation believes that these independent sources are generally reliable, the accuracy and completeness of the information from such sources are not guaranteed and have not been independently verified.

This Prospectus Supplement and the Base Shelf Prospectus are part of the U.S. Registration Statement. This Prospectus Supplement and the Base Shelf Prospectus do not contain all of the information set forth in the U.S. Registration Statement, certain parts of which are omitted in accordance with the rules and regulations of the SEC, or the schedules or exhibits that are part of the U.S. Registration Statement. Investors in the United States should refer to the U.S. Registration Statement and the exhibits thereto for further information with respect to IMV and the Offered Shares.

In this Prospectus Supplement, the Base Shelf Prospectus and the documents incorporated by reference herein and therein, unless the context otherwise requires, references to “IMV” or the “Corporation” refer to IMV Inc., together with its subsidiary, Immunovaccine Technologies Inc.

| S-3 |

The consolidated financial statements incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus and the other documents incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus, and the financial data derived from those consolidated financial statements included in this Prospectus Supplement and the Base Shelf Prospectus, are presented in Canadian dollars, unless otherwise specified, and have been prepared in accordance with IFRS. References in this Prospectus Supplement to “dollars”, “C$” or “$” are to Canadian dollars. United States dollars are indicated by the symbol “US$”.

The following table lists, for each period presented, the high and low exchange rates, the average of the exchange rates during the period indicated, and the exchange rates at the end of the period indicated, for one Canadian dollar, expressed in United States dollars, based on the exchange rate published by the Bank of Canada for the applicable periods. Periods prior to March 1, 2017 are based on the noon rate published by the Bank of Canada. Periods from and after March 1, 2017 are based on the closing exchange rate published by the Bank of Canada.

| Year ended December 31, | Nine months ended September 30, | |||||||||||||||||||

| 2018 | 2017 | 2016 | 2018 | 2017 | ||||||||||||||||

| High for the period | 0.8138 | 0.8245 | 0.7972 | 0.8138 | 0.8245 | |||||||||||||||

| Low for the period | 0.7330 | 0.7276 | 0.6854 | 0.7513 | 0.7276 | |||||||||||||||

| End of period | 0.7330 | 0.7971 | 0.7448 | 0.7725 | 0.8013 | |||||||||||||||

| Average for the period | 0.7721 | 0.7708 | 0.7548 | 0.7769 | 0.7657 | |||||||||||||||

On February 27, 2019, the closing exchange rate for one Canadian dollar, expressed in United States dollars, as reported by the Bank of Canada, was C$1.00 = US$0.7607.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this Prospectus Supplement, the Base Shelf Prospectus and the documents incorporated by reference in this Prospectus Supplement and the Base Shelf Prospectus may constitute “forward-looking information” within the meaning of applicable securities laws in Canada and “forward-looking statements” within the meaning of the United States Private Securities Legislation Reform Act of 1995 (collectively, “forward-looking statements”) which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Corporation, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. When used in this Prospectus Supplement, such statements reflect current expectations regarding future events and operating performance and speak only as of the date of this Prospectus Supplement. Forward-looking statements may use such words as “will”, “may”, “could”, “intends”, “potential”, “plans”, “believes”, “expects”, “projects”, “estimates”, “anticipates”, “continue”, “predicts” or “should” and other similar terminology.

Forward-looking statements include, but are not limited to, statements relating to:

| - | the Corporation’s business strategy; |

| - | statements with respect to the sufficiency of the Corporation’s financial resources to support its activities; |

| - | potential sources of funding; |

| - | the Corporation’s ability to obtain necessary funding on favorable terms or at all; |

| - | the Corporation’s expected expenditures and accumulated deficit level; |

| - | the Corporation’s expected outcomes from its ongoing and future research and research collaborations; |

| - | the Corporation’s ability to obtain necessary regulatory approvals; |

| - | the Corporation’s expected outcomes from its pre-clinical studies and trials; |

| S-4 |

| - | the Corporation’s exploration of opportunities to maximize shareholder value as part of the ordinary course of its business through collaborations, strategic partnerships and other transactions with third parties; |

| - | the Corporation’s plans for the research and development of certain product candidates; |

| - | the Corporation’s strategy for protecting its intellectual property; |

| - | the Corporation’s ability to identify licensable products or research suitable for licensing and commercialization; |

| - | the Corporation’s ability to obtain licences on commercially reasonable terms; |

| - | the Corporation’s plans for generating revenue; |

| - | the Corporation’s plans for future clinical trials; |

| - | the Corporation’s expected use of the net proceeds from this offering; and |

| - | the Corporation’s hiring and retention of skilled staff. |

The forward-looking statements reflect the Corporation’s current views with respect to future events, are subject to risks and uncertainties, and are based upon a number of estimates and assumptions that, while considered reasonable by the Corporation, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors could cause the Corporation’s actual results, performance or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements, including, among others:

| - | obtaining additional funding on reasonable terms when necessary; |

| - | positive results of pre-clinical studies and clinical trials; |

| - | the Corporation’s ability to successfully develop existing and new products; |

| - | the Corporation’s ability to hire and retain skilled staff; |

| - | the products and technology offered by the Corporation’s competitors; |

| - | general business and economic conditions; |

| - | the Corporation’s ability to protect its intellectual property; |

| - | the Corporation’s ability to manufacture its products and to meet demand; |

| - | the general regulatory environment in which the Corporation operates; and |

| - | obtaining necessary regulatory approvals and the timing in respect thereof. |

Should one or more of these risks or uncertainties materialize, or should the assumptions set out in the section entitled “Risk Factors” underlying those forward-looking statements prove incorrect, actual results may vary materially from those described herein. These forward-looking statements are made as of the date of this Prospectus Supplement or the date of the Base Shelf Prospectus or, in the case of documents incorporated by reference in this Prospectus Supplement or the Base Shelf Prospectus, as of the date of such documents, and the Corporation does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by law. There is no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Purchasers are cautioned that forward-looking statements are not guarantees of future performance and accordingly purchasers are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein. New factors emerge from time to time, and it is not possible for management of the Corporation to predict all of these factors or to assess in advance the impact of each such factor on the Corporation’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

| S-5 |

The forward-looking statements contained in this Prospectus Supplement and the Base Shelf Prospectus are expressly qualified by the foregoing cautionary statements and are made as of the date of this Prospectus Supplement or the Base Shelf Prospectus. The Corporation does not undertake any obligation to publicly update or revise any forward-looking statements, except as required by applicable securities laws. Purchasers should read this entire Prospectus Supplement and the Base Shelf Prospectus and consult their own professional advisors to assess the income tax, legal, risk factors and other aspects of their investment in the Offered Shares.

DOCUMENTS INCORPORATED BY REFERENCE

This Prospectus Supplement is deemed to be incorporated by reference into the Base Shelf Prospectus solely for the purpose of the Offering. Other information has also been incorporated by reference in the Base Shelf Prospectus from documents filed with the securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of the Corporation at 130 Eileen Stubbs Avenue, Suite 19, Dartmouth, Nova Scotia, Canada, B3B 2C4 (telephone (902) 492-1819), and are also available electronically at www.sedar.com.

In addition to the continuous disclosure obligations of the Corporation under the securities laws of certain provinces of Canada, the Corporation is subject to certain of the information requirements of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance therewith file reports and other information with the SEC. Under MJDS, some reports and other information may be prepared in accordance with the disclosure requirements of Canada, which requirements are different from those of the United States. As a foreign private issuer, the Corporation is exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements, and the Corporation’s officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, the Corporation may not be required to publish financial statements as promptly as U.S. companies. A free copy of any public document filed by IMV with the SEC’s Electronic Data Gathering and Retrieval (EDGAR) system is available from the SEC’s website at www.sec.gov.

The following documents filed with the securities commissions or similar authorities in the provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Québec, Nova Scotia and Newfoundland and Labrador are specifically incorporated by reference in and form an integral part of this Prospectus Supplement:

| (i) | the annual information form of the Corporation dated March 20, 2018 for the year ended December 31, 2017 (the “AIF”); |

| (ii) | the audited annual consolidated financial statements of the Corporation and the notes thereto for the years ended December 31, 2017 and 2016, together with the auditor’s report thereon; |

| (iii) | the management’s report on financial position and operating results of the Corporation for the year ended December 31, 2017 (the “Annual MD&A”), except for the “Letter to Shareholders” which is specifically excluded and is not incorporated by reference herein; |

| (iv) | the unaudited interim condensed consolidated financial statements of the Corporation and the notes thereto for the nine months ended September 30, 2018 and 2017; |

| (v) | the management’s report on financial position and operating results of the Corporation for the three and nine-month period ended September 30, 2018, except for the “Letter to Shareholders” which is specifically excluded and is not incorporated by reference herein; |

| (vi) | the management information circular dated March 29, 2018 relating to the annual and special meeting of shareholders of the Corporation held on May 1, 2018; |

| (vii) | the material change report dated February 2, 2018 relating to a bought-deal financing agreement to sell Common Shares (the “February 2018 Public Offering”); |

| S-6 |

| (viii) | the material change report dated February 21, 2018 relating to the closing of the February 2018 Public Offering; and |

| (ix) | the material change report dated May 10, 2018 relating the NASDAQ listing, the consolidation of the Common Shares and the name change. |

Any documents of the Corporation of the type referred to in the preceding paragraph and any material change reports (excluding any confidential material change reports) filed by the Corporation with a securities commission or similar regulatory authority in Canada on or after the date of this Prospectus Supplement and prior to the termination of the Offering shall be deemed to be incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus.

In addition, to the extent that any document or information incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus is included in any report on Form 6-K, Form 40-F or Form 20-F (or any respective successor form) that is filed with or furnished to the SEC by the Corporation after the date of this Prospectus, such document or information shall be deemed to be incorporated by reference as an exhibit to the U.S. Registration Statement of which this Prospectus forms a part. In addition, the Corporation may incorporate by reference into this Prospectus, or the U.S. Registration Statement of which it forms a part, other information from documents that the Corporation will file with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act, if and to the extent expressly provided therein.

Any statement contained in this Prospectus Supplement, the Base Shelf Prospectus or in a document incorporated or deemed to be incorporated by reference in this Prospectus Supplement or the Base Shelf Prospectus shall be deemed to be modified or superseded for purposes of this Prospectus Supplement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference in this Prospectus Supplement or the Base Shelf Prospectus modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. Any statement so modified or superseded shall not be deemed to constitute a part of this Prospectus Supplement or the Base Shelf Prospectus, except as so modified or superseded.

You should rely only on the information contained in or incorporated by reference in this Prospectus Supplement and the Base Shelf Prospectus and on the other information included in the U.S. Registration Statement of which the Base Shelf Prospectus forms a part. The Corporation is not making an offer of Offered Shares in any jurisdiction where the offer is not permitted by law.

DOCUMENTS FILED AS PART OF THE U.S. REGISTRATION STATEMENT

The following documents have been or will be (through post-effective amendment or incorporation by reference) filed with the SEC as part of the U.S. Registration Statement of which this Prospectus is a part insofar as required by the SEC’s Form F-10:

| · | the documents listed under “Documents Incorporated by Reference” in this Prospectus;. |

| · | the form of Underwriting Agreement described in this Prospectus Supplement; |

| · | the consent of PricewaterhouseCoopers LLP, the Corporation’s independent auditor; |

| · | the consent of McCarthy Tétrault LLP, the Corporation’s Canadian counsel; and |

| · | powers of attorney of the Corporation’s directors and officers, as applicable. |

Marketing Materials and Contractual Right

Before filing this Prospectus Supplement in respect of this Offering, the Corporation and the Underwriters intend to hold road shows that potential investors in the United States and certain provinces in Canada will be able to attend. The Corporation and the Underwriters may provide marketing materials to those potential investors in connection with those road shows.

| S-7 |

In doing so, the Corporation and the Underwriters are relying on a provision in applicable Canadian securities legislation that allows issuers in certain U.S. cross-border offerings to not have to file marketing materials relating to those road shows on SEDAR at www.sedar.com or include or incorporate by reference those marketing materials in the Base Shelf Prospectus. To rely on this exemption, the Corporation and the Underwriters must give contractual rights to Canadian investors in the event the marketing materials contain a misrepresentation.

Accordingly, the Corporation and the Underwriters signing the certificate contained in this Prospectus Supplement have agreed that in the event the marketing materials relating to the road shows described above contain a misrepresentation (as defined in securities legislation in certain provinces of Canada), a purchaser resident in a province of Canada who was provided with those marketing materials in connection with the road shows and who purchases Common Shares under the Prospectus Supplement during the period of distribution shall have, without regard to whether the purchaser relied on the misrepresentation, rights against the Corporation and each Underwriter signing the certificate contained in the Prospectus Supplement with respect to the misrepresentation which are equivalent to the rights under the securities legislation of the jurisdiction of Canada where the purchaser is resident, subject to the defences, limitations and other terms of that legislation, as if the misrepresentation was contained in the Prospectus Supplement.

However, this contractual right does not apply (i) to the extent that the contents of the marketing materials relating to the road shows have been modified or superseded by a statement in the Prospectus Supplement, and (ii) to any “comparables” (as such term is defined in National Instrument 44-102 – Shelf Distributions) in the marketing materials provided in accordance with applicable securities legislation.

The following description of IMV is derived from selected information about the Corporation contained in the documents incorporated by reference and does not contain all of the information about the Corporation and its business that should be considered before investing in the securities. This Prospectus Supplement, the accompanying Base Shelf Prospectus and the documents incorporated by reference herein and therein should be reviewed and considered by prospective purchasers in connection with their investment in the Offered Shares. This Prospectus Supplement may add to, update or change information in the accompanying Base Shelf Prospectus. You should carefully read this entire Prospectus Supplement and the accompanying Base Shelf Prospectus, including the risks and uncertainties discussed in the section titled “Risk Factors,” and the information incorporated by reference in this Prospectus Supplement, including the consolidated financial statements of the Corporation, before making an investment decision. If you invest in the Corporation’s securities, you are assuming a high degree of risk.

The Corporation was incorporated on May 18, 2007 under the name of Rhino Resources Inc. pursuant to the Canada Business Corporations Act. On September 28, 2009, the Corporation changed its name to Immunovaccine Inc. and consolidated its outstanding share capital on a 5 to 1 basis. On May 2, 2018, the Corporation changed its name to IMV Inc. and consolidated its outstanding share capital on a 3.2 to 1 basis.

The Corporation has one wholly-owned subsidiary, Immunovaccine Technologies Inc. (“IVT”), which is incorporated under the laws of Nova Scotia.

The Corporation’s head and registered office is located at 130 Eileen Stubbs Avenue, Suite 19, Dartmouth, Nova Scotia, Canada, B3B 2C4.

| S-8 |

| Common Shares Offered by the Corporation | Common Shares | |

| Common Shares to be Outstanding After This Offering | Common Shares (or Common Shares if the Option is exercised in full). | |

| Use of Proceeds |

The Corporation estimates that the net proceeds from the Offering will be approximately $ million (or $ million if the Option is exercised in full) after deducting the Underwriters’ Commission of $ (or $ if the Option is exercised in full) and Offering expenses, which are estimated to be $ .

The Corporation expects to use the net proceeds of the Offering to accelerate the development of DPX-Survivac in combination with Keytruda as part of the basket trial select advanced or recurrent solid tumours in bladder, liver (hepatocellular carcinoma), ovarian or non-small-cell lung (NSCLC) cancers, as well as tumours shown to be positive for the microsatellite instability high (MSI-H) biomarker and for general corporate purposes. See the section titled “Use of Proceeds” on page S-19 of this Prospectus Supplement. | |

| Risk Factors | Investing in the Common Shares involves a high degree of risk. Please read the information contained in and incorporated by reference under the section titled “Risk Factors” beginning on page S-29 of this Prospectus Supplement, and under similar headings in the other documents that are filed after the date hereof and incorporated by reference into this Prospectus Supplement. | |

| NASDAQ Symbol | “IMV” | |

| TSX Symbol | “IMV” |

The number of Common Shares that will be outstanding immediately after this Offering as shown above is based on 44,981,427 Common Shares outstanding as of September 30, 2018. The number of Common Shares outstanding as of September 30, 2018 as used throughout this Prospectus Supplement, unless otherwise indicated, excludes:

| - | 1,448,478 Common Shares issuable upon exercise of outstanding options outstanding as of September 30, 2018, with a weighted average exercise price of $4.05; |

| - | an aggregate of 1,461,181 Common Shares reserved for future issuance under our stock option plans as of September 30, 2018. |

Subsequent to September 30, 2018, and through the date of this Prospectus Supplement:

| - | we granted an additional 273,100 stock options with a weighted average exercise price of $7.22 per share; and |

| - | we issued an additional 119,336 Common Shares upon the exercise of warrants, and 86,704 Common Shares upon the exercise of stock options. |

See the section titled “Prior Sales” on page S-25 of this prospectus supplement.

Unless otherwise indicated, all information in this Prospectus Supplement assumes no exercise by the Underwriters of the Option and no exercise of outstanding options or warrants.

| S-9 |

Overview

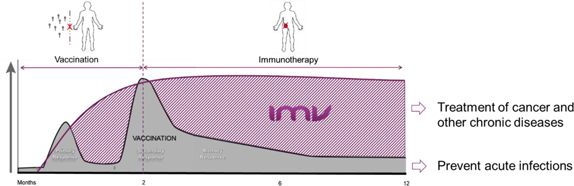

IMV is a clinical-stage biopharmaceutical company dedicated to making immunotherapy more effective, more broadly applicable, and more widely available to people facing cancer and other serious diseases. IMV is headquartered in Halifax, Nova Scotia and currently has 54 employees. IMV is pioneering a new class of immunotherapies based on the Corporation’s proprietary drug delivery platform (“DPX”). This patented technology, leverages a novel mechanism of action (“MOA”) discovered by the Corporation. This MOA does not release the active ingredients at the site of injection but forces an active uptake and delivery of active ingredients into immune cells and lymph nodes. It enables the programming of immune cells in vivo, which are aimed at generating powerful new synthetic therapeutic capabilities. DPX’s no release MOA can be leveraged to generate “first-in-class” T cell therapies with the potential to be transformative in the treatment of cancer.

Figure 1: Illustrative representation of IMV’s DPX new MOA

DPX also has multiple manufacturing advantages; it is fully synthetic, can accommodate hydrophilic and hydrophobic compounds, is amenable to a wide-range of applications (for example, peptides, small molecules, RNA/DNA or antibodies), and provides long-term stability as well as low cost of goods.

| S-10 |

The Corporation’s first cancer immunotherapy uses survivin-based peptides licensed from Merck KGaA, on a world-wide exclusive basis, formulated in DPX (“DPX-Survivac”). DPX-Survivac leverages the MOA of DPX to generate a constant flow of T cells in the blood that are targeted against survivin expressed on cancer cells. It is comprised of five minimal MHC class I peptides to activate naïve T cells against survivin.

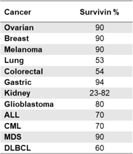

Survivin is a well characterized and recognized tumor associated antigen known to be expressed during fetal development and across most tumour cell types, but is rarely present in normal, non-malignant adult cells survivin controls key cancer processes (apoptosis, cell division and metastasis) and has been associated with chemotherapy resistance and cancer progression. It has been shown that survivin was expressed in all 60 different human tumour lines used in the National Cancer Institute’s cancer drug-screening program and documented in the literature to be overexpressed in more than 20 indications. |

Figure 2: Examples of % of patients with survivin expression in different indications |

The Corporation’s clinical strategy is to establish monotherapy activity in order to increase value and de-risk clinical development and to target late-stage unmet medical needs for a shorter path to clinical demonstration and regulatory approval.

The Corporation is focussing on fast path to market in ovarian and diffuse large B cell lymphoma (“DLBCL”) cancers and on repeating its clinical demonstrations of activity in other indications.

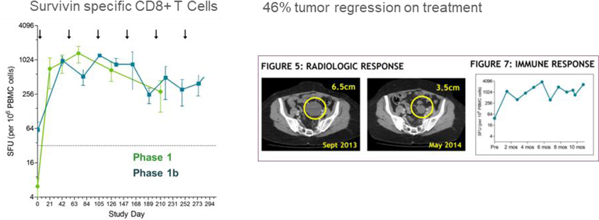

The Corporation has completed Phase 1 and 1b clinical trials in ovarian cancer in a maintenance setting after first or second line in 56 subjects.

The results provided first in human clinical demonstration of DPX-Survivac mechanism of action (survivin-specific T cell flow in the blood) and potential as treatment. 87% of patients generated one of highest T cell level reported in the literature and that level was maintained during a year with repeated injection every two months. One patient with measurable residual disease experienced a -46% tumor reduction.

Figure 3: Phase 1/1b result (ASCO 2015)

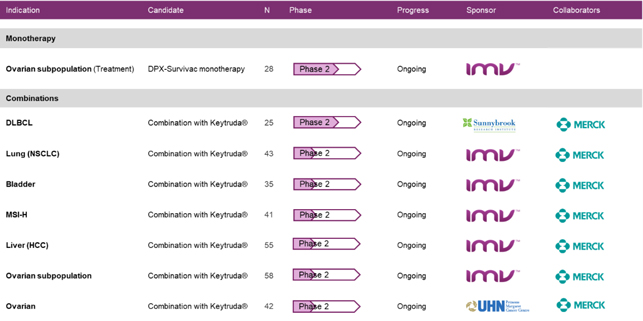

DPX-Survivac is currently being tested in:

| · | a phase 2 clinical trial which evaluates DPX -Survivac in an open label safety and efficacy study in ovarian cancer patients with advanced platinum-sensitive and resistant ovarian cancer with sum of base line target lesions per Recist criteria less than five centimeters; |

| S-11 |

| · | two investigator-sponsored phase 2 clinical trials in combination with checkpoint inhibitor Keytruda® (pembrolizumab) of Merck & Co Inc. (“Merck”) in patients with recurrent, platinum-resistant and sensitive ovarian cancer and in patients with measurable or recurrent DLBCL. In these cases, the primary and secondary endpoints include objective response rate (“ORR”), tumor regression, toxicity profile and duration of responses; and |

| · | a phase 2 basket trial in combination with Merck’s Keytruda® (pembrolizumab), in five different indications in patients with select advanced or recurrent solid tumours in bladder, liver (hepatocellular carcinoma), ovarian or non-small-cell lung (NSCLC) cancers, as well as tumours shown to be positive for the microsatellite instability high (MSI-H) biomarker. |

Figure 4: Ongoing phase 2 clinical trials

In infectious disease vaccine applications, the Corporation has completed a demonstration phase 1 clinical trial with a target against the respiratory syncytial virus (RSV). The Corporation also has a commercial licensing agreement with Zoetis for the development of two cattle vaccines and is also conducting several research and clinical collaborations, including a collaboration with the Dana-Farber Cancer Institute for Human Papillomavirus (HPV) related cancers and with Leidos, Inc. in the United States for the development of vaccine candidates for malaria and the Zika virus.

For further information, see “Description of the Business” in the AIF.

Appointment of a New Board Member

On November 6, 2018, the Corporation announced that it has appointed seasoned biopharmaceutical executive Markus Warmuth, MD, to its Board of Directors. Dr. Warmuth currently serves as an Entrepreneur in Residence at the life science venture capital firm Third Rock Ventures. He brings more than 20 years of drug discovery experience and scientific acumen, with a strong focus on developing targeted therapy and immune-oncology programs, to his new role on IMV’s Board.

Phase 1b/2 Clinical Trial

On November 20, 2018, the Corporation announced an amendment to its phase 1b/2 clinical trial evaluating the safety and efficacy of IMV’s lead candidate, DPX-Survivac, in combination with either 100 mg or 300 mg of epacadostat in patients with recurrent ovarian cancer.

| S-12 |

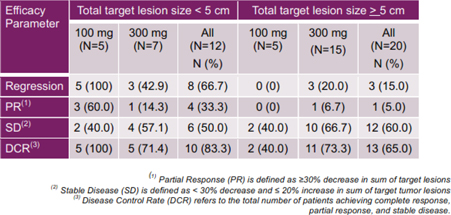

Review of new data from the phase 1b portion of the clinical trial demonstrates a high response rate and a durable clinical benefit in a subpopulation of patients with a clinical marker predictive of a response to DPX-Survivac and correlated to its novel MOA. New data includes:

| · | Efficacy signals in the subpopulation of patients who received 100 mg dose epacadostat (n=5) included 100% tumor regressions and 100% disease control rate; and 60% of these patients (3/5) reached a best response of a partial response (“PR”); |

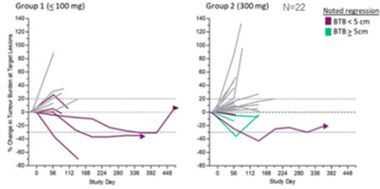

Figure 5: Phase 1b Tumor Regressions (ESMO-IO 2018)

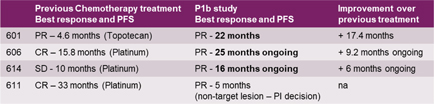

| · | Long duration of clinical benefits observed in responders that lasted beyond treatment duration (1 year) for a median duration of 590 days, including one patient who has passed the two-year mark without disease progression and prolonged tumor control observed in 3 out 4 PR in that subpopulation. |

Figure 6: Longer progression-free Survival (PFS) than previous chemotherapy treatment (ESMO IO 2018)

| · | Clinical benefit correlated to DPX-Survivac’s MOA and clinical study primary endpoints: survivin-specific T cells in the blood and T cell infiltration into tumors; and, |

| · | The safety profile of DPX-Survivac is consistent with the profile observed in the Corporation’s previously reported studies. |

| S-13 |

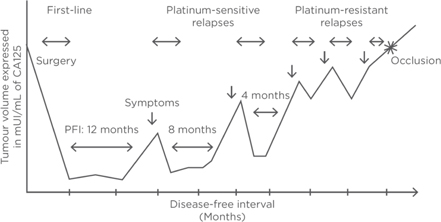

Figure 7: Ovarian cancer disease-free interval (Source: Ovarian cancer, Giornelli, EMJ 2017)

Based on 300 mg cohort results, IMV and Incyte Corporation (“Incyte”) have agreed to stop dosing patients with epacadostat. IMV will continue the phase 1b/2 trial as a monotherapy study evaluating DPX-Survivac in the recurrent ovarian cancer subpopulation. IMV will inform and work with investigators to appropriately modify the study in a manner consistent with the best interests of each patient.

IMV and Incyte will continue to explore the potential of additional combination studies.

On December 13, 2018, the Corporation announced that investigators shared new positive data from the Corporation’s ongoing DeCidE1 (DPX-Survivac with low dose CyclophosphamIDe and Epacadostat) clinical trial at the 2018 ESMO Immuno-Oncology Congress. The phase 1b/2 study is evaluating the safety and efficacy of the combination of IMV’s lead candidate DPX-Survivac, low dose cyclophosphamide, and 100 mg or 300mg of Incyte’s IDO1 enzyme inhibitor epacadostat in patients with advanced recurrent ovarian cancer.

Key findings include:

| · | Evidence of a clinical marker based on Baseline Tumor Burden (“BTB”), a measure of tumor size predictive of patient response to DPX-Survivac |

| o | 37.5% (12/32) of evaluable study subjects began treatment with a non-bulky disease defined as BTB < 5 cm. |

| o | 73% (8/11) of tumor regressions and 80% of clinical responses (4/5) observed in a subset of patients with BTB < 5 cm. |

| · | Responders showing prolonged duration of clinical benefits reaching up to more than two years, surpassing the progression-free interval from their previous chemotherapy treatment |

| · | Robust systemic survivin-specific T cell responses and evidence of survivin-specific T cells tumor infiltration correlated with clinical benefits |

| o | 100% of durable clinical responses correlated with T cell infiltration, |

| · | Epacadostat triggered inhibition of the conversion of tryptophan into kynurenine that was dose dependent |

| · | Cohort demographics were balanced and the combination yielded a tolerable safety profile |

| S-14 |

At the time of data cut-off, 53 patients were enrolled in the phase 1b clinical trial, including 14 from the 100 mg epacadostat dosing cohort and 39 from 300 mg epacadostat cohort. Based on 300 mg cohort results, IMV and Incyte agreed to stop dosing patients with epacadostat before completion of the study. Patients who completed at least one CT scan, as required per the trial protocol, were evaluable for response analysis.

71% of patients were evaluable for responses in the 100 mg cohort and 56% in the 300mg dose cohort. At time of data cut-off, 8 participants remained on treatment and were being evaluated for clinical responses.

New Role of Senior Director, Investor Relations and Communications

On December 5, 2018, the Corporation announced that Marc Jasmin has joined the Corporation in the newly created role of Senior Director, Investor Relations and Communications.

First Patient Dosed in Phase 1 Clinical Trial Evaluating Neoepitopes Formulated in IMV’s DPX Delivery Platform in Ovarian Cancer Patients

On January 17, 2019, the Corporation announced that the first patient has been treated in the phase 1 trial evaluating neoepitopes formulated in the Corporation’s proprietary DPX delivery platform in patients with ovarian cancer. The study is part of the Corporation’s DPX-NEO program, which is an ongoing collaboration between UConn Health and IMV to develop neoepitope-based anti-cancer therapies.

Investigators will assess the safety and efficacy of using patient-specific neoepitopes discovered at UConn Health and formulated in IMV’s proprietary DPX-based delivery technology in women with ovarian cancer. Investigators plan to enroll up to 15 patients in the phase 1 study. UConn Health is funding the trial with IMV providing materials and counsel.

Epitopes are the part of the biological molecule that is the target of an immune response. Neoepitopes are the mutated proteins produced by a patient's own tumors. Neoepitope immunotherapies target these patient-specific proteins and have been referred to as ‘the next immunotherapy frontier’.

Clinical update for DPX-Survivac program in ovarian cancer following positive feedback from U.S. FDA

On January 30, 2019, the Corporation announced an update on its clinical program for its lead investigational treatment, DPX-Survivac, as a potential monotherapy in advanced recurrent ovarian cancer. In December 2018, IMV met with the U.S. Food and Drug Administration (“FDA”) in a Type B meeting to discuss the results to date of its Decide1 clinical trial and continuing development plan, as well as to obtain agency guidance on a potential accelerated regulatory pathway for DPX-Survivac as a T-cell immunotherapy for the treatment of advanced ovarian cancer in patients with progressing disease.

| S-15 |

FDA meeting highlights

The purpose of IMV’s Type B meeting with the FDA was to request feedback on the design of the clinical program for DPX-Survivac. This program includes the continuing Decide phase 2 clinical study and a potential future registration trial for accelerated approval in a subset of ovarian cancer patients.

The FDA reviewed the Corporation’s proposed clinical development plan and acknowledged the potential for accelerated approvals in advanced ovarian cancer based on ORR according to Recist 1.1 criteria with reported median duration of response (“DOR”). In addition, the FDA provided important guidance on clinical design considerations for different lines of therapy and platinum-sensitive and resistant patient populations.

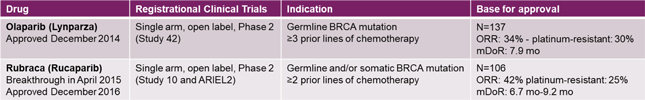

Figure 8: Examples of previous US FDA accelerated approvals in ovarian cancer (source: FDA website)

In addition, IMV submitted a protocol amendment for a predictive enrichment approach to the phase 2 Decide trial, and further discussed those details with the FDA during the Type B meeting. The phase 2 primary end point, based on ORR per Recist 1.1 criteria, is intended to confirm the high response rate and duration of clinical benefits observed in previously announced results in a patient population defined by a clinical biomarker based on BTB.

The Corporation believes there is still an urgent medical need in advanced recurrent ovarian cancer (Sources: 1. NCCN Guidelines Ovarian Cancer V2.2018;.SEER Ovarian Cancer; JCO, vol 33; 32 Nov 2015, Gyn Onc 133(2014) 624-631):

| · | Nearly 70% of ovarian cancers are diagnosed in advanced stage |

| · | The overall 5-year survival rate is 46.5%, and only 29% for advanced disease |

| · | Most patients develop advanced, platinum-resistant, poor prognosis disease |

| · | Limited options with current single-agents 6-30% response rates and mPFS of 2.1-4.2 months |

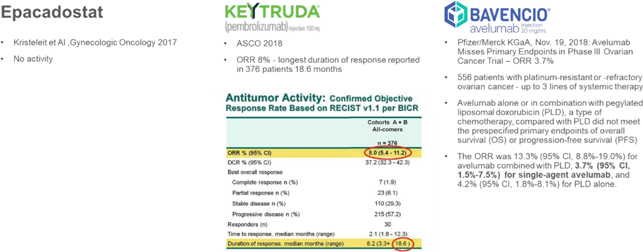

The Corporation believes that it has the potential to be “best-in-class” in the competitive landscape of recurrent ovarian cancer as other immunotherapeutic treatments tested in this patient population (Incyte’s epacadostat, Merck’s Keytruda, and Pfizer/Merck KGaA’s Bavencio) are unlikely to proceed into registration trials based on published results available:

| S-16 |

Figure 9: Recurrent ovarian cancer immunotherapy competitive landscape

Multiple clinical sites are now open for enrolment in the DECIDE phase 2 trial. Subject to phase 2 results, IMV plans to schedule a follow-up meeting with the FDA to finalize the design of a potential pivotal trial based on ORR and DOR.

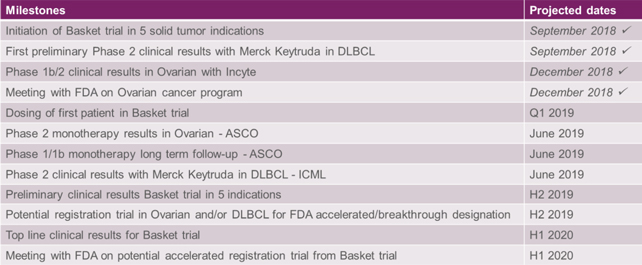

The Corporation has completed key clinical milestones in the last quarter of 2018 and is expecting a significant number of additional clinical results in 2019 and 2020:

Figure 10: Key clinical milestones completed in Q4 2018 and expected in 2019-2020

Expected Fiscal Year 2018 Earnings Results

While we have not yet finalized our full financial results for the fiscal year ended December 31, 2018, we expect to report that we had approximately $14,917,000 in cash and cash equivalents as of December 31, 2018. This amount is preliminary, has not been audited and is subject to change upon completion of our audited financial statements for the year ended December 31, 2018. Additional information and disclosures would be required for a more complete understanding of our financial position and results of operations as of December 31, 2018.

| S-17 |

Since September 30, 2018, the end of the most recent interim reporting period of the Corporation, there have been no material changes in the loan capital of the Corporation and no material changes in the share capital of the Corporation on a consolidated basis other than as outlined under “Prior Sales.” For information on the exercise of options pursuant to the stock option plan of the Corporation and other outstanding convertible securities, see the section titled “Prior Sales.”

The following table summarizes the Corporation’s share and loan capital as at September 30, 2018 on an actual basis and as adjusted to give effect to the issue and sale of Common Shares in this Offering at a public offering price of $ per Common Share and after deducting the Underwriters’ Commission and estimated Offering expenses. This table should be read in conjunction with the audited consolidated annual financial statements of the Corporation as at and for the years ended December 31, 2017 and 2016. Figures are in thousands of Canadian dollars, except share data.

| As at September 30, 2018 (Unaudited) | ||||||||

| Actual | As Adjusted(1) | |||||||

| Cash and cash equivalents | $ | 20,271,000 | $ | |||||

| Long-Term Debt | $ | 7,493,000 | $ | |||||

| Equity: | ||||||||

| Common Shares | 44,981,427 | (2) | ||||||

| Common Share Purchase Warrants | 297,372 | 297,372 | ||||||

| Stock Options | 1,448,478 | 1,448,478 | ||||||

| Deferred share units | 224,368 | 224,368 | ||||||

| Total Equity | ||||||||

| Total Share Capital (fully diluted) | 46,951,645 | |||||||

| (1) | Based on the issuance of Offered Shares for aggregate gross proceeds of $ , less the Underwriters’ Commission of $ and expenses of the Offering, estimated at $ . |

| (2) | Up to Common Shares if the Option is exercised in full for aggregate gross proceeds of up to $ , less the Underwriters’ Commission of $ and expenses of the Offering, estimated at $ . |

| S-18 |

The estimated net proceeds to be received by the Corporation under the Offering will be approximately $ (up to approximately $ if the Option is exercised in full), after deducting the Underwriters’ Commission and the estimated expenses in connection with this Offering of approximately $ .

The Corporation has negative operating cash flow and it is expected that the proceeds from the Offering will be used to fund operating cash flow. The Corporation expects its current cash and cash equivalents, together with the anticipated net proceeds from this Offering (not including any exercise of the Option), to fund its planned operations until the fourth quarter of 2020. Specifically, the Corporation intends to use approximately $ million of the net proceeds from the Offering to accelerate the development of DPX-Survivac in combination with Keytruda as part of the basket trial select advanced or recurrent solid tumours in bladder, liver (hepatocellular carcinoma), ovarian or non-small-cell lung (NSCLC) cancers, as well as tumours shown to be positive for the microsatellite instability high (MSI-H) biomarker; and the remainder for general corporate purposes.

The key business objective the Corporations intends to meet with the net proceeds is to accelerate the development of DPX-Survivac, its lead product candidate in combination with other Keytruda in survivin-expressing tumors, for select advanced or recurrent solid tumours in bladder, liver (hepatocellular carcinoma), ovarian or non-small-cell lung (NSCLC) cancers, as well as tumours shown to be positive for the microsatellite instability high (MSI-H) biomarker. This objective will require additional capital exceeding the cash on hand resources of the Corporation even after giving effect to the Offering and the exercise, if any, of the Option. In addition, actual costs and development time may exceed management’s current expectations. It is unlikely that the Corporation will generate sufficient operating cash flow to meet the total capital obligation in the proposed development time frame. Accordingly, the Corporation will need to raise additional capital in the future over and above the proceeds from the current Offering.

If the Option is exercised in whole or in part, the Corporation expects to use the additional net proceeds from such exercise to support its key business objectives and for general corporate purposes.

While the Corporation intends to spend the net proceeds of the Offering as stated above, there may be circumstances where, for sound business reasons, a re-allocation of funds may be necessary or advisable. The actual amount that the Corporation spends in connection with each of the intended uses of proceeds may vary significantly from the amounts specified above, and will depend on a number of factors, including those listed under the heading “Risk Factors” in this Prospectus Supplement and the accompanying Base Shelf Prospectus and the documents incorporated by reference herein and therein.

Negative Cash Flow

The Corporation has incurred significant operating losses and negative cash flows from operations since inception and has an accumulated deficit of $85,073,000 as of September 30, 2018. The ability of the Corporation to continue as a going concern is dependent upon raising additional financing through equity and non-dilutive funding and partnerships. There can be no assurance that the Corporation will have sufficient capital to fund its ongoing operations, develop or commercialize any products without future financings. These material uncertainties cast significant doubt as to the Corporation’s ability to meet its obligations as they come due and, accordingly, the appropriateness of the use of accounting principles applicable to a going concern. If the Corporation is unable to obtain additional financing when required, the Corporation may have to substantially reduce or eliminate planned expenditures or the Corporation may be unable to continue operations.

The Corporation’s ability to continue as a going concern is dependent upon its ability to fund its research and development programs and defend its patent rights. It is expected that proceeds from the Offering will be used to fund anticipated negative cash flow from operating activities, as described above.

| S-19 |

Pursuant to the Underwriting Agreement dated , 2019 among the Corporation and Wells Fargo Securities Canada, Ltd. and Raymond James Ltd., as the representatives (the “Representatives”) of the Underwriters named below and the joint book-running managers of the Offering, the Corporation has agreed to sell to the Underwriters, and each of the Underwriters has severally (and not jointly, nor jointly and severally) agreed to purchase, as principals, or cause to be purchased, on the Closing Date, the respective number of Offered Shares shown opposite its name below, at the Offering Price for aggregate gross proceeds of $ payable in cash to the Corporation against delivery of the Offered Shares, subject to compliance with all necessary legal requirements and the terms and conditions of the Underwriting Agreement. The Offering Price was determined by arm’s length negotiations between the Corporation and the Underwriters, with reference to the prevailing market price of the Common Shares.

| Underwriter | Number of Shares | |||

| Wells Fargo Securities Canada, Ltd. | ||||

| Raymond James Ltd. | ||||

| B. Riley FBR, Inc. | ||||

| Total | ||||

The Underwriters are offering the Offered Shares, subject to prior sale, when, as and if issued to and accepted by them, subject to approval of legal matters by their counsel, including the validity of the Offered Shares, and other conditions contained in the underwriting agreement, such as the receipt by the underwriters of officers’ certificates and legal opinions. The obligations of the Underwriters under the Underwriting Agreement are several and not joint (nor joint and several) and may be terminated at their discretion upon the occurrence of certain stated events. Such events include, but are not limited to (i) the occurrence of any material adverse change or any development that could reasonably be expected to result in a material adverse change, in the condition (financial or other), results of operations, business, properties, management or prospects of the Corporation and its subsidiary taken as a whole, whether or not arising in the ordinary course of business that is so material and adverse as to make it impractical or inadvisable to proceed with the offering of the Securities, (ii) the occurrence of any material adverse change in the financial markets in the United States, Canada or the international financial markets, any declaration of a national emergency or war by the United States or Canada, any outbreak of hostilities or escalation thereof or other calamity or crisis or any change or development involving a prospective change in national or international political, financial or economic conditions (including, without limitation, as a result of terrorist activities), in each case the effect of which is such as to make it, in the judgment of the Representatives, impracticable or inadvisable to market the Offered Shares or to enforce contracts for the sale of the Offered Shares, (iii) (A) trading in any securities of the Corporation has been suspended or materially limited on Nasdaq or TSX by such exchange, the SEC, any qualifying authority or any other governmental authority having jurisdiction, or (B) trading generally on the Nasdaq Stock Market or the TSX has been suspended or limited, or minimum or maximum prices for trading have been fixed, or maximum ranges for prices have been required, by any of said exchanges or by order of the SEC, FINRA or any other governmental authority, or (C) the occurrence of a material disruption in commercial banking or securities settlement or clearance services in the United States or Canada, or (iv) declaration of a banking moratorium by either United States federal, Canadian federal or New York authorities. The Underwriters are, however, obligated, to take up and pay for (or cause the payment for) all of the Offered Shares if any of the Offered Shares are purchased under the Underwriting Agreement. The Underwriters may offer selling group participation to other registered dealers, with compensation to be negotiated between the Underwriters and such selling group participants, but at no additional cost to the Corporation. Pursuant to the terms of the Underwriting Agreement, the Corporation has agreed to pay certain expenses incurred by the Underwriters in connection with the Offering. The Corporation has also agreed pursuant to the terms of the Underwriting Agreement to indemnify the Underwriters, their affiliates and their respective directors, employees, shareholders and agents against certain liabilities, including liabilities under the U.S. Securities Act, and expenses and to contribute to payments that the Underwriters may be required to make in respect thereof.

Commissions and Discounts

In consideration for the services provided by the Underwriters in connection with the Offering and pursuant to the terms of the Underwriting Agreement, the Corporation has agreed to pay the Underwriters the Underwriters’ Commission, equal to % of the aggregate gross proceeds of the Offering (including in respect of any Additional Offered Shares sold upon exercise of the Option). The compensation realized by the Underwriters will be decreased by the amount that the aggregate price paid by the purchasers for the Offered Shares is less than the gross proceeds paid by the Underwriters to the Corporation. Any such reduction will not affect the proceeds received by the Corporation.

The Underwriters propose to offer the Offered Shares to the public initially at the Offering Price and to dealers at that price less a concession not in excess of $ per share.. Without affecting the firm obligation of the Underwriters to purchase the Offered Shares in accordance with the Underwriting Agreement, the Underwriters may decrease the Offering Price of the Offered Shares which they sell under this Prospectus Supplement after they have made a reasonable effort to sell all such Offered Shares at the Offering Price. The sale by the Underwriters of Offered Shares at a price of less than the Offering Price will have the effect of reducing the compensation realized by the Underwriters by the amount that the aggregate price paid by the purchasers for Offered Shares is less than the gross proceeds paid by the Underwriters for the Offered Shares.

The following table shows the public Offering Price, underwriting discounts and commissions and proceeds before expenses to the Corporation. The information assumes either no exercise or full exercise by the Underwriters of the Option.

| Per Share | Without Option | With Option | ||||||||||

| Public offering price | $ | $ | $ | |||||||||

| Underwriting discounts and commissions | $ | $ | $ | |||||||||

| Proceeds, before expenses, to the Corporation | $ | $ | $ | |||||||||

It is estimated that expenses payable by the Corporation in connection with this Offering, other than the underwriting discounts and commissions referred to above, will be approximately $ . The Corporation has also agreed to reimburse the Underwriters for up to $75,000 for certain FINRA-related and other expenses incurred in connection with this Offering. In accordance with FINRA Rule 5110, this reimbursement fee is deemed underwriting compensation for this Offering.

| S-20 |

Option to Purchase Additional Shares

The Corporation has also granted the Underwriters the Option, exercisable in whole or in part in the sole discretion of the Underwriters for a period of 30 days from the Closing Date, to purchase, from time to time, up to an additional Additional Offered Shares at the Offering Price, less underwriting discounts and commissions. If the Underwriters exercise the Option, each Underwriter will be obligated, subject to specified conditions, to purchase a number of additional shares proportionate to that Underwriter’s initial purchase commitment as indicated in the table above.

Price Stabilization, Short Positions and Penalty Bids

In connection with the Offering, the Underwriters may purchase and sell Common Shares in the open market. These transactions may include short sales, purchases on the open market to cover positions created by short sales and stabilizing transactions. Short sales involve the sale by the Underwriters of a greater number of shares than they are required to purchase in the offering. “Covered” short sales are sales made in an amount not greater than the Option described above. The Underwriters may close out any covered short position by either exercising the Option or purchasing shares in the open market. In determining the source of Common Shares to close out the covered short position, the Underwriters will consider, among other things, the price of Common Shares available for purchase in the open market as compared to the price at which they may purchase Common Shares through the Option. “Naked” short sales are sales in excess of the Option. The Underwriters must close out any naked short position by purchasing Common Shares in the open market. A naked short position is more likely to be created if the Underwriters are concerned that there may be downward pressure on the price of the Common Shares in the open market after pricing that could adversely affect investors who purchase in the Offering. Stabilizing transactions consist of various bids for or purchases of Common Shares made by the Underwriters in the open market prior to the closing of the Offering.

The Underwriters may also impose a penalty bid. This occurs when a particular Underwriter repays to the Underwriters a portion of the underwriting discount received by it because the Representatives have repurchased shares sold by or for the account of such Underwriter in stabilizing or short covering transactions.

Similar to other purchase transactions, the Underwriters’ purchases to cover the syndicate short sales may have the effect of raising or maintaining the market price of the Common Shares or preventing or retarding a decline in the market price of the Common Shares. As a result, the price of the Common Shares may be higher than the price that might otherwise exist in the open market. The Underwriters may conduct these transactions on NASDAQ, the TSX, in the over-the-counter market or otherwise.

Neither the Corporation nor any of the Underwriters make any representation or prediction as to the direction or magnitude of any effect that the transactions described above may have on the price of the Common Shares. In addition, neither the Corporation nor any of the Underwriters make any representation that the Representatives will engage in these transactions or that these transactions, once commenced, will not be discontinued without notice.

Electronic Distribution

In connection with the Offering, certain of the Underwriters or securities dealers may distribute this Prospectus Supplement and the Base Shelf Prospectus electronically.

No Sale of Similar Securities

The Corporation and its executive officers and directors will not, subject to certain limited exceptions, directly or indirectly, offer, issue, sell or grant any Common Shares or securities convertible into, exchangeable for, or otherwise exercisable to acquire Common Shares or other equity securities of the Corporation for a period of 90 days after the Closing Date, without the prior written consent of Wells Fargo Securities Canada Ltd and Raymond James Ltd., on behalf of the Underwriters, such consent not to be unreasonably withheld.

| S-21 |

Settlement

Subscriptions for Offered Shares will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. It is anticipated that an electronic position representing the Offered Shares will be issued, registered and deposited in electronic form with CDS or its nominee pursuant to the book-based system. Except in limited circumstances, no beneficial holder of Offered Shares will receive definitive certificates representing their interest in the Offered Shares. Further, except in limited circumstances, beneficial holders of Offered Shares will receive only a customer confirmation from the Underwriters or other registered dealer who is a CDS participant and from or through whom a beneficial interest in the Offered Shares is acquired.

We expect that delivery of the Offered Shares will be made to investors on or about the Closing Date, which is the third business day following the date of pricing of the Offered Shares (such settlement being referred to as “T+3”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Offered Shares on the date of pricing of the Offered Shares or the next succeeding business days will be required, by virtue of the fact that the Offered Shares initially will settle in T+3, to specify an alternate settlement cycle at the time of any such trade to prevent failed settlement and should consult their own advisers.

NASDAQ and Toronto Stock Exchange Listing

The Common Shares are listed on the TSX under the symbol “IMV” and on NASDAQ under the symbol “IMV.” An application has been made to list the Offered Shares on the TSX and NASDAQ. Listing of the Offered Shares will be subject to the Corporation fulfilling the listing requirements of the TSX and NASDAQ. Closing of the Offering is subject to usual closing conditions.

Other Relationships

The Underwriters and certain of their affiliates are full service financial institutions engaged in various activities, which may include securities trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. Some of the Underwriters and certain of their affiliates may in the future engage in investment banking and other commercial dealings in the ordinary course of business with the Corporation and its affiliates, for which they may in the future receive customary fees, commissions and expenses.

In addition, in the ordinary course of their business activities, the Underwriters and their affiliates may make or hold a broad array of investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers.