Exhibit 99.22

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

AND

MANAGEMENT INFORMATION CIRCULAR OF

IMMUNOVACCINE INC.

March 31, 2017

| Suite 412 | Tel (902) 492-1819 | |

| #53-1344 Summer Street | Fax (902) 492-0888 | |

| Halifax, Nova Scotia | Web: http://www.imvaccine.com/ | |

| B3H 0A8 |

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the annual and special meeting of the shareholders (the “Meeting”) of Immunovaccine Inc. (the “Corporation”) will be held at the Innovation Enterprise Centre, 1344 Summer Street, in Halifax, Nova Scotia, Canada, at 12:30 pm AST, on May 10, 2017, for the purposes of:

| 1. | receiving the financial statements of the Corporation for the year ended December 31, 2016 and the report of the auditor thereon; |

| 2. | electing directors for the ensuing year; |

| 3. | appointing auditor and authorizing the directors to fix its remuneration; |

| 4. | adopting a resolution, the text of which is set out in Schedule “A” to the management information circular of the Corporation dated March 31, 2017 (the “Circular”), approving, ratifying and confirming an increase of the number of common shares of the Corporation reserved for issuance under the Corporation’s stock option plan; |

| 5. | adopting a resolution, the text of which is set out in Schedule “C” to the Circular, approving, ratifying and confirming the adoption of a deferred share unit (“DSU”) plan by the Corporation (the “DSU Plan”), as more particularly described in the Circular; |

| 6. | adopting a resolution, the text of which is set out in Schedule “D” to the Circular, ratifying and confirming the grant of 399,842 DSUs, under the DSU Plan in compliance with the requirements of the Toronto Stock Exchange; and |

| 7. | transacting such other business as may properly be brought before the Meeting. |

Halifax, Nova Scotia, March 31, 2017

| By order of the Board of Directors | |

| (s)Pierre Labbé | |

| Mr. Pierre Labbé | |

| Chief Financial Officer |

IMPORTANT

Shareholders may exercise their rights by attending the Meeting or by completing a form of proxy. If you are unable to attend the Meeting in person, please complete, date, and sign the enclosed form of proxy and return it in the envelope provided for that purpose. Proxies, to be valid, must be deposited at the office of the registrar and transfer agent of the Corporation, Computershare Investor Services Inc., 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1 no later than 48 hours, excluding Saturdays, Sundays and holidays, prior to the Meeting. Your Shares will be voted in accordance with your instructions as indicated on the form of proxy or, if no instructions are given on the form of proxy, the proxy holder will vote “IN FAVOUR” of each of the matters indicated above.

These security holder materials are being sent to both registered and non-registered owners of the securities. If you are a non-registered owner, and the Corporation or its agent has sent these materials directly to you, your name and address and information about your holdings of securities, have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding your securities on your behalf. By choosing to send these materials to you directly, the Corporation (and not the intermediary holding your securities on your behalf) has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. Please return your voting instructions as specified in the request for voting instructions. The Corporation or its agent is sending these materials directly to non-registered owners who are “non-objecting beneficial owners” as defined in Canadian securities laws.

IMMUNOVACCINE INC.

MANAGEMENT INFORMATION CIRCULAR

SOLICITATION OF PROXIES AND VOTING INSTRUCTIONS

The information contained in this management information circular (the “Circular”) is furnished in connection with the solicitation of proxies from registered owners of common shares (the “Shares”) of Immunovaccine Inc. (the “Corporation”, “we,” “our” and “us,” as the context requires) (and of voting instructions in the case of non-registered owners of Shares) to be used at the annual and special meeting of shareholders of the Corporation (the “Shareholders”) to be held on May 10, 2017 at 12:30 pm AST at the time and place and for the purposes set forth in the accompanying notice of meeting and at all adjournments, thereof (the “Meeting”). It is expected that the solicitation will be made primarily by mail, but proxies and voting instructions may also be solicited personally by our employees. The solicitation of proxies and voting instructions by this Circular is being made by or on behalf of our management. The total cost of the solicitation of proxies will be borne by us. The Corporation shall send directly to the non-objecting beneficial owners of Shares the proxy documents. The Corporation shall send indirectly the proxy documents to the objecting beneficial owners of Shares and shall reimburse brokers and other persons holding Shares on their behalf or on behalf of nominees, for reasonable costs incurred in sending the proxy documents to the objecting beneficial owners. The information contained in this Circular is given as at March 31, 2017, except where otherwise noted.

REGISTERED OWNERS

If you are a registered owner of Shares, you may vote in person at the Meeting or you may appoint another person to represent you as proxy holder and vote your Shares at the Meeting. If you wish to attend the Meeting, do not complete or return the enclosed form of proxy because you will vote in person at the Meeting. Please register with the transfer agent, Computershare Investor Services Inc., when you arrive at the Meeting.

Appointment of Proxies

If you do not wish to attend the Meeting, you should complete and return the enclosed form of proxy. The individuals named in the form of proxy are representatives of our management and are directors and officers of the Corporation. You have the right to appoint someone else to represent you at the Meeting. If you wish to appoint someone else to represent you at the Meeting, insert that other person’s name in the blank space in the form of proxy. The person you appoint to represent you at the Meeting need not be a shareholder of the Corporation. To be valid, proxies must be deposited with the Corporation either by using the enclosed return envelope or by faxing the proxy to Immunovaccine Inc., c/o Computershare Investor Services Inc., Facsimile: (902) 420-2764 not later than 12:30 pm AST on May 8, 2017 or, if the Meeting is adjourned, 48 hours, (excluding Saturdays, Sundays and holidays) before any adjourned Meeting.

Revocation

If you have submitted a proxy and later wish to revoke it you can do so by:

| (a) | completing and signing a form of proxy bearing a later date and depositing it with Computershare Investor Services Inc. as described above; |

| (b) | depositing a document that is signed by you (or by someone you have properly authorized to act on your behalf): (i) at our registered office at Suite 412, #53-1344 Summer Street, Halifax, Nova Scotia, B3H 0A8 at any time up to the last business day preceding the day of the Meeting, or any adjournment of the Meeting, at which the proxy is to be used; or (ii) with the chair of the Meeting before the Meeting starts on the day of the Meeting or any adjournment of the Meeting; |

| 3 |

| (c) | electronically transmitting your revocation in a manner permitted by law, provided that the revocation is received: (i) at our registered office at Suite 412, #53-1344 Summer Street, Halifax, Nova Scotia, B3H 0A8 at any time up to and including the last business day preceding the day of the Meeting, or any adjournment of the Meeting, at which the proxy is to be used; or (ii) by the chair of the Meeting before the Meeting starts on the day of the Meeting or any adjournment of the Meeting; or |

| (d) | following any other procedure that is permitted by law. |

Voting of Proxies

In connection with any ballot that may be called for, the management representatives designated in the enclosed form of proxy, or any other person you may have appointed, will vote or withhold from voting your Shares in accordance with the instructions you have indicated on the proxy and, if you specify a choice with respect to any matter to be acted upon, the Shares will be voted accordingly. In the absence of any direction, your Shares will be voted by the management representatives IN FAVOUR of the election of each director, IN FAVOUR of the appointment of the auditor, IN FAVOUR of the resolution approving the amendment to the stock option plan, IN FAVOUR of the resolution approving the deferred share unit plan and IN FAVOUR of the resolution ratifying the grant of deferred share units.

The management representatives designated in the enclosed form of proxy have discretionary authority with respect to amendments to or variations of matters identified in the accompanying notice of meeting and with respect to other matters that may properly come before the Meeting. At the date of this Circular, our management knows of no such amendments, variations or other matters.

NON-REGISTERED OWNERS

If your Shares are registered in the name of a depository (such as The Canadian Depository for Securities Limited) or an intermediary (such as a bank, trust company, securities dealer or broker, or trustee or administrator of a self administered RRSP, RRIF, RESP or similar plan), you are a non-registered owner.

Only registered owners of Shares, or the persons they appoint as their proxies, are permitted to attend and vote at the Meeting. If you are a non-registered owner, you are entitled to direct how the Shares beneficially owned by you are to be voted or you may obtain a form of legal proxy that will entitle you to attend and vote at the Meeting.

In accordance with Canadian securities law, we have distributed copies of the notice of meeting, this Circular and the 2016 financial statements of the Corporation (collectively, the “Meeting Materials”) to the intermediaries for onward distribution to non-registered owners who have not waived their right to receive them. Typically, intermediaries will use a service company (such as Broadridge Investor Communications Solutions) to forward the Meeting Materials to non-registered owners.

If you are a non-registered owner and have not waived your right to receive Meeting Materials, you will receive either a request for voting instructions or a form of proxy with your Meeting Materials. The purpose of these documents is to permit you to direct the voting of the Shares you beneficially own. You should follow the procedures set out below, depending on which type of document you receive.

A. Request for Voting Instructions.

If you do not wish to attend the Meeting (or have another person attend and vote on your behalf), you should complete, sign and return the enclosed request for voting instructions in accordance with the directions provided. You may revoke your voting instructions at any time by written notice to your intermediary, except that the intermediary may not be required to honour the revocation unless it is received at least seven days before the Meeting.

If you wish to attend the Meeting and vote in person (or have another person attend and vote on your behalf), you must complete, sign and return the enclosed request for voting instructions in accordance with the directions provided and a form of proxy will be sent to you giving you (or the other person) the right to attend and vote at the Meeting. You (or the other person) must register with the transfer agent, Computershare Investor Services Inc., when you arrive at the Meeting.

| 4 |

OR

B. Form of Proxy.

The form of proxy has been signed by the intermediary (typically by a facsimile, stamped signature) and completed to indicate the number of Shares beneficially owned by you. Otherwise, the form of proxy is incomplete.

If you do not wish to attend the Meeting, you should complete the form of proxy in accordance with the instructions set out in the section titled “Registered Owners” above.

If you wish to attend the Meeting, you must strike out the names of the persons named in the proxy and insert your name in the blank space provided. To be valid, proxies must be signed and deposited at the office of the registrar and transfer agent of the Corporation, Computershare Investor Services Inc., no later than 48 hours prior to the Meeting or any adjournment thereof. You must register with the transfer agent, Computershare Investor Services Inc., when you arrive at the Meeting.

You should follow the instructions on the document that you have received and contact your intermediary promptly if you need assistance.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

No person who has been a director or an executive officer of the Corporation nor any proposed nominee for election as a director of the Corporation at any time since the beginning of its last completed financial year, or any associate of any such director, officer or proposed nominee, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting, except as disclosed in this Circular.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

As of March 31, 2017, the Corporation had 118,946,971 Shares issued and outstanding, being the only class of securities of the Corporation entitled to be voted at the Meeting. Each holder of Shares of record at the close of business on March 16, 2017, the record date established for notice of the Meeting, will be entitled to vote on all matters proposed to come before the Meeting on the basis of one vote for each Share held.

As at March 31, 2017, to the knowledge of our directors and officers, the following person beneficially owned, directly or indirectly, or exercised control or direction over, more than 10% of the voting shares of the Corporation.

| Name and place of business | Number of shares held | Percentage | ||||||

| Ruffer LLP | 16,503,087 | 13.87 | % | |||||

| London, United Kingdom | ||||||||

BUSINESS TO BE TRANSACTED AT THE MEETING

Presentation of the Financial Statements

The financial statements of the Corporation, for the year ended December 31, 2016 and the auditor’s report thereon, will be presented to the Shareholders at the Meeting, but no vote with respect thereto is required or proposed to be taken.

| 5 |

Election of Directors

The articles of the Corporation provide that the Board of Directors of the Corporation (the “Board”) shall consist of a minimum of one director and a maximum of 15 directors.

At the Meeting, management of the Corporation will propose that the Board be constituted of eight directors, all of whom to be elected annually. The directors elected at the Meeting shall remain in office until the dissolution of any shareholders’ meeting appointing their successors.

Majority Voting Policy

The Board has adopted a majority voting policy for the election of directors (the “Majority Voting Policy”). The form of proxy that accompanies this Circular enables Shareholders to vote in favour of, or to withhold their vote, separately for each director nominee. The voting results will be publicly disclosed promptly after the Meeting through a voting results report filed on the SEDAR website at www.sedar.com.

The Majority Voting Policy provides that, in an uncontested election, if a director nominee is not elected by at least a majority (50% +1 vote) of the votes cast by Shareholders with respect to his election, the director nominee will be considered by the Board not to have received the support of the Shareholders and such nominee must immediately submit his resignation to the Board, effective on acceptance by the Board. The Board will refer the resignation to the Compensation and Corporate Governance Committee for consideration.

Within 90 days following the applicable meeting of the Shareholders, the Board will determine whether to accept or reject the director resignation offer that has been submitted, on the recommendation of the Compensation and Corporate Governance Committee, and will promptly publicly disclose its decision via a press release. A director who so tenders his or her resignation will not participate in any discussion or action of the Compensation and Corporate Governance Committee or of the Board with respect to the decision to accept his or her resignation. In cases where the Board determines to reject the resignation, the reasons for its decision will also be disclosed. Absent exceptional circumstances that would warrant the continued service of the applicable director on the Board, the Board is expected to accept the resignation of said applicable director. If a resignation is accepted, the Board may appoint a new director to fill any vacancy, or may reduce the size of the Board.

The following table and the notes thereto state the names and places of residence of all persons proposed to be nominated for election as directors of the Corporation, the positions they hold with the Corporation, their principal occupations or employments during the past five years, the year such persons began to serve as directors of the Corporation and the number of Shares beneficially owned or over which control or direction is exercised by each of them as at March 31, 2017. Each director will hold office until the next annual meeting of shareholders or until his successor is duly elected, unless prior thereto the director resigns or the director’s office becomes vacant by reason of death or other cause.

Unless authority to vote is withheld, the persons named in the accompanying form of proxy intend to vote IN FAVOUR of the election of the eight nominees whose names are set forth hereafter.

| 6 |

| Position | Shares Beneficially | |||||||||

| Name and | Held with | Owned, Controlled or | ||||||||

| Municipality of | the | Directed, Directly or | ||||||||

| Residence | Corporation | Principal Occupation during Past Five Years | Director Since | Indirectly(5) | ||||||

| Andrew Sheldon(1) (Quebec, Quebec, Canada) | Chairman of the Board and Director | Head of Medicago New Ventures and formerly President and Chief Executive Officer of Medicago Inc. (biotech company) | April 14, 2016 | 112,000 | ||||||

| Wade K. Dawe(2) (Halifax, Nova Scotia, Canada) | Director | Chairman and Chief Executive Officer of Fortune Bay Corp. Former President, Chief Executive Officer and Chairman of Brigus Gold Corp. (formerly Linear Gold Corp.) and Chairman of Stockport Exploration Inc. (formerly Linear Metals Corporation) (mining companies) | September 25, 2014(4) | 4,181,107 | ||||||

| James Hall(3) (Toronto, Ontario, Canada) | Director | Vice President of Callidus Capital Corporation (specialized asset-based lender to companies in Canada and the United States) President of James Hall Advisors Inc. (advisory firm) | February 22, 2010 | 118,788 | ||||||

| Frederic Ors (Quebec, Quebec, Canada) | Chief Executive Officer and Director | Chief Executive Officer of Immunovaccine Inc. Former Chief Business Officer of Immunovaccine Inc. Vice President of Business development and Strategic Planning of Medicago Inc. (biotech company) | April 14, 2016 | 325,100 | ||||||

| Wayne Pisano (2) (3) (Asbury, New Jersey, USA) | Director | Former President and Chief Executive Officer of VaxInnate (pandemic and influenza vaccine company) and Former President and Chief Executive Officer of Sanofi Pasteur (pediatric and adult vaccine manufacturing company) | October 17, 2011 | 138,200 | ||||||

| Albert Scardino(2) (London, United Kingdom) | Director | Chairman of Auctionair Limited (on-line auction retailer); Vice-Chairman of The Tree Council (non-profit environmental policy organization); and Trustee of Media Standards Trust (non-profit that monitors ethical performance of UK news outlets) | July 29, 2010 | 6,698,695 | ||||||

| Alfred Smithers (Halifax, Nova Scotia, Canada) | Director | President and Chief Executive Officer of Iona Resources Holdings Limited (investment company) | September 25, 2014 | 3,787,500 | ||||||

| Shermaine Tilley (3) (Montréal, Québec, Canada) | Director | Managing Partner of CTI Life Sciences Fund (venture capital fund) | June 8, 2016 | - | ||||||

| (1) | Mr. Sheldon is a non-voting member of the Compensation and Corporate Governance Committee and the Audit Committee. |

| (2) | Member of the Compensation and Corporate Governance Committee. |

| (3) | Member of the Audit Committee. |

| (4) | Mr. Dawe was first elected as director of the Corporation on May 18, 2007. Mr. Dawe did not stand for re-election at the 2014 annual general meeting of the Shareholders of the Corporation. However, he was reappointed as director on September 25, 2014. |

| (5) | The information as to the number of Shares beneficially owned or over which control is exercised, not being within the knowledge of the Corporation, has been furnished by each director individually as of March 31, 2017. |

As at March 31, 2017, as a group, the Corporation’s directors and executive officers beneficially owned, directly or indirectly, or exercised control over an aggregate of 15,471,840 Shares of the Corporation representing 13.01% of the outstanding Shares.

| 7 |

Biographies

Andrew (Andy) Sheldon, Chairman of the Board and Director

Mr. Sheldon has thirty years of experience in the pharmaceutical industry, and was named CEO of the Year by the Vaccine Industry Excellence awards at the World Vaccine Congress in April 2012. He is the head of Medicago New Ventures and was formerly President and Chief Executive Officer of Medicago Inc. Before joining Medicago Inc. in 2003, Mr. Sheldon served as Vice President, Sales and Marketing, of Shire Biologics. Mr. Sheldon has a bachelor’s degree in agricultural sciences from Université Laval, Québec City, and a bachelor’s of science degree with honors in biological sciences from the University of East Anglia, in Norwich, England.

Wade K. Dawe, Director

Mr. Dawe is an accomplished entrepreneur, financier and investor based in Halifax, Nova Scotia, Canada. He currently serves as Chairman of Pivot Technology Solutions Inc., a TSX listed company and Chairman and CEO of Fortune Bay Corp., a TSX listed company formed in 2014. Mr. Dawe has founded or co-founded a number of successful companies. He was recently Chairman & Chief Executive Officer of Brigus Gold Corp., a NYSE and TSX publically listed gold production company. Mr. Dawe holds a Bachelor of Commerce degree from Memorial University of Newfoundland (MUN), where he currently serves on the Advisory board to the Faculty of Business Administration. Mr. Dawe, a native of Newfoundland and Labrador, also serves on the Queen Elizabeth II Hospital Foundation and is a member of the Young Presidents’ Organization (YPO), an international organization for business leaders. He established and personally funds the annual James R. Pearcey Entrepreneurial Scholarship at MUN and recently funded DC Makes, a new entrepreneurship-based program at the Discovery Centre in Halifax, Nova Scotia.

James W. Hall, Director

Mr. Hall is Vice President of Callidus Capital Corporation – a specialized asset-based lender to companies in Canada and the United States. He is also President of James Hall Advisors Inc., a financial and management advisory firm. Prior to James Hall Advisors Inc., Mr. Hall was Chairman and Chief Executive Officer of Philadelphia-based pure-play newspaper company Journal Register Company, and served as Senior Vice President & Chief Investment Officer of private equity investment fund Working Ventures Canadian Fund Inc. from 1990 to 2002. Mr. Hall is a director of Atomic Energy of Canada Limited and Trustee of an OMERS Trust. A Chartered Professional Accountant (CPA, CA), Mr. Hall is a graduate of the Richard Ivey School of Business at Western University in London, Ontario.

Frederic Ors, Chief Executive Officer and Director

Mr. Frederic Ors has served as our Chief Executive Officer since April 2016. He brings over 19 years of experience in the biopharmaceutical industry, having served in a number of management roles encompassing business development, intellectual property, strategic planning, pre-marketing and communication. Before joining Immunovaccine, Mr. Ors spent 14 years at Medicago Inc. serving in many roles of increasing responsibility and most recently as Vice President of Business development and Strategic Planning. He also has served as second Vice-Chair of the Vaccine Industry Committee of Biotech Canada for five years between 2012 and 2016. Prior to Medicago Inc., he was licensing manager at the University Paris VII-Denis Diderot, one of the largest science and medical university in France. He has a B.Sc. degree in Biology and a Master degree in Management from the University of Angers (France).

Wayne Pisano, Director

Mr. Pisano has more than 30 years of experience as a pharmaceutical industry executive and was recognized in 2010 as Pharma Executive of the Year by the World Vaccine Congress. He has a depth of experience across the spectrum of commercial operations, public immunization policies and pipeline development. Mr. Pisano is a former president and CEO of Sanofi Pasteur, one of the largest vaccine companies in the world. He joined Sanofi Pasteur in 1997 and was promoted to President and CEO in 2007, the position he successfully held until his retirement in 2011. Post his retirement from Sanofi Pasteur, Mr. Pisano joined VaxInnate, a privately held biotech company, from January 2012 until November 2016 serving as president and CEO. Prior to joining Sanofi Pasteur, he spent 11 years with Novartis (formerly Sandoz). He has a bachelor’s degree in biology from St. John Fisher College, New York and an MBA from the University of Dayton, Ohio.

| 8 |

Albert Scardino, Director

Mr. Scardino is a technology and media investor. He has extensive experience as a director of both for-profit and not-for-profit organizations, public and private, in the US and the UK. He was a correspondent, commentator and editor for The New York Times, The Guardian, The Independent, the BBC and Sky News. He has served as a communications director in political campaigns and government. He earned his bachelor’s degree at Columbia University and his master’s at the University of California, Berkeley.

Alfred (Fred) Smithers, Director

Mr. Smithers is the President and Chief Executive Officer of Iona Resources Holdings Limited. He was founder and former President and Chief Executive Officer of the Secunda Group of Companies. In 2003 Mr. Smithers was named one of the “Top 50 CEOs of Atlantic Canada”, and is a member of the Nova Scotia Business Hall of Fame. He received an Honorary Diploma from the Nova Scotia Community College and holds an Honorary Doctorate in Commerce from Saint Mary’s University. Mr. Smithers currently sits on the Board of Directors of the Dartmouth General Hospital, and is on the Advisory Board of Atlantic Signature Mortgage & Loan. He is a recipient of the Canadian Red Cross Humanitarian Award, an Officer of the Order of Canada, and the Honorary British Consul for the Maritimes.

Dr. Shermaine Tilley, Director

Shermaine Tilley is a Managing Partner at CTI Life Sciences Fund, a Montreal-based venture capital fund investing across Canada as well as in the U.S. Prior to joining CTI Life Sciences Fund in 2006, Dr. Tilley was Senior VP at DRI Capital Inc. (formerly Drug Royalty Corporation), the world’s first private equity firm doing royalty transactions in the biotech/pharma space. Before DRI Capital Inc., Dr. Tilley ran and managed a research laboratory, holding faculty positions at the NYU School of Medicine and Public Health Research Institute (PHRI), NY, and on the PHRI Board of Directors. Concomitantly with her tenure at NYU School of Medicine and PHRI, she consulted for the NIH Small Business Innovation Research (SBIR) program in immunology and infectious disease for 10 years. Dr. Tilley holds a Ph.D. in biochemistry from the Johns Hopkins University School of Medicine, an MBA from the University of Toronto, and is a member of the CFA Society of Toronto. She currently sits on the boards of CellAegis Devices, PHEMI, Xagenic Inc., Zymeworks Inc. and BIOTECanada.

Shareholding, Cease Trade Orders, Bankruptcies, Penalties or Sanctions

Except as disclosed below and to the knowledge of the Corporation, none of the proposed directors of the Corporation is, as of the date hereof, or within 10 years before the date hereof, has been:

| (a) | a director, chief executive officer or chief financial officer of any company (including the Corporation) that: |

| (i) | was subject to an order that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or |

| (ii) | was subject to an order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer. |

| (b) | a director or executive officer of any company (including the Corporation) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| 9 |

| (c) | has become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromises with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed director. |

For the purposes of (a) above, “order” means a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, in each case that was in effect for a period of more than 30 consecutive days.

Except as disclosed below and to the knowledge of the Corporation, none of the proposed directors of the Corporation has been subject to:

| (a) | any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| (b) | any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director. |

Mr. James Hall was Chairman and Chief Executive Officer of Journal Register Corporation (“JRC”) on February 21, 2009 when it filed a voluntary petition for relief under the U.S. Bankruptcy Code (pre-negotiated joint Chapter 11 plan of reorganization). Mr. Hall left JRC in March 2009.

Appointment of Auditor

At the Meeting, the Shareholders will be asked to approve a resolution to appoint the auditor of the Corporation until the close of the next annual meeting of the Shareholders. The Board, upon the advice of the Audit Committee, recommends that PricewaterhouseCoopers LLP, chartered professional accountants of Halifax, Nova Scotia, be appointed as auditor of the Corporation. The appointment of PricewaterhouseCoopers LLP must be approved by a majority of the votes cast on the matter at the Meeting. PricewaterhouseCoopers LLP were first appointed auditor of the Corporation in 2003.

Unless authority to vote is withheld, the persons named in the accompanying form of proxy intend to vote IN FAVOUR of retaining PricewaterhouseCoopers LLP, chartered professional accountants of Halifax, Nova Scotia, as auditor of the Corporation to hold office until the next annual meeting of the Shareholders and to authorize the directors of the Corporation to determine the auditor’s remuneration.

Amendment to the Stock Option Plan

On March 7, 2017, the Board authorized, subject to Shareholder approval, the increase of the number of Shares reserved for issuance under the Corporation’s current stock option plan (the “Stock Option Plan”) by 1,900,000, so that the maximum number of Shares reserved for issuance is now 11,000,000, which represents 9.25% of total issued and outstanding Shares. The proposed amendment to the Stock Option Plan has been conditionally approved by the Toronto Stock Exchange (“TSX”).

As of the date hereof, there are outstanding options to purchase 5,643,947 Shares under the Stock Option Plan, representing 4.74% of the issued and outstanding Shares and 289,694 Shares remain available for future issuance under the Stock Option Plan, representing 0.24% of the issued and outstanding Shares. If the amendment to the Stock Option Plan is approved by the Shareholders at the Meeting, 2,189,694 Shares would remain available for future issuance under the Stock Option Plan, representing 1.84% of the issued and outstanding Shares of the Corporation.

| 10 |

As the Corporation is an early stage development company and has not begun earning significant revenue from its operations, it is expected to continue to have limited cash resources and must preserve its cash. Therefore, equity-based incentive compensation is a critical component of the compensation offered to directors, officers, employees and consultants of the Corporation. Further, the Stock Option Plan continues to advance the interest of the Corporation by attracting the best candidates, encouraging the officers, employees, consultants to acquire Shares, encouraging such persons to remain associated with the Corporation, and furnishing such persons with an additional incentive in their efforts on behalf of the Corporation. For these reasons, the Board believes it is necessary to increase the number of Shares reserved for issuance under the Stock Option Plan, thereby allowing enough flexibility for the Corporation to continue using this important long-term compensation tool. See “Securities Authorized for Issuance Under Equity Compensation Plans – Stock Option Plan” on page 29 of this Circular for a summary of the material provisions of the Stock Option Plan.

At the Meeting, the Shareholders will be asked to approve a resolution (the “Stock Option Plan Resolution”) substantially attached as Schedule “A” to this Circular to approve, ratify and confirm the increase of the maximum number of Shares reserved for issuance under the Stock Option Plan. Pursuant to the requirements of the TSX, the Stock Option Plan Resolution requires the approval of a majority of the votes cast by the Shareholders at the Meeting. The Board has concluded that the amendment of the Stock Option Plan is in the best interest of the Corporation and its Shareholders. Accordingly, the Board unanimously recommends that Shareholders vote in favour of the Stock Option Plan Resolution.

Unless authority to vote is withheld, the persons named in the accompanying form of proxy intend to vote IN FAVOUR of the Stock Option Plan Resolution.

Deferred Share Unit Plan

Background

The Board’s past practice was to grant stock options to members of the Board who are not employees or officers of the Corporation or of its subsidiaries (the “Non-Executive Directors”) under the Stock Option Plan. In 2016, further to a review by the Board of its Non-Executive Director compensation practices, the Board determined it would no longer grant stock options to Non-Executive Directors as compensation and elected to assess other compensation methods. Following its assessment, the Board adopted, subject to Shareholder approval, a deferred share unit plan (the “DSU Plan”) pursuant to which the Board may grant deferred share units (“DSUs” or “Deferred Share Units”) to Non-Executive Directors. The Board believes the DSU Plan will achieve a better alignment of the interest of Non-Executive Directors with those of its Shareholders.

If the DSU Plan is approved by Shareholders at the Meeting, the maximum number of Shares which the Corporation will be entitled to issue from treasury in connection with the redemption of DSUs granted under the DSU Plan will be 1,500,000 Shares, which represents 1.26% of total issued and outstanding Shares. The Corporation will be entitled to issue from treasury an aggregate maximum of 13,100,000 Shares under all security based compensation arrangements of the Corporation, namely (i) 1,500,000 Shares under the DSU Plan; (ii) 11,000,000 Shares under the Stock Option Plan if the Stock Option Plan Resolution is approved by Shareholders at the Meeting; (iii) 200,000 Shares under the CMO Options (see “Compensation Discussion and Analysis – Components of Executive Compensation – Long-term Incentive and Retention Program – Employee Inducement Options” on page 23 of this Circular); and (iv) 400,000 stock options granted to Mr. Pierre Labbé on January 31, 2017 in connection with his appointment as Chief Financial Officer of the Corporation, which represents 11.01% of total issued and outstanding Shares. 399,842 Shares may be issued upon the redemption of 399,842 DSUs outstanding as of March 31, 2017, which represents 0.34% of total issued and outstanding Shares. No DSUs have been redeemed as of the date of this Circular.

At the Meeting, Shareholders will be asked to approve a resolution (the “DSU Plan Resolution”) substantially in the form attached as Schedule “C” to this Circular to approve, ratify and confirm (a) the DSU Plan; and (b) the issuance of up to 1,500,000 Shares on the exercise of DSUs under the DSU Plan.

| 11 |

Summary of DSU Plan

The following is a summary of the material provisions of the DSU Plan. This summary does not purport to be complete and is subject to, and qualified in its entirety by reference to, the provisions of the DSU Plan, the full text of which is set out in Schedule “B” to this Circular.

Purpose

The purpose of the DSU Plan is to provide Non-Executive Directors with an opportunity to receive a portion or all of their compensation in Deferred Share Units. The DSU Plan aims to align the interests of Non-Executive Directors with those of the Shareholders. The DSU Plan is meant to qualify under paragraph 6801(d) of the Income Tax Regulations (Canada) and consequently will not be a salary deferral arrangement or an employee benefit plan as those terms are defined in subsection 248(1) of the Income Tax Act (Canada).

Eligible Participants

Any director of the Corporation who is not an employee or officer of the Corporation or of its subsidiaries is eligible to be credited with Deferred Share Units under the DSU Plan.

Administration

The DSU Plan will be administered by the Board, which will have full authority to interpret the DSU Plan, to establish, amend and rescind any rules and regulations relating to the DSU Plan and to make such determinations as it deems necessary or desirable for the administration of the DSU Plan. The Board may require that any person which participates in the DSU Plan provide certain representations, warranties and certifications to the Corporation to satisfy the requirements of applicable laws. All actions taken and decisions made by the Board in this regard will be final, conclusive and binding on all parties concerned, including, but not limited to, the Corporation, the Non-Executive Directors and their legal representatives. The Board may delegate to any director, officer or employee of the Corporation such of the Board’s duties and powers relating to the DSU Plan as the Board may see fit.

Elections

Each year, a Non-Executive Director may elect to receive up to 100% of his or her annual board retainer, and fees for chairing the Board, a committee of the Board or being a member of a committee (collectively, the “Fees”), but not less than 50% of his or her Fees, in the form of DSUs with the balance to be paid in cash. The Corporation will grant, in respect of each Non-Executive Director, that number of DSUs as is determined by dividing the amount of Fees that, but for an election, would have been paid to the Non-Executive Director, by the volume-weighted average trading price calculation per Share for the five (5) trading days immediately preceding the award date, being the last day of each of March, June, September and December (the “Fair Market Value”), and will credit the Non-Executive Director’s account with such DSUs.

Discretionary Grants

The Board may from time to time award Deferred Share Units to a Non-Executive Director. The number of Deferred Share Units to be credited as of the Award Date in respect of a discretionary grant will be such number of Deferred Share Units as the Board in its discretion determines to be appropriate in the circumstances.

Vesting

Deferred Share Units will vest immediately upon being credited to a Non-Executive Director’s account.

| 12 |

Redemption of DSUs

DSUs credited to the Non-Executive Director’s account may only be redeemed in the event of the cessation of a Non-Executive Director’s directorship for any reason, including such person’s death (the “Termination”). Each Deferred Share Unit is equivalent in value to a Share.

Upon redemption, the Corporation will issue to the person a number of Shares from treasury equal to the number of DSUs credited in the account, less the number of Shares that results by dividing the aggregate amount of any federal, provincial, local or foreign taxes and other amounts required by law to be withheld (the “Applicable Withholding Taxes”) by the Fair Market Value as of the date of redemption. Instead of issuing Shares from treasury, the Corporation may elect, in its sole discretion, to pay to the person an amount of money determined by multiplying the number of DSUs credited in the account by the Fair Market Value as of the date of redemption, net of any Applicable Withholding Taxes, by cheque, upon redemption. All Deferred Share Units will expire and terminate upon such issuance of Shares or upon such payment, as the case may be.

Insider Limitations

During any 12 month period, the number of Shares issued from treasury to insiders under the DSU Plan or any other security based compensation arrangement (as such term is defined in the Toronto Stock Exchange Company Manual) of the Corporation, including the Stock Option Plan, will not exceed 10% of the issued and outstanding Shares; and the number of Shares issuable from treasury to insiders, at any time, under the DSU Plan or any other security based compensation arrangement of the Corporation, including the Stock Option Plan, will not exceed 10% of the issued and outstanding Shares.

Individual Limitations

The DSU Plan does not provide for a maximum number of Shares which may be issued to an individual pursuant to the redemption of DSUs.

Number of Shares Reserved for Issuance

Subject to adjustment in accordance with the DSU Plan, the maximum number of Shares which the Corporation may issue from treasury in connection with the redemption of Deferred Share Units granted under the DSU Plan will be 1,500,000 Shares.

Termination

The Board may, at any time, suspend or terminate the DSU Plan.

Adjustments

The number of Deferred Share Units standing to the credit of an Account will also be appropriately adjusted to reflect the payment of dividends in Shares (other than dividends in the ordinary course), the subdivision, consolidation reclassification, conversion or exchange of the Shares, or a merger, consolidation, recapitalization, reorganization, spin off or any other change or event which affects the Fair Market Value and which, in the sole discretion of the Board, necessitates action by way of adjustment to the number of Deferred Share Units. The appropriate adjustment in any particular circumstance will be conclusively determined by the Board in its sole discretion, subject to acceptance by the TSX, if applicable.

Assignability

The rights of a Non-Executive Director pursuant to the terms of the DSU Plan are non-assignable or alienable by him or her either by pledge, assignment or in any other manner, and after his or her lifetime will enure to the benefit of and be binding upon the Non-Executive Director’s estate. The rights and obligations of the Corporation under the DSU Plan may be assigned by the Corporation to a successor in the business of the Corporation.

| 13 |

Amendments

The Board may, at any time, amend or revise the terms of the DSU Plan subject to the receipt of all necessary regulatory and Shareholders approvals, provided that no such amendment or revision will alter the terms of any Deferred Share Unit granted under the DSU Plan prior to such amendment or revision ..

Without limiting the generality of the foregoing, the Board may make the following types of amendments to the DSU Plan without seeking the approval of the Shareholders: (i) amendments to the definition of “Participant” or the eligibility requirements for participating in the DSU Plan, where such amendments would not have the potential of broadening or increasing insider participation; (ii) amendments to the manner in which Non-Executive Directors may elect to participate in the DSU Plan; (iii) amendments to the provisions of the DSU Plan relating to the redemption of DSUs and the dates for the redemption of the same, provided that no amendment will accelerate the redemption of a Non-Executive Director’s DSUs prior to the earlier of his or her Termination, subject to obtaining the required regulatory approvals; (iv) amendments of a “housekeeping” nature including, without limiting the generality of the foregoing, any amendment for the purpose of curing any ambiguity, error or omission in the DSU Plan or to correct or supplement any provision of the DSU Plan that is inconsistent with any other provision of the DSU Plan; (v) amendments necessary to comply with the provisions of applicable laws and the requirements of the TSX; (vi) amendments respecting the administration of the DSU Plan; (vii) amendments to the vesting provisions of the DSU Plan; (viii) amendments necessary to continuously meet the requirements of paragraph 6801(d) of the Income Tax Regulations (Canada) and to ensure that the DSU Plan is not a salary deferral arrangement or an employee benefit plan as those terms are defined in subsection 248(1) of the Income Tax Act (Canada); (ix) amendments necessary to suspend or terminate the DSU Plan; and (x) any other amendment, whether fundamental or otherwise, not requiring shareholders’ approval under applicable laws.

Notwithstanding the provisions of foregoing paragraph, the Board may not, without the approval of the Shareholders, make amendments to the DSU Plan for any of the following purposes: (i) to increase the maximum number of Shares that may be issued from treasury under the DSU Plan; (ii) to increase the maximum number of Shares that may be issued to insiders of the Corporation during any twelve month period; and (iii) to amend the amendment provisions set forth in the DSU Plan.

TSX Approval

The DSU Plan is subject to the approval of the TSX. The TSX has conditionally approved the DSU Plan and the listing of the 1,500,000 Shares reserved for issuance under the DSU Plan, subject to the receipt of Shareholder approval.

Shareholder Approval

At the Meeting, Shareholders will be asked to approve the DSU Plan Resolution in the form attached as Schedule “C” to this Circular. The ordinary resolution must be approved by a majority vote of the Shareholders. The DSU Plan will be terminated and the Ratification DSUs (as defined below) will be cancelled forthwith if the DSU Plan Resolution is not passed by the Shareholders at the Meeting.

The Board has concluded that the approval of (a) the DSU Plan in the form attached as Schedule “B” to this Circular; and (b) the issuance of up to 1,500,000 Shares upon redemption of DSUs under the DSU Plan is in the best interest of the Corporation and its Shareholders. Accordingly, the Board unanimously recommends that Shareholders entitled to vote on the DSU Plan Resolution, vote in favour of such DSU Plan Resolution.

Unless authority to vote is withheld, the persons named in the accompanying form of proxy intend to vote IN FAVOUR of the DSU Plan Resolution.

| 14 |

Ratification of DSU Grants

The Board adopted on December 21, 2016 the DSU Plan. Please refer to the section “Business to be Transacted at the Meeting - Deferred Share Unit Plan - Summary of DSU Plan” on page 12 of this Circular for a summary of the main provisions of the DSU Plan. Since the DSU Plan was adopted, (i) 325,000 DSUs have been granted to Non-Executive Directors as transitional compensation (see “Director Compensation – Components of Director Compensation” on page 16 of this Circular) and (ii) 74,842 DSUs have been granted to Non-Executive Directors as payment of the portion of their Fees for the first quarter of 2017 that they elected to receive in the form of DSUs in accordance with the DSU Plan (collectively, the “Ratification DSUs”), subject to the approval of the DSU Plan by the Shareholders and ratification of the grant of the Ratification DSUs by the Shareholders at the Meeting. The following table presents details of the Ratification DSUs.

| Name | Number of DSUs | Date of Grant | ||||

| Andrew Sheldon | 75,000 | December 21, 2016 | ||||

| James W. Hall | 50,000 | December 21, 2016 | ||||

| Wade K. Dawe | 50,000 | December 21, 2016 | ||||

| Wayne Pisano | 50,000 | December 21, 2016 | ||||

| Albert Scardino | 50,000 | December 21, 2016 | ||||

| Alfred A. Smithers | 50,000 | December 21, 2016 | ||||

| Andrew Sheldon | 13,655 | March 31, 2017 | ||||

| James W. Hall | 16,807 | March 31, 2017 | ||||

| Wade K. Dawe | 7,878 | March 31, 2017 | ||||

| Wayne Pisano | 13,393 | March 31, 2017 | ||||

| Albert Scardino | 15,756 | March 31, 2017 | ||||

| Alfred A. Smithers | 7,353 | March 31, 2017 | ||||

At the Meeting, the Shareholders will be asked to approve a resolution to ratify and confirm the grant of the Ratification DSUs substantially in the form set out in Schedule “D” to this Circular (the “Ratification Resolution”). Pursuant to the requirements of the TSX, the DSU Ratification Resolution requires the approval of a majority of the votes cast by the Shareholders at the Meeting. Until the DSU Ratification Resolution is passed, the Ratification DSUs may not vest. If the DSU Ratification Resolution is not passed, all the Ratification DSUs will be cancelled forthwith.

The Board has concluded that the grant of the Ratification DSUs under the DSU Plan is in the best interest of the Corporation and its Shareholders. Accordingly, the Board unanimously recommends that Shareholders entitled to vote on the Ratification Resolution, vote in favour of such Ratification Resolution.

Unless authority to vote is withheld, the persons named in the accompanying form of proxy intend to vote IN FAVOUR of the Ratification Resolution.

| 15 |

DIRECTOR COMPENSATION

Components of Director Compensation

Non-Executive Directors are entitled to receive an annual board retainer, and fees for chairing the Board, a committee of the Board or being a member of a committee (collectively, the “Fees”). Fees were paid to Non-Executive Directors during the year ended December 31, 2016 on the following basis:

| Fees | ||||

| Chairman of the Board: | $ | 60,000 | ||

| All other Directors: | $ | 30,000 | ||

| Chairman of Finance Committee(1): | $ | 20,000 | ||

| Chairman of Audit Committee: | $ | 10,000 | ||

| Chairman of Corporate Governance and Compensation Committee: | $ | 10,000 | ||

| Committee Member: | $ | 5,000 | ||

(1) The Finance Committee was dissolved as of June 30, 2016.

In addition to the Fees described above, the Board’s past practice was to grant stock options to Non-Executive Directors under the Corporation’s Stock Option Plan. In 2016, further to a review by the Board of its Non-Executive Director compensation practices, the Board determined it would no longer grant stock options to Non-Executive Directors as compensation and elected to assess other compensation methods. Following its assessment, the Board chose to adopt a DSU Plan, which it believes will achieve a better alignment of the interest of Non-Executive Directors with those of its Shareholders. Accordingly, no stock options were granted to Non-Executive Directors for the year ended December 31, 2016, and, as transitional compensation, the Chairman of the Board and the other Non-Executive Directors were paid in December 2016 an additional $54,000 and $36,000, respectively, by the issuance of DSUs. Starting in 2017, Non-Executive Directors will be required to elect to receive at least 50% of their Fees in the form of DSUs with the balance of their Fees to be paid in cash.

Director Compensation Table

Annual retainers and share-based awards were earned by the members of the Board who are not employees or officers of the Corporation on the following basis during the year ended December 31, 2016.

| Option- | Non-equity | |||||||||||||||||||||||||||

| Fees | based | Share-based | Incentive Plan | All Other | ||||||||||||||||||||||||

| Earned | Awards | Awards(1)(2) | Compensation | Pension Value | Compensation | Total | ||||||||||||||||||||||

| Name | ($) | ($) | ($) | ($) | ($) | ($) | ($) | |||||||||||||||||||||

| Wade K. Dawe | 45,000 | Nil | 36,000 | Nil | Nil | Nil | 81,000 | |||||||||||||||||||||

| James Hall | 42,500 | Nil | 36,000 | Nil | Nil | Nil | 78,500 | |||||||||||||||||||||

| Wayne Pisano | 45,000 | Nil | 36,000 | Nil | Nil | Nil | 81,000 | |||||||||||||||||||||

| Albert Scardino(4) | 46,250 | Nil | 36,000 | Nil | Nil | Nil | 82,250 | |||||||||||||||||||||

| Andrew Sheldon(4) | 49,583 | Nil | 54,000 | Nil | Nil | Nil | 103,583 | |||||||||||||||||||||

| Alfred Smithers | 32,500 | Nil | 36,000 | Nil | Nil | Nil | 68,500 | |||||||||||||||||||||

| Bradley Thompson(3) | 14,396 | Nil | Nil | Nil | Nil | Nil | 14,396 | |||||||||||||||||||||

| Shermaine Tilley (5) | Nil | Nil | Nil | Nil | Nil | Nil | Nil | |||||||||||||||||||||

| (1) | Deferred share units vest immediately on the date of grant. |

| (2) | The fair value of the deferred share units granted is determined by multiplying the number of deferred share units awarded by the volume-weighted average trading price calculation per Share ($0.72) for the five trading days immediately preceding the award date, December 21, 2016. |

| (3) | Bradley Thompson resigned from the Board effective May 6, 2016. |

| (4) | Andrew Sheldon joined the Board and replaced Albert Scardino as Chairman effective April 15, 2016. |

| (5) | Shermaine Tilley is not entitled to receive compensation as a result of the policies of CTI Life Sciences Fund, a shareholder of the Corporation. |

| 16 |

Outstanding Share-Based Awards and Option-Based Awards

The following table presents details of all outstanding option-based awards and share-based awards to the Board as at December 31, 2016.

| Option-based Awards | Share-based Awards | |||||||||||||||||||||||||

| Market or | ||||||||||||||||||||||||||

| Number of | Market or | payout value of | ||||||||||||||||||||||||

| securities | Value of | Number of | payout value of | share-based | ||||||||||||||||||||||

| underlying | Option | unexercised | shares or units | Share-based | awards not paid | |||||||||||||||||||||

| unexercised | exercise | in-the-money | of shares that | awards that have | out or | |||||||||||||||||||||

| options | price | Option expiration | options | have not vested | not vested | distributed | ||||||||||||||||||||

| Name | (#) | ($) | date | ($)(1) | (#) | ($) | ($)(2) | |||||||||||||||||||

| Wade K. Dawe | 10,000 | 1.000 | 03/31/2017 | - | N/A | N/A | 36,000 | |||||||||||||||||||

| 10,000 | 1.000 | 03/31/2018 | - | |||||||||||||||||||||||

| 10,000 | 1.000 | 03/31/2019 | - | |||||||||||||||||||||||

| 35,000 | 0.400 | 03/09/2017 | 9,800 | |||||||||||||||||||||||

| 35,000 | 0.280 | 04/30/2018 | 14,000 | |||||||||||||||||||||||

| 50,000 | 0.740 | 01/17/2019 | - | |||||||||||||||||||||||

| 50,000 | 0.660 | 02/02/2020 | 1,000 | |||||||||||||||||||||||

| James W. Hall | 35,000 | 0.400 | 03/09/2017 | 9,800 | N/A | N/A | 36,000 | |||||||||||||||||||

| 35,000 | 0.280 | 04/30/2018 | 14,000 | |||||||||||||||||||||||

| 50,000 | 0.740 | 01/17/2019 | - | |||||||||||||||||||||||

| 50,000 | 0.660 | 02/02/2020 | 1,000 | |||||||||||||||||||||||

| Wayne Pisano | 35,000 | 0.400 | 03/09/2017 | 9,800 | N/A | N/A | 36,000 | |||||||||||||||||||

| 50,000 | 0.740 | 01/17/2019 | - | |||||||||||||||||||||||

| 50,000 | 0.660 | 02/02/2020 | 1,000 | |||||||||||||||||||||||

| Albert Scardino | N/A | N/A | N/A | N/A | N/A | N/A | 36,000 | |||||||||||||||||||

| Andrew Sheldon | N/A | N/A | N/A | N/A | N/A | N/A | 54,000 | |||||||||||||||||||

| Alfred Smithers | 50,000 | 0.790 | 09/25/2019 | - | N/A | N/A | 36,000 | |||||||||||||||||||

| 50,000 | 0.660 | 02/02/2020 | 1,000 | |||||||||||||||||||||||

| Bradley Thompson(3) | 50,000 | 0.740 | 01/17/2019 | - | N/A | N/A | N/A | |||||||||||||||||||

| 50,000 | 0.660 | 02/02/2020 | 1,000 | |||||||||||||||||||||||

| Shermaine Tilley(4) | N/A | N/A | N/A | N/A | N/A | N/A | N/A | |||||||||||||||||||

| (1) | The value of the unexercised in-the-money options at the financial year-end is the difference between the closing price of the Shares on December 31, 2016 ($0.68) on the TSX and their respective exercise prices. |

| (2) | The value of the share-based awards not paid out or distributed is determined by multiplying the number of deferred share units awarded by the volume-weighted average trading price calculation per share for the five trading days immediately preceding their grant date. |

| (3) | Bradley Thompson resigned from the Board effective May 6, 2016. |

| (4) | Shermaine Tilley is not entitled to receive compensation as a result of the policies of CTI Life Sciences Fund, a shareholder of the Corporation. |

Incentive Plan Awards – Value Vested or Earned during the year ended December 31, 2016

The table below presents the value vested during the year ended December 31, 2016 of all awards to the directors of the Corporation and the value earned during the year ended December 31, 2016 for awards to the directors of the Corporation under non-equity incentive plans.

| 17 |

| Option-Based Awards - Value | Non-equity Incentive Plan | |||||||||||

| Vested During 2016 | Share-Based Awards - Value | Compensation - Value Earned | ||||||||||

| Name | ($) | Vested During 2016 | during 2016 | |||||||||

| Wade K. Dawe | 5,225 | 36,000 | N/A | |||||||||

| James W. Hall | 5,225 | 36,000 | N/A | |||||||||

| Wayne Pisano | 5,225 | 36,000 | N/A | |||||||||

| Albert Scardino | 7,838 | 36,000 | N/A | |||||||||

| Andrew Sheldon | N/A | 54,000 | N/A | |||||||||

| Alfred Smithers | 6,947 | 36,000 | N/A | |||||||||

| Bradley Thompson(1) | 5,225 | N/A | N/A | |||||||||

| Shermaine Tilley(2) | N/A | N/A | N/A | |||||||||

| (1) | Bradley Thompson resigned from the Board effective May 6, 2016. |

| (2) | Shermaine Tilley is not entitled to receive compensation as a result of the policies of CTI Life Sciences Fund, a shareholder of the Corporation. |

COMPENSATION DISCUSSION AND ANALYSIS

Compensation philosophy

The Corporation’s executive compensation program is based on the philosophy that in order to enhance long-term shareholder value, a strong and motivated leadership team must exist whose interests are aligned with the Corporation’s strategic goals.

To build and retain a high performing leadership team, the Corporation needs to be competitive with other comparable clinical-stage biotechnology companies. To enable the Corporation to attract and retain talent, compensation must balance fixed and variable components including strong base salaries along with both long- and short-term incentives that are tied to objective performance goals. The intent is to reward executives for demonstrated leadership and the achievement of strategic goals. By having these components of compensation in place, the executive leaders will focus on attaining the corporate performance goals, thereby creating success for the Corporation and creating value for our Shareholders.

Members of Compensation and Corporate Governance Committee

The members of the Compensation and Corporate Governance Committee are currently Mr. Wayne Pisano (Chairman), Mr. Wade Dawe and Mr. Albert Scardino. Mr. Andrew Sheldon attends the meetings of the Compensation and Corporate Governance Committee as a non-voting member. Mr. Pisano, Mr. Dawe and Mr. Scardino are all independent.

The education and related experience (as applicable) of each current Compensation and Corporate Governance Committee member is described below:

Wayne Pisano – Mr. Pisano is the former Chief Executive Officer of VaxInnate, a pandemic and influenza vaccine company. He also was the Chief Executive Officer of Sanofi Pasteur for over 3.5 years and had direct responsibility in evaluating the compensation levels for other executive officers.

Wade Dawe – Mr. Dawe, as Chairman and Chief Executive Officer of Fortune Bay Corp., is responsible for ensuring compensation levels are competitive and in line with the company’s business strategy. He is also the Chairman and Director of Stockport Exploration Inc. and former Chairman and Chief Executive Officer of Brigus Gold Corp.

Albert Scardino – Mr. Scardino has extensive experience as a director of both for-profit and not-for-profit organizations, public and private, in the US and the UK.

| 18 |

Role of Compensation and Corporate Governance Committee

The Compensation and Corporate Governance Committee of the Corporation (the “Compensation and Corporate Governance Committee”) has been assigned the responsibility of reviewing the remuneration package for the Chief Executive Officer, the Chief Financial Officer, and other senior executives and to recommend changes, if any, to the Board. In making its recommendations, the Compensation and Corporate Governance Committee considers each individual’s performance and remuneration and incentives paid to senior executives of comparable companies. The Compensation and Corporate Governance Committee also seeks the views of the members of the senior executive team, when reviewing compensation for other executive officers. It is also the responsibility of the Compensation and Corporate Governance Committee to review any proposals concerning the Corporation’s incentive stock option plan and deferred share unit plan, including grant proposals for approval by the Board.

The Compensation and Corporate Governance Committee evaluates all executive compensation policies and programs with a view to confirming that the policies and programs do not drive behaviors that would result in inappropriate or excessive risk taking, and that the Corporation’s compensation policies and practices do not result in identified risks that are likely to have a material effect on the Corporation. This evaluation process which focuses on five areas: 1) strategic / operational risk; 2) compliance risk; 3) reputational risk; 4) talent risk; and 5) financial / economic risk. Risks are assessed and considered on both an individual element basis and in totality.

The Corporation’s remuneration package is designed to attract, retain and reward highly qualified individuals and motivate them to achieve performance objectives aligned with the Corporation’s vision and strategic direction and consistent with shareholders value creation. The Corporation’s goal is to provide market competitive remuneration consistent with responsibility level, experience and performance. In addition, the Compensation and Corporate Governance Committee also takes into consideration the current financial position of the Corporation, the corporate objectives and evaluation of how these objectives were or were not met, and individual performance when determining annual compensation levels.

Benchmarking

In 2016, the Compensation and Corporate Governance Committee did not perform a benchmark analysis with respect to the Corporation’s executive compensation program.

Named Executive Officers

Applicable securities regulations require that the Corporation give details of the compensation paid to the Corporation’s “Named Executive Officers” who are defined as follows:

| (a) | the Chief Executive Officer of the Corporation; |

| (b) | the Chief Financial Officer of the Corporation; |

| (c) | each of the three most highly compensated executive officers of the Corporation, or the three mostly highly compensated individuals acting in a similar capacity, other than the Chief Executive Officer and Chief Financial Officer, at the end of the most recently completed financial year whose total compensation was, individually, more than $150,000 for that financial year; and |

| (d) | each individual who would be a named executive officer under paragraph (c) but for the fact that the individual was neither an executive officer of the Corporation, nor acting in a similar capacity, at the end of that financial year. |

Based on the above criteria, the Corporation has determined the Named Executive Officers to be the Chief Executive Officer, the Chief Financial Officer, the Chief Medical Officer, the Vice President of Clinical Research and the Vice President of Manufacturing and Product Development.

| 19 |

Components of Executive Compensation

The Corporation’s executive compensation philosophy is supported by the following four elements of our executive compensation program for the Named Executive Officers:

Fixed components:

| 1. | Base salary |

| 2. | Employee benefits program and other perquisites |

Variable components:

| 1. | Short-term incentive opportunity |

| 2. | Long-term incentive and retention program |

Each component of the executive compensation program is defined and discussed below.

Base salary

A competitive base salary serves to attract and retain strong leadership. The base salary for an executive is determined through the evaluation of the responsibilities of the position, the executive’s relevant experience, past and current performance, as well as through evaluation of market compensation levels for the role. Individual salaries are adjusted annually based on the individual’s competencies and through evaluation of the Corporation’s results.

Employee benefits program and other perquisites

The Corporation’s employee benefits program includes health, dental, vision, life and disability components and is designed to provide a level of protection to all employees, including executive officers, and their families in the event of death, illness, or disability.

In terms of perquisites, the Corporation’s RRSP matching program is open to all employees, including executives, and allows for Corporation matching of up to 5% of the employee’s base salary per year. The Corporation also sponsors up to 50% of the cost of fitness memberships for all employees to a maximum of $300.

Short-term incentive opportunity

The Corporation believes that long-term growth of value for Shareholders is derived from the execution of short and long-term approved strategic initiatives.

The annual incentive program for the Named Executive Officers is based on their performance as a team against corporate objectives approved by the Board of Directors. Bonuses are paid in full following awards approved by the Board of Directors, at its full discretion, based on recommendation of the Committee. The target for annual incentive compensation for Named Executives has been established as a percentage of their respective base salary as shown in the table, the Board of Directors retains full discretion in assessing such achievement and may approve an award in excess of such target. In addition, the Board may also factor in individual achievement, if warranted.

The annual incentive is calculated as a percentage of the salary as shown in the table.

| 20 |

| Maximum annual incentive in | Distribution of the annual incentive in 2016 | |||||||||||||||||||

| percentage of | Corporate | Personal | ||||||||||||||||||

| Named Executive Officers | the salary | objectives | performance | Education | Total | |||||||||||||||

| Frederic Ors | 50 | % | 100 | % | - | - | 100 | % | ||||||||||||

| Kimberly Stephens | 30 | % | 100 | % | - | - | 100 | % | ||||||||||||

| Gabriela Rosu(1) | Nil | Nil | Nil | Nil | Nil | |||||||||||||||

| Marc Mansour(2) | Nil | Nil | Nil | Nil | Nil | |||||||||||||||

| Leeladhar Sammatur | 25 | % | 80 | % | 15 | % | 5 | % | 100 | % | ||||||||||

| Rita Nigam | 25 | % | 80 | % | 15 | % | 5 | % | 100 | % | ||||||||||

| (1) | Dr. Rosu joined the Corporation on November 7, 2016 and was not eligible for a bonus in 2016. |

| (2) | Dr. Mansour resigned on March 15, 2016 with an effective date on March 31, 2016. |

As part of its duties and responsibilities and in conjunction with year-end assessments, the Committee will review the realization of the Corporation’s objectives and meet with management to discuss and consider each element contained in the corporate objectives. The Committee also meets in private to discuss this matter.

The Corporation’s 2016 annual key objectives (the “2016 Key Objectives”) were grouped under four general goals including (i) Financial/share Appreciation, (ii) Scientific/Clinical, (iii) Business Development/Partnering and (iv) Human Resources. The following specific objectives were underlying 2016 Key Objectives:

| Objectives | % | Attainment | ||||||||||||||

| Financial / | 1. | Execute a Board approved financing strategy by | 20 | % | 100% | 20 | % | |||||||||

| Share Appreciation | Q2 2016, which secures a minimum of $7.5 million for the Corporation to fund operations and the planned clinical trials over the next year. | - | Raised $16M in 2016 in two bought deals at a minimal discount | |||||||||||||

| 2. | Execute an IR/PR strategy, in cooperation with the Finance Committee to increase exposure to Canadian/ US investors | 20 | % |

- | 50% Stock price was around 0.40$ when new CEO was appointed at the end of March 2016 and was $0.68 on December 30, 2016. | 10 | % | |||||||||

| - | Two new analyst coverage | |||||||||||||||

| - | More trading volume | |||||||||||||||

| TOTAL | 40 | % | 30 | % | ||||||||||||

| Scientific / | 1. | Obtain interim clinical data with DPX-Survivac | 6 | % | 90% | 5.5 | % | |||||||||

| Clinical | - | Results in Q1-2017 | ||||||||||||||

| 2. | Successfully receive regulatory clearance for a | 6 | % | 100% | 6 | % | ||||||||||

| combination trial with a checkpoint inhibitor in ovarian cancer by Q4 2016 | - | Approval of Incyte trial by FDA and Health Canada | ||||||||||||||

| 3. | Successfully initiate a Phase 2 combination trial | 6 | % | 0% | 0 | % | ||||||||||

| - | Not yet initiated | |||||||||||||||

| 4. | To generate the pre-clinical data to support | 6 | % | 100% | 6 | % | ||||||||||

| another immunotherapy combination with a defined clinical path | - | PD-1 +CPA + DPX Survivac combination study successfully completed | ||||||||||||||

| 5. | To be compliant for DPX-Survivac (GMP, GCP, | 6 | % | 100% | 6 | % | ||||||||||

| GLP) confirmed by external audit by Q4 2016. | - | Successfully completed | ||||||||||||||

| TOTAL | 30 | % | 23.5 | % | ||||||||||||

| 21 |

| Objectives | % | Attainment | ||||||||||||||

| Business | 1. | Finalize a clinical trial collaboration with a | 8.3 | % | 80% | 6.75 | % | |||||||||

| Development /Partnering | pharma company with their checkpoint inhibitor. | - | Approval received but implementation significantly delayed | |||||||||||||

| 2. | Secure at least one additional clinical trial | 8.3 | % | 80% | 6.75 | $ | ||||||||||

| collaboration with a pharmaceutical company with a checkpoint inhibitor. | - | Final approval from Merck but contract with PMH not yet finalized | ||||||||||||||

| 3. | Sign licensing deals for infectious diseases. | 8.4 | % | 0% | 0 | % | ||||||||||

| - | Entered into new collaboration with Leidos (Zika and Malaria) | |||||||||||||||

| TOTAL | 25 | % | 13.5 | % | ||||||||||||

| Human | 1. | Expand the senior management team by one | 1.67 | % | 100% | 1.67 | % | |||||||||

| Resources | additional officer. | - | Hired Chief Medical Officer | |||||||||||||

| 2. | Improve communications across the Corporation | 1.67 | % | 100%: | 1.67 | % | ||||||||||

| - | Increased frequency of executive and company meetings. | |||||||||||||||

| 3. | Invest in employees’ professional development | 1.67 | % | 100% | 1.67 | % | ||||||||||

| by ensuring that every employee completes professional development training that benefits them in their role within the Corporation. | - | Successfully completed at all levels with GxP training, project management and other job specific training | ||||||||||||||

| TOTAL | 5 | % | 5 | % | ||||||||||||

| TOTAL | 100 | % | 72 | % | ||||||||||||

The Compensation and Corporate Governance Committee then reviewed the Annual Incentive Award recommendation prepared by the Chief Executive Officer for all Named Executive Officers (except for himself). The Committee also assessed the Chief Executive Officer’s performance for 2016 and, further to such review the Committee provided a recommendation to the Board. The Board reviewed and discussed the recommendation of the Committee for the Named Executive Officers and for the Chief Executive Officer and approved the following payment of the Annual Incentive Award to the Named Executive Officers and the Chief Executive Officer:

| Annual incentive | Distribution of the annual incentive in 2016 | |||||||||||||||||||

| approved as a | Corporate | Personal | ||||||||||||||||||

| percentage of Base | objectives | performance | Education | Total | ||||||||||||||||

| Named Executive Officers | Salary | ($) | ($) | ($) | ($) | |||||||||||||||

| Frederic Ors | 36.7 | % | 110,000 | — | — | 110,000 | ||||||||||||||

| Kimberly Stephens | 22.5 | % | 43,300 | — | — | 43,300 | ||||||||||||||

| Gabriela Rosu(1) | Nil | Nil | Nil | Nil | Nil | |||||||||||||||

| Marc Mansour(2) | Nil | Nil | Nil | Nil | Nil | |||||||||||||||

| Leeladhar Sammatur | 19.0 | % | 23,000 | 5,400 | 2,000 | 30,400 | ||||||||||||||

| Rita Nigam | 18.9 | % | 23,000 | 5,300 | 2,000 | 30,300 | ||||||||||||||

| (1) | Dr. Rosu joined the Corporation on November 7, 2016 and was not eligible for a bonus in 2016. |

| (2) | Dr. Mansour resigned on March 15, 2016 with an effective date on March 31, 2016. |

| 22 |

Long-term incentive and retention program

Stock option grants are part of the long-term incentive and retention program and serve to motivate and encourage executives and employees to deliver performance that increases the value of the Corporation through growth of the share price over the long term. All stock option grants are approved by the Board through its Compensation and Corporate Governance Committee. The process for issuing stock option grants is in line with the short-term incentive program described above. Previous grants of stock options are taken into account when considering new grants. The Stock Option Plan provides for the issuance of options to the Corporation’s directors and employees (and for the purposes of the Stock Option Plan, an “employee” includes a person who provides services to the Corporation). See “Securities Authorized for Issuance Under Equity Compensation Plans” on page 29 of this Circular for a summary of the material provisions of the Stock Option Plan.

Named Executive Officers or directors are not permitted to purchase financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the Named Executive Officer or director.

Employee Inducement Options

As an inducement for Ms. Gabriela Rosu to join the Corporation as Chief Medical Officer, Ms. Rosu was granted, on November 7, 2016, 200,000 stock options of the Corporation (the “CMO Options”). The CMO Options were issued outside the number of options available for grant under the Stock Option Plan as per the Toronto Stock Exchange’s Company Manual but are governed by the terms of the Stock Option Plan. The CMO Options have an exercise price of $0.69, vest in accordance with the following schedule: (i) 66,666 options will vest 6 months after the date of grant; (ii) 66,667 additional options will vest 12 months after the date of grant; and (iii) the remaining 66,667 options will vest 18 months after the date of grant and the CMO Options expire on November 7, 2021.

Option-based awards

Option-based awards are granted in accordance with the terms set out in the above section “Long-term incentive and retention program”.

| 23 |

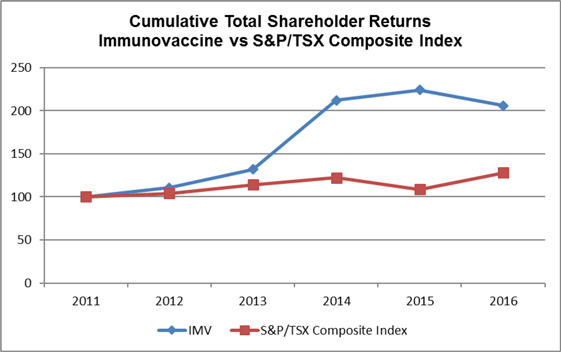

PERFORMANCE GRAPH

The following graph compares the total cumulative shareholder return for $100 invested in the Corporation’s Common Shares on December 31, 2011 with the cumulative total return of the Toronto Stock Exchange’s S&P/TSX Composite Index (including the reinvestment of dividends) for the five most current completed financial years.

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | |||||||||||||||||||

| IMV | $ | 100.00 | $ | 110.61 | $ | 131.82 | $ | 212.12 | $ | 224.24 | $ | 206.06 | ||||||||||||