No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise. This prospectus supplement, together with the short form base shelf prospectus dated June 5, 2018 to which it relates, as amended or supplemented, and each document incorporated or deemed to be incorporated by reference in this prospectus supplement and in the short form base shelf prospectus dated June 5, 2018 to which it relates, constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities. See “Plan of Distribution.”

Information has been incorporated by reference in this prospectus supplement, and in the short form base shelf prospectus dated June 5, 2018 to which it relates from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of IMV Inc. at 130 Eileen Stubbs Avenue, Suite 19, Dartmouth, Nova Scotia, Canada, B3B 2C4 (telephone (902) 492-1819), and are also available electronically at www.sedar.com.

PROSPECTUS SUPPLEMENT

TO THE SHORT FORM BASE SHELF PROSPECTUS DATED JUNE 5, 2018

| New Issue | March 18, 2020 |

IMV INC.

US$30,000,000

Common Shares

IMV Inc. (“IMV” or the “Corporation”) has entered into an Equity Distribution Agreement dated March 18, 2020 (the “Equity Distribution Agreement”) with Piper Sandler & Co. (“Piper Sandler”) relating to the Corporation’s common shares (the “Common Shares”). In accordance with the terms of the Equity Distribution Agreement, the Corporation may offer and sell Common Shares having an aggregate offering price of up to US$30,000,000 (the “Offered Shares”) through Piper Sandler, as agent, under this prospectus supplement (the “Prospectus Supplement”). See “Plan of Distribution” beginning on page S-13 of this Prospectus Supplement for more information regarding these arrangements.

The Common Shares are listed on the Toronto Stock Exchange (the “TSX”) under the symbol “IMV” and on the Nasdaq Capital Market (“Nasdaq”) under the symbol “IMV”. On March 17, 2020, the last trading day of the Common Shares on the TSX and Nasdaq before the date hereof, the closing price of the Common Shares was C$2.90 and US$2.00, respectively. The TSX has conditionally approved the listing of the Offered Shares offered by this Prospectus Supplement, subject to the Corporation fulfilling all of the listing requirements of the TSX. The Nasdaq has been notified of the Offering. See “Plan of Distribution”.

Upon delivery of a placement notice by the Corporation, if any, Piper Sandler may sell the Offered Shares in the United States only and such sales will only be made by transactions that are deemed to be an “at-the-market” offering as defined in Rule 415 under the United States Securities Act of 1933, as amended (the “Securities Act”), including, without limitation, sales made directly on Nasdaq, or on any other existing trading market for the Common Shares in the United States (the “Offering”). No Offered Shares will be offered or sold in Canada or on the TSX or any other trading markets in Canada. See “Plan of Distribution” in this Prospectus Supplement. Piper Sandler will make all sales using commercially reasonable efforts consistent with their normal sales and trading practices and on mutually agreed upon terms between Piper Sandler and the Corporation. The Offered Shares will be distributed at the market prices prevailing at the time of the sale of such Offered Shares. As a result, prices may vary as between purchasers and during the period of distribution. There is no arrangement for funds to be received in escrow, trust or similar arrangement.

The compensation to Piper Sandler for sales of the Offered Shares under this Prospectus Supplement will not exceed three percent (3%) of the gross proceeds from the sale of such Offered Shares. See “Plan of Distribution” in this Prospectus Supplement. The net proceeds, if any, from sales under this Prospectus Supplement will be used as described under the section titled “Use of Proceeds” in this Prospectus Supplement. The proceeds the Corporation receives from sales will depend on the number of Offered Shares actually sold and the offering price of such Offered Shares. In connection with the sale of the Offered Shares on the Corporation’s behalf, Piper Sandler will be deemed to be an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act, and the compensation of Piper Sandler will be deemed to be an underwriting commission or discount. IMV has agreed to provide indemnification and contribution to Piper Sandler against certain liabilities, including liabilities under the Securities Act.

Neither Piper Sandler, nor any of its affiliates or any person or company acting jointly or in concert with Piper Sandler, has over-allotted, or will over-allot, Common Shares in connection with this Offering or effect any other transactions that are intended to stabilize or maintain the market price of the Common Shares.

An investment in the Offered Shares involves a high degree of risk. Prospective investors should carefully consider the risk factors described in and/or incorporated by reference in this Prospectus Supplement and the Base Shelf Prospectus. See “Cautionary Statement Regarding Forward-Looking Statements” and “Risk Factors”.

The offering of Securities hereunder is made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system (“MJDS”) adopted by the United States and Canada, to prepare this Prospectus Supplement and the Base Shelf Prospectus in accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those of the United States. Annual financial statements for the year ended December 31, 2018 included or incorporated herein have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”) and are subject to Canadian auditing and auditor independence standards and thus may not be comparable to financial statements of United States companies.

The enforcement by investors of civil liabilities under the United States federal securities laws may be affected adversely by the fact that the Corporation is incorporated or organized under the laws of a foreign country, that some or all of its officers and directors may be residents of a foreign country, that some or all of the experts named in this Prospectus Supplement and the Base Shelf Prospectus may by residents of a foreign country and that all or a substantial portion of the assets of the Corporation and said persons may be located outside the United States. See “Enforceability of Judgments”.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (THE “SEC”), THE SECURITIES COMMISSION OF ANY STATE OF THE UNITED STATES OR ANY CANADIAN SECURITIES COMMISION OR REGULATORY AUTHORITY NOR HAVE ANY OF THE FOREGOING PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS SUPPLEMENT AND THE BASE SHELF PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Prospective investors should be aware that the acquisition, holding or disposition of the Offered Shares described herein may have tax consequences both in the United States and in Canada. Such consequences for investors who are resident in, or citizens of, the United States and Canada may not be described fully herein. You should read the tax discussion contained in this Prospectus Supplement and consult your own tax advisor with respect to your own particular circumstances. See the sections titled “Certain Canadian Federal Income Tax Considerations”, “Certain U.S. Federal Income Tax Considerations” and “Risk Factors.”

The Offered Shares may only be sold in those jurisdictions where offers and sales are permitted. This Prospectus Supplement is not an offer to sell or a solicitation of an offer to buy the Offered Shares in any jurisdiction in which it is unlawful.

ii

Julia Gregory, Wayne Pisano and Markus Warmuth, members of the board of directors of the Corporation, all reside outside of Canada and have appointed IMV Inc., 130 Eileen Stubbs Avenue, Suite 19, Dartmouth, Nova Scotia, Canada, B3B 2C4, as agent for service of process. Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process.

The Corporation’s head office and registered office is located at 130 Eileen Stubbs Avenue, Suite 19, Dartmouth, Nova Scotia, Canada, B3B 2C4.

There is no minimum amount of funds that must be raised under this offering. This means that the Corporation could complete this offering after raising only a small proportion of the offering amount set forth above.

Piper Sandler & Co.

Prospectus Supplement dated March 18, 2020

iii

TABLE OF CONTENTS

Prospectus Supplement

TABLE OF CONTENTS

Base Shelf Prospectus

ii

This document is in two parts. The first part is this Prospectus Supplement, which describes the terms of the Offering and adds to and updates information in the accompanying Base Shelf Prospectus and the documents incorporated by reference therein. The second part is the accompanying Base Shelf Prospectus, which gives more general information, some of which may not apply to the Offering. This Prospectus Supplement is deemed to be incorporated by reference into the accompanying Base Shelf Prospectus solely for the purposes of this Offering. This Prospectus Supplement may add, update or change information contained in the accompanying Base Shelf Prospectus. Before investing, you should carefully read both this Prospectus Supplement and the accompanying Base Shelf Prospectus together with the additional information about the Corporation to which you are referred in the sections of this Prospectus Supplement and the Base Shelf Prospectus titled “Documents Incorporated by Reference”.

Purchasers of Offered Shares should rely only on the information contained in or incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus. The Corporation has not authorized anyone to provide purchasers with different or additional information. If information in this Prospectus Supplement is inconsistent with the Base Shelf Prospectus or the information incorporated by reference, you should rely on this Prospectus Supplement. If anyone provides purchasers with different or additional information, purchasers should not rely on it. Neither the Corporation nor Piper Sandler are making an offer to sell or seeking an offer to buy the Offered Shares in any jurisdiction where the offer or sale is not permitted. Purchasers should assume that the information contained in this Prospectus Supplement and the Base Shelf Prospectus is accurate only as of the date on the front of those documents and that information contained in any document incorporated by reference is accurate only as of the date of that document, regardless of the time of delivery of this Prospectus Supplement and the Base Shelf Prospectus or of any sale of the Offered Shares. The Corporation’s business, financial condition, results of operations and prospects may have changed since those dates.

This Prospectus Supplement and the Base Shelf Prospectus include references to trade names and trademarks of other companies, which trade names and trademarks are the properties of their respective owners.

The corporate website of the Corporation is www.imv-inc.com. The information on the Corporation’s website is not intended to be included or incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus and prospective purchasers should not rely on such information when deciding whether or not to invest in the Offered Shares.

Statistical information and other data relating to the pharmaceutical and biotechnology industry included in this Prospectus Supplement and the Base Shelf Prospectus are derived from recognized industry reports published by industry analysts, industry associations and/or independent consulting and data compilation organizations. Market data and industry forecasts used throughout this Prospectus Supplement and the Base Shelf Prospectus were obtained from various publicly available sources. Although the Corporation believes that these independent sources are generally reliable, the accuracy and completeness of the information from such sources are not guaranteed and have not been independently verified.

This Prospectus Supplement and the Base Shelf Prospectus are part of the Corporation’s registration statement on Form F-10 (File No. 333-225326) filed with and declared effective by the U.S. Securities and Exchange Commission under the Securities Act (as amended, the “U.S. Registration Statement”). This Prospectus Supplement and the Base Shelf Prospectus do not contain all of the information set forth in the U.S. Registration Statement, certain parts of which are omitted in accordance with the rules and regulations of the SEC, or the schedules or exhibits that are part of the U.S. Registration Statement. Investors in the United States should refer to the U.S. Registration Statement and the exhibits thereto for further information with respect to IMV and the Offered Shares.

In this Prospectus Supplement, the Base Shelf Prospectus and the documents incorporated by reference herein and therein, unless the context otherwise requires, references to “IMV” or the “Corporation” refer to IMV Inc., together with its subsidiary, Immunovaccine Technologies Inc. (“IVT”).

S-1

The consolidated financial statements incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus and the other documents incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus, and the financial data derived from those consolidated financial statements included in this Prospectus Supplement and the Base Shelf Prospectus, are presented in Canadian dollars, unless otherwise specified, and have been prepared in accordance with IFRS. References in this Prospectus Supplement to “dollars”, “C$” or “$” are to Canadian dollars. United States dollars are indicated by the symbol “US$”.

The following table lists, for each period presented, the high and low exchange rates, the average of the exchange rates during the period indicated, and the exchange rates at the end of the period indicated, for one Canadian dollar, expressed in United States dollars, based on the exchange rate published by the Bank of Canada for the applicable periods. Periods prior to March 1, 2017 are based on the noon rate published by the Bank of Canada. Periods from and after March 1, 2017 are based on the closing exchange rate published by the Bank of Canada.

| Year ended December 31, | Nine Months

ended September 30, | |||||||||||||||||||

| 2019 | 2018 | 2017 | 2019 | 2018 | ||||||||||||||||

| High for the period | 0.7699 | 0.8138 | 0.8245 | 0.7670 | 0.8138 | |||||||||||||||

| Low for the period | 0.7353 | 0.7330 | 0.7276 | 0.7353 | 0.7513 | |||||||||||||||

| End of period | 0.7699 | 0.7330 | 0.7971 | 0.7551 | 0.7725 | |||||||||||||||

| Average for the period | 0.7537 | 0.7721 | 0.7708 | 0.7524 | 0.7769 | |||||||||||||||

On March 17, 2020, the closing exchange rate for one Canadian dollar, expressed in United States dollars, as reported by the Bank of Canada, was C$1.00 = US$0.7055.

Cautionary Statement Regarding Forward-Looking Statements

Certain statements contained in this Prospectus Supplement, the Base Shelf Prospectus and the documents incorporated by reference in this Prospectus Supplement and the Base Shelf Prospectus may constitute “forward-looking information” within the meaning of applicable securities laws in Canada and “forward-looking statements” within the meaning of the United States Private Securities Legislation Reform Act of 1995 (collectively, “forward-looking statements”) which involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Corporation, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. When used in this Prospectus Supplement, such statements reflect current expectations regarding future events and operating performance and speak only as of the date of this Prospectus Supplement. Forward-looking statements may use such words as “will”, “may”, “could”, “intends”, “potential”, “plans”, “believes”, “expects”, “projects”, “estimates”, “anticipates”, “continue”, “predicts” or “should” and other similar terminology.

Forward-looking statements include, but are not limited to, statements relating to:

| - | the Corporation’s business strategy; |

| - | statements with respect to the sufficiency of the Corporation’s financial resources to support its activities; |

| - | potential sources of funding; |

| - | the Corporation’s ability to obtain necessary funding on favorable terms or at all; |

| - | the Corporation’s expected expenditures and accumulated deficit level; |

| - | the Corporation’s expected outcomes from its ongoing and future research and research collaborations; |

| - | the Corporation’s ability to obtain necessary regulatory approvals; |

| - | the Corporation’s expected outcomes from its pre-clinical studies and trials; |

S-2

| - | the Corporation’s exploration of opportunities to maximize shareholder value as part of the ordinary course of its business through collaborations, strategic partnerships and other transactions with third parties; |

| - | the Corporation’s plans for the research and development of certain product candidates; |

| - | the Corporation’s strategy for protecting its intellectual property; |

| - | the Corporation’s ability to identify licensable products or research suitable for licensing and commercialization; |

| - | the Corporation’s ability to obtain licences on commercially reasonable terms; |

| - | the Corporation’s plans for generating revenue; |

| - | the Corporation’s plans for future clinical trials; |

| - | the Corporation’s expected reporting with respect to its cash equivalents and working capital as of December 31, 2019; |

| - | the Corporation’s expected use of the net proceeds from this offering, if any; and |

| - | the Corporation’s hiring and retention of skilled staff. |

The forward-looking statements reflect the Corporation’s current views with respect to future events, are subject to risks and uncertainties, and are based upon a number of estimates and assumptions that, while considered reasonable by the Corporation, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors could cause the Corporation’s actual results, performance or achievements to be materially different from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements, including, among others:

| - | obtaining additional funding on reasonable terms when necessary; |

| - | positive results of pre-clinical studies and clinical trials; |

| - | the Corporation’s ability to successfully develop existing and new products; |

| - | the Corporation’s ability to hire and retain skilled staff; |

| - | the products and technology offered by the Corporation’s competitors; |

| - | general business and economic conditions, including as a result of the pandemic outbreak of COVID-19 |

| - | the Corporation’s ability to protect its intellectual property; |

| - | the Corporation’s ability to manufacture its products and to meet demand; |

| - | the general regulatory environment in which the Corporation operates; and |

| - | obtaining necessary regulatory approvals and the timing in respect thereof. |

Should one or more of these risks or uncertainties materialize, or should the assumptions set out in the section entitled “Risk Factors” underlying those forward-looking statements prove incorrect, actual results may vary materially from those described herein. These forward-looking statements are made as of the date of this Prospectus Supplement or the date of the Base Shelf Prospectus or, in the case of documents incorporated by reference in this Prospectus Supplement or the Base Shelf Prospectus, as of the date of such documents, and the Corporation does not intend, and does not assume any obligation, to update these forward-looking statements, except as required by law. There is no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Purchasers are cautioned that forward-looking statements are not guarantees of future performance and accordingly purchasers are cautioned not to put undue reliance on forward-looking statements due to the inherent uncertainty therein. New factors emerge from time to time, and it is not possible for management of the Corporation to predict all of these factors or to assess in advance the impact of each such factor on the Corporation’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement.

S-3

In addition, statements that “the Corporation believes” and similar statements reflect management’s beliefs and opinions on the relevant subject. These statements are based upon information available to management as of the date of this Prospectus Supplement, and while management believes such information forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate that management has conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

The forward-looking statements contained in this Prospectus Supplement and the Base Shelf Prospectus are expressly qualified by the foregoing cautionary statements and are made as of the date of this Prospectus Supplement or the Base Shelf Prospectus. The Corporation does not undertake any obligation to publicly update or revise any forward-looking statements, except as required by applicable securities laws. Purchasers should read this entire Prospectus Supplement and the Base Shelf Prospectus and consult their own professional advisors to assess the income tax, legal, risk factors and other aspects of their investment in the Offered Shares.

DOCUMENTS INCORPORATED BY REFERENCE

This Prospectus Supplement is deemed to be incorporated by reference into the Base Shelf Prospectus solely for the purpose of the Offering. Other information has also been incorporated by reference in the Base Shelf Prospectus from documents filed with the securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of the Corporation at 130 Eileen Stubbs Avenue, Suite 19, Dartmouth, Nova Scotia, Canada, B3B 2C4 (telephone (902) 492-1819), and are also available electronically on the Corporation’s issuer profile at www.sedar.com.

In addition to the continuous disclosure obligations of the Corporation under the securities laws of certain provinces of Canada, the Corporation is subject to certain of the information requirements of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in accordance therewith file reports and other information with the SEC. Under MJDS, some reports and other information may be prepared in accordance with the disclosure requirements of Canada, which requirements are different from those of the United States. As a foreign private issuer, the Corporation is exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements, and the Corporation’s officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, the Corporation may not be required to publish financial statements as promptly as U.S. companies. A free copy of any public document filed by IMV with the SEC’s Electronic Data Gathering and Retrieval (“EDGAR”) system is available from the SEC’s website at www.sec.gov.

As of the date hereof, the following documents filed with the securities commissions or similar authorities in the provinces of British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, Québec, Nova Scotia and Newfoundland and Labrador are specifically incorporated by reference in and form an integral part of this Prospectus Supplement:

| (i) | the annual information form of the Corporation dated April 1, 2019 for the year ended December 31, 2018 (the “AIF”); |

| (ii) | the audited annual consolidated financial statements of the Corporation and the notes thereto for the years ended December 31, 2018 and 2017, together with the auditor’s report thereon; |

| (iv) | the unaudited interim condensed consolidated financial statements of the Corporation and the notes thereto for the nine months ended September 30, 2019 and 2018; |

S-4

| (vi) | the management information circular dated April 4, 2019 relating to the annual and special meeting of shareholders of the Corporation held on May 9, 2019; |

| (vii) | the material change report dated March 1, 2019 relating to the pricing of an underwritten public offering of Common Shares (the “2019 Public Offering”); and |

| (viii) | the material change report dated March 6, 2019 relating to the closing of the 2019 Public Offering. |

All documents of the Corporation of the type described in Section 11.1(1) of Form 44-101F1 — Short Form Prospectus to National Instrument 44-101 — Short Form Prospectus Distributions (“NI 44-101”), including any documents of the Corporation of the type referred to in the preceding paragraph and any material change reports (excluding any confidential material change reports) filed by the Corporation with a securities commission or similar regulatory authority in Canada on or after the date of this Prospectus Supplement and prior to the termination of the Offering shall be deemed to be incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus.

In addition, to the extent that any document or information incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus is included in any report on Form 6-K, Form 40-F or Form 20-F (or any respective successor form) that is filed with or furnished to the SEC by the Corporation after the date of this Prospectus, such document or information shall be deemed to be incorporated by reference as an exhibit to the U.S. Registration Statement of which this Prospectus forms a part. In addition, the Corporation may incorporate by reference into this Prospectus, or the U.S. Registration Statement of which it forms a part, other information from documents that the Corporation will file with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act, if and to the extent expressly provided therein.

Any statement contained in this Prospectus Supplement, the Base Shelf Prospectus or in a document incorporated or deemed to be incorporated by reference in this Prospectus Supplement or the Base Shelf Prospectus shall be deemed to be modified or superseded for purposes of this Prospectus Supplement to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference in this Prospectus Supplement or the Base Shelf Prospectus modifies or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. Any statement so modified or superseded shall not be deemed to constitute a part of this Prospectus Supplement or the Base Shelf Prospectus, except as so modified or superseded.

You should rely only on the information contained in or incorporated by reference in this Prospectus Supplement and the Base Shelf Prospectus and on the other information included in the U.S. Registration Statement of which the Base Shelf Prospectus forms a part. The Corporation is not making an offer of Offered Shares in any jurisdiction where the offer is not permitted by law.

DOCUMENTS FILED AS PART OF THE U.S. REGISTRATION STATEMENT

The following documents have been or will be (through post-effective amendment or incorporation by reference) filed with the SEC as part of the U.S. Registration Statement of which this Prospectus is a part insofar as required by the SEC’s Form F-10:

| · | the documents listed under “Documents Incorporated by Reference” in this Prospectus; |

| · | the form of Equity Distribution Agreement described in this Prospectus Supplement; |

| · | the consent of PricewaterhouseCoopers LLP, the Corporation’s independent auditor; |

S-5

| · | the consent of McCarthy Tétrault LLP, the Corporation’s Canadian counsel; and |

| · | powers of attorney of the Corporation’s directors and officers, as applicable. |

| Common Shares Offered by the Corporation | Common Shares having an aggregate offering price of up to US$30,000,000 | |

| Manner of Offering | “At-the-market” offering that may be made from time to time through Piper Sandler, as sales agent. See the section titled “Plan of Distribution” on page S-13 of this Prospectus Supplement. | |

| Use of Proceeds | The Corporation intends to use the net proceeds of the Offering for general corporate purposes including but not limited to working capital expenditures, capital expenditures, research and development expenditures, including development of its vaccine candidate DPX-COVID-19, and clinical trial expenditures. See the section titled “Use of Proceeds” on page S-12 of this Prospectus Supplement. | |

| Risk Factors | Investing in the Common Shares involves a high degree of risk. Please read the information contained in and incorporated by reference under the section titled “Risk Factors” beginning on page S-16 of this Prospectus Supplement, and under similar headings in the other documents that are filed after the date hereof and incorporated by reference into this Prospectus Supplement. | |

| Nasdaq Symbol | “IMV” | |

| TSX Symbol | “IMV” |

Piper Sandler may sell the Offered Shares in the United States only and such sales will only be made by transactions that are deemed to be an “at-the-market” offering as defined in Rule 415 under the Securities Act, including, without limitation, sales made directly on Nasdaq, or on any other existing trading market for the Common Shares in the United States. No Common Shares will be offered or sold in Canada or on the TSX or any other trading markets in Canada.

The following description of IMV is derived from selected information about the Corporation contained in the documents incorporated by reference and does not contain all of the information about the Corporation and its business that should be considered before investing in the Offered Shares. This Prospectus Supplement, the accompanying Base Shelf Prospectus and the documents incorporated by reference herein and therein should be reviewed and considered by prospective purchasers in connection with their investment in the Offered Shares. This Prospectus Supplement may add to, update or change information in the accompanying Base Shelf Prospectus. You should carefully read this entire Prospectus Supplement and the accompanying Base Shelf Prospectus, including the risks and uncertainties discussed in the section titled “Risk Factors,” and the information incorporated by reference in this Prospectus Supplement, including the consolidated financial statements of the Corporation, before making an investment decision. If you invest in the Corporation’s securities, you are assuming a high degree of risk.

The Corporation was incorporated on May 18, 2007 under the name of Rhino Resources Inc. pursuant to the Canada Business Corporations Act. On September 28, 2009, the Corporation changed its name to Immunovaccine Inc. and consolidated its outstanding share capital on a 5 to 1 basis. On May 2, 2018, the Corporation changed its name to IMV Inc. and consolidated its outstanding share capital on a 3.2 to 1 basis.

The Corporation has one wholly-owned subsidiary, IVT, which is incorporated under the laws of Nova Scotia.

The Corporation’s head and registered office is located at 130 Eileen Stubbs Avenue, Suite 19, Dartmouth, Nova Scotia, Canada, B3B 2C4.

S-6

Overview

IMV is a clinical-stage biopharmaceutical company dedicated to making immunotherapy more effective, more broadly applicable, and more widely available to people facing cancer and other serious diseases. IMV is headquartered in Dartmouth, Nova Scotia and currently has 67 employees. IMV is pioneering a new class of immunotherapies based on the Corporation’s proprietary drug delivery platform (“DPX”). This patented technology leverages a novel mechanism of action (“MOA”) discovered by the Corporation. This MOA does not release the active ingredients at the site of injection but forces an active uptake by immune cells (antigen-presenting cells) and delivery of active ingredients into lymph nodes. This unique MOA enables the programming of immune cells in vivo, which are aimed at generating powerful target-specific therapeutic capabilities. DPX’s no-release MOA can be leveraged to generate “first-in-class” T cell therapies with the potential, in the opinion of IMV, to be disruptive in the treatment of cancer.

The DPX platform is based on active ingredients formulated in lipid nanoparticles and, after freeze drying, suspended directly into a lipidic formulation. DPX-based products are stored in a dry format, which provides the added benefit of an extended shelf life. The formulation is designed to be easy to re-suspend and administer to patients.

DPX also has multiple manufacturing advantages; it is fully synthetic, can accommodate hydrophilic and hydrophobic compounds, is amenable to a wide-range of applications (for example, peptides, small molecules, RNA/DNA or antibodies), and provides long-term stability.

The DPX platform forms the basis of all IMV’s product development programs.

The Corporation’s first cancer immunotherapy uses survivin-based peptides licensed from Merck KGaA, on a world-wide exclusive basis, formulated in DPX (“DPX-Survivac”). DPX-Survivac leverages the MOA of DPX to generate a constant flow of T cells in the blood that are targeted against survivin expressed on cancer cells. It is comprised of five minimal MHC class I peptides to activate naïve T cells against survivin.

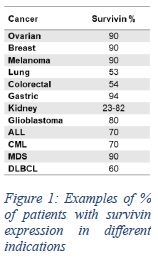

The Corporation’s first cancer immunotherapy uses survivin-based peptides licensed from Merck KGaA, on a world-wide exclusive basis, formulated in DPX (“DPX-Survivac”). Survivin is a well characterized and tumor-associated antigen known to be overexpressed in more than 20 different cancers. DPX-Survivac leverages the MOA of the DPX platform to generate a constant flow of killer T cells in the blood that are targeted against survivin expressed on cancer cells. It is comprised of five minimal MHC class I peptides to activate naïve T cells against survivin.

Foremost, the Corporation’s clinical strategy is to target late stage unmet medical needs for a potentially shorter path to clinical demonstration and first regulatory approval. In addition, the Corporation is evaluating potential combinations with checkpoint inhibitor Keytruda® (pembrolizumab) of Merck & Co Inc. (“Merck”) in multiple solid tumor indications, as discussed below. |

|

The Corporation is focusing on a path to market in ovarian and diffuse large B cell lymphoma (“DLBCL”) cancers and on repeating its clinical demonstrations of activity in other indications.

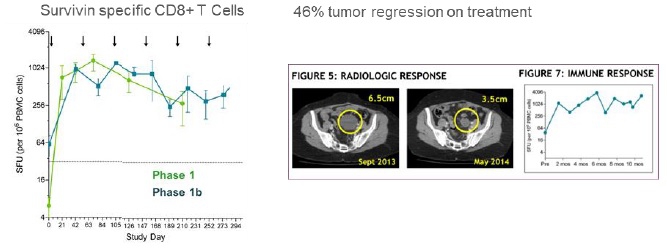

The Corporation has completed Phase 1 and 1b clinical trials in ovarian cancer in a maintenance setting after first or second line in 56 subjects.

The results provided first in human clinical demonstration of DPX-Survivac mechanism of action (survivin-specific T cell flow in the blood) and potential as treatment. 87% of patients generated one of the highest T cell levels reported in the literature and that level was maintained during a year with repeated injection every two months.

S-7

Figure 2: Phase 1/1b result (ASCO 2015)

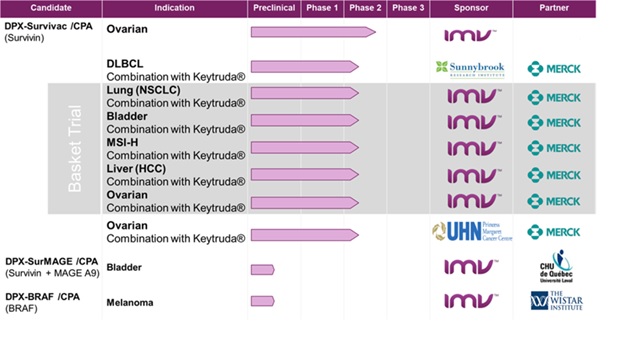

DPX-Survivac is currently being tested in:

| · | a phase 2 open label clinical trial which evaluates DPX-Survivac in patients with advanced platinum-sensitive and resistant ovarian cancer with sum of baseline target lesions per RECIST criteria less than five centimeters; |

| · | two investigator-sponsored phase 2 clinical trials in combination with Merck’s checkpoint inhibitor Keytruda® (pembrolizumab) in patients with recurrent, platinum-resistant and sensitive ovarian cancer and in patients with measurable or recurrent DLBCL. In these cases, the primary and secondary endpoints include objective response rate (“ORR”), tumor regression, toxicity profile and duration of responses; and |

| · | a phase 2 basket trial in combination with Merck’s Keytruda® (pembrolizumab), in five different indications in patients with select advanced or recurrent solid tumours in bladder, liver (“hepatocellular carcinoma”), ovarian or non-small-cell lung (“NSCLC”) cancers, as well as tumours shown to be positive for the microsatellite instability high (“MSI-H”) biomarker. |

S-8

Figure 3: Ongoing phase 2 clinical trials

In infectious disease vaccine applications, the Corporation has completed a demonstration phase 1 clinical trial with a target against the respiratory syncytial virus (“RSV”). The Corporation also has a commercial licensing agreement with Zoetis for the development of two targeted therapies for cattle and is also conducting several research and clinical collaborations, including a collaboration with the Dana-Farber Cancer Institute for Human Papillomavirus (“HPV”) related cancers and with Leidos, Inc. in the United States for the development of targeted therapies for malaria and the Zika virus.

For further information, see “Description of the Business” in the AIF.

Phase 2 SPiReL Study

On December 8, 2019, the Corporation announced that updated results from SPiReL, an ongoing Phase 2 investigator-sponsored study of DPX-Survivac in combination with pembrolizumab in patients with recurrent/refractory diffuse large B-cell lymphoma (“r/r DLBCL”), were presented in a poster session at the 61st American Society of Hematology (“ASH”) Annual Meeting in Orlando, FL. The poster, which included additional data collected between the abstract submission and the presentation, continued to demonstrate a favorable therapeutic profile and treatment-associated clinical benefit in r/r DLBCL patients who received the combination therapy with DPX-Survivac.

In the poster presentation at ASH, Dr. Neil Berinstein, MD, FFCPC, ABIM, hematologist at Sunnybrook Health Sciences Centre and lead investigator for the clinical trial, reported updated clinical results from the ongoing Phase 2 SPiReL study. Highlights of this preliminary data are outlined below:

| · | 7/9 (77.8%) evaluable subjects exhibited clinical benefit, including three (33.3%) complete responses and two (22.2%) partial responses; |

| · | Reproducible survivin-specific T cell responses observed in all subjects that achieved clinical responses on treatment; |

S-9

| · | One subject, who received three prior lines of systemic therapies and failed autologous stem cell transplant, reached a complete response at the first on-study scan following treatment with the DPX-Survivac combination regimen and remains free of disease recurrence after completing the study; and |

| · | Clinical benefits and favorable toxicity profile observed in a heterogenous population of r/r DLBCL patients, including patients of advanced age and/or with comorbidities, who are more susceptible to adverse effects and more difficult to treat. |

As of December 1, 2019, 17 subjects had been enrolled in the study.

Clinical Translational Data

On February 4, 2020, IMV announced that clinical translational data supporting the MOA of DPX-Survivac, would be presented during the 2020 ASCO-SITC Clinical Immuno-Oncology Symposium being held in early February 2020 in Orlando, FL. As part of this analysis, the Corporation measured systemic immune responses, tumor immune infiltrates and clinical tumor response from pre- and post-treatment patient samples in connection with three Phase 1 and/or Phase 2 clinical studies, each evaluating DPX-Survivac alone or in a combination with pembrolizumab in patients with platinum sensitive or resistant, advanced ovarian cancer. Highlights from these translational data include:

| · | DPX-Survivac generated survivin-specific T cells in the blood of 80% of patients sampled; |

| · | Clinical anti-tumor responses were correlated with increased infiltration of T cells into tumors following treatment with DPX-Survivac; |

| · | DPX-Survivac induced enrichment in T cell, cytotoxic lymphocytes and B cell-specific signatures which correlate with clinical response; and |

| · | Antigen-specific T cells retained their functionality throughout the duration of treatment. |

Board retirement

On February 14, 2020, IMV announced that Albert Scardino would retire from the board of directors of the Corporation effective February 28, 2020.

Phase 2 DeCidE1 Study

On February 25, 2020, IMV reported updated results from DeCidE1, an ongoing Phase 2 study of its lead candidate, DPX-Survivac, in patients with advanced recurrent ovarian cancer. The new results show that DPX-Survivac immunotherapy is active and well-tolerated in patients with advanced ovarian cancer.

As of February 24, 2020, 19 patients were evaluable for efficacy with six patients (31%) still receiving treatment. Key preliminary findings are outlined below:

| · | 15 patients (79%) achieved disease control, defined as Stable Disease (“SD”) or Partial Response (“PR”) on target lesions: |

| o | Tumor shrinkage of target lesions was observed in 10 patients (53%). |

| · | Durable clinical benefits lasting ≥6 months were observed in seven patients (37%) so far: |

| o | Four of these seven patients (21% of evaluable patients) achieved PR with tumor regression >30% on target lesions; |

| o | Three stable diseases were ongoing for > 6 months (range 7-9) including -29.5% and -12% tumor regressions; and |

| o | Median duration not reached yet, with five of these seven (71%) patients still on treatment at > 6 months (range 7-10). |

S-10

| · | Analysis of Baseline Tumor Burden (“BTB”) showed durable clinical benefits across a broad range of BTB (1.5-7.7 cm) with a higher number of patients achieving benefits in BTB < 5 cm as previously observed in other arms of the study: |

| o | Six out 11 with BTB < 5 cm (55%) achieved clinical benefits lasting > 6 months. |

| · | Durable clinical benefits include platinum-resistant and refractory patients who previously received PARP inhibitors and bevacizumab. |

| · | Treatment was well-tolerated, with most adverse events being Grade 1-2 reactions at the injection site. |

The Corporation plans to take these results to the U.S. Food and Drug Administration (“FDA”) for a Type B meeting, to align on the design of a Phase 2b study with potential to support registration under accelerated approval in this indication.

DPX-COVID-19

The ongoing pandemic outbreak of COVID-19 and its alarmingly quick transmission to over 125 countries across the world resulted in the World Health Organization (WHO) declaring a pandemic on March 11, 2020.

The outbreak is caused by a novel coronavirus, the Severe Acute Respiratory Syndrome Coronavirus 2 (SARS-CoV-2). There is an urgent need to develop vaccines to control its spread and help protect vulnerable populations. However, the bottleneck with current conventional vaccine approaches is the length of time required for vaccine development. We believe IMV’s DPX delivery technology offers the possibility of a fully synthetic epitope-based approach with the potential for accelerated development and rapid, large-scale production of a vaccine that would be compliant with current good manufacturing practice (cGMP).

Research in coronaviruses has identified the benefit of humoral and cellular (B and T cell) immune responses for treatment and protection from infection.

IMV believes that it has already demonstrated in multiple clinical trials in oncology and infectious diseases the potential of its technology for the induction of robust and sustained B and T cells. The Corporation believes there is an opportunity to pursue a COVID-19 development program to establish the clinical safety and immunogenicity using a similar approach for COVID-19.

IMV intends to develop its vaccine candidate DPX-COVID-19 in collaboration with lead investigators for the phase 1 clinical study: Joanne Langley, M.D. and Scott Halperin, M.D., of the Canadian Center for Vaccinology (CCfV) at Dalhousie University, the Izaak Walton Killam Health Center and the Nova Scotia Health Authority and the Canadian Immunization Research Network (CIRN); along with Dr. Gary Kobinger, Ph.D., Director of the Research Centre on Infectious Diseases at the University Laval in Quebec City and Global Urgent and Advanced Research and Development (GUARD) in Canada. The investigators will assist with preclinical and clinical evaluation and with further development strategy in collaboration with the Canadian government and others.

Third-party research in related coronaviruses has identified the benefit of humoral and cellular (B and T cell) immune responses for protection and resolution of infection, and the Company believes the body of data it has produced to date supports its DPX platform for peptide-based induction of B cells and T cells. The Corporation is now designing a vaccine candidate against COVID-19 based on third-party immunological studies of SARS-CoV and third-party sequencing data available for SARS-CoV-2 with the goal of selecting potentially immunogenic epitopes within the virus that induce neutralizing antibody responses and protective T cell responses.

Through the Corporation’s other clinical studies, the Corporation believes its DPX technology has demonstrated a favorable safety profile and immunogenicity in both cancer and infectious disease settings, with sustained effect and potential for single-dose effectiveness as a prophylactic vaccine. Over 200 patients have been dosed with DPX-based immunotherapies and data from these studies suggest treatment is well-tolerated, including in heavily pre-treated cancer patients with advanced-stage disease. The Corporation has also applied this technology for the prevention of respiratory syncytial virus (RSV), the second-leading cause of respiratory illness in infants, the elderly and the immunosuppressed. The Corporation reported its Phase 1 data from its clinical candidate, DPX-RSV, which demonstrated a favorable safety profile and immunogenicity in older adults (age 50-64), as well as preclinical data from research-stage candidates aimed at other infectious diseases, including malaria and anthrax.

S-11

Expected Fiscal Year 2019 Earnings Results

While the Corporation has not yet finalized its full financial results for the fiscal year ended December 31, 2019, IMV expects to report that it had as of December 31, 2019, cash and cash equivalents of $14.9 million and working capital of $12.2 million. This amount is preliminary, has not been audited and is subject to change upon completion of the audited financial statements for the year ended December 31, 2019.

Since September 30, 2019, the end of the most recent interim reporting period of the Corporation, there have been no material changes in the long term debt of the Corporation and no material changes in the share capital of the Corporation on a consolidated basis other than as outlined under “Prior Sales”. For information on the exercise of options pursuant to the stock option plan of the Corporation and other outstanding convertible securities, see the section titled “Prior Sales”.

The net proceeds from the Offering, if any, are not determinable in light of the nature of the distribution. The net proceeds of any given distribution of Offered Shares through Piper Sandler in an “at-the-market offering” will represent the gross proceeds after deducting the compensation payable to Piper Sandler under the Equity Distribution Agreement and expenses of the distribution. Piper Sandler will receive a cash fee not exceeding three percent (3%) of the gross proceeds realized from the sale of the Offered Shares for services rendered in connection with the Offering. The Corporation estimates the total expenses of this Offering, excluding the fee paid to Piper Sandler, will be approximately US$200,000. All expenses relating to the Offering will be paid out of the proceeds from the sale of Offered Shares, unless otherwise stated in this Prospectus Supplement.

The Corporation has negative operating cash flow and it is expected that the proceeds from the Offering will be used to fund operating cash flow. The Corporation may sell Offered Shares for aggregate gross proceeds of up to US$30,000,000. Because there is no minimum amount of our Common Shares that must be sold pursuant to the Offering, the actual number of Offered Shares sold and aggregate proceeds to us, if any, are not presently determinable and may be substantially less than the amounts set forth above.

The Corporation intends to use the net proceeds of the Offering, if any, for general corporate purposes including but not limited to working capital expenditures, capital expenditures, research and development expenditures, including development of its vaccine candidate DPX-COVID-19, and clinical trial expenditures.

While the Corporation intends to spend the net proceeds of the Offering, if any, as stated above, there may be circumstances where, for sound business reasons, a re-allocation of funds may be necessary or advisable. The actual amount that the Corporation spends in connection with the intended uses of proceeds may vary significantly , and will depend on a number of factors, including those listed under the heading “Risk Factors” in this Prospectus Supplement and the accompanying Base Shelf Prospectus and the documents incorporated by reference herein and therein.

Negative Cash Flow

The Corporation has incurred significant operating losses and negative cash flows from operations since inception and has an accumulated deficit of C$111,644,000 as of September 30, 2019. The ability of the Corporation to continue as a going concern is dependent upon raising additional financing through equity and non-dilutive funding and partnerships. There can be no assurance that the Corporation will have sufficient capital to fund its ongoing operations, develop or commercialize any products without future financings. These material uncertainties cast significant doubt as to the Corporation’s ability to meet its obligations as they come due and, accordingly, the appropriateness of the use of accounting principles applicable to a going concern. If the Corporation is unable to obtain additional financing when required, the Corporation may have to substantially reduce or eliminate planned expenditures or the Corporation may be unable to continue operations.

S-12

The Corporation’s ability to continue as a going concern is dependent upon its ability to fund its research and development programs and defend its patent rights. It is expected that proceeds from the Offering will be used to fund anticipated negative cash flow from operating activities, as described above.

The Corporation has entered into the Equity Distribution Agreement with Piper Sandler under which it may issue and sell from time to time up to US$30,000,000 of Offered Shares through Piper Sandler, as agent. Sales of the Offered Shares, if any, will be made in transactions that are deemed to be an “at-the-market offering” as defined in Rule 415 under the Securities Act, including sales made directly on the Nasdaq, or on any other existing trading market for the Common Shares in the United States. Piper Sandler will use commercially reasonable efforts to sell the Offered Shares directly on the Nasdaq or other existing trading markets in the United States requested to be sold by the Corporation, consistent with Piper Sandler’s normal trading and sales practices, under the terms and subject to the conditions set forth in the Equity Distribution Agreement. No Offered Shares will be offered and sold in Canada. The Corporation and Piper Sandler may suspend the offering of Offered Shares upon proper notice and subject to other conditions, as specified in the Equity Distribution Agreement.

No Offered Shares will be sold in Canada or on the TSX or any other trading markets in Canada. Neither the Corporation nor Piper Sandler will undertake any act, advertisement, solicitation, conduct or negotiation directly or indirectly in furtherance of the sale of the Offered Shares in Canada, undertake an offer or sale of any of the Offered Shares to a person that it knows or has reason to believe is in Canada or has been pre-arranged with a buyer in Canada, or to any person who it knows or has reason to believe is acting on the behalf of persons in Canada or to any person whom it knows or has reason to believe intends to reoffer, resell or deliver the Offered Shares in Canada on the TSX or on other trading markets in Canada or to any persons in Canada or acting on behalf of persons in Canada.

To compensate Piper Sandler for services in acting as agent in the sale of Offered Shares, IMV will pay a commission not to exceed three percent (3%) of the gross sales price realized from the sale of the Offered Shares. The Corporation has also agreed to reimburse Piper Sandler for certain specified expenses, including the fees and disbursements of its legal counsel, in an amount not to exceed US$75,000, including fees and disbursements of Piper Sandler’s counsel incident to any required review by the Financial Industry Regulatory Authority. IMV estimates that the total expenses for the Offering, excluding compensation and reimbursements payable to Piper Sandler under the terms of the Equity Distribution Agreement, will be approximately US$200,000.

Settlement for sales of the Offered Shares will occur on the second business day following the date on which any sales are made, or on such other date as is industry practice for regular-way trading, in return for payment of the net proceeds to the Corporation. Sales of our Common Shares as contemplated in this Prospectus Supplement will be settled through the facilities of The Depository Trust Company or by such other means as we and the Agent may agree upon. There is no arrangement for funds to be received in escrow, trust or similar arrangement.

In connection with the sale of the Offered Shares on the Corporation’s behalf, Piper Sandler will be deemed to be an “underwriter” within the meaning of the Securities Act, and the compensation of Piper Sandler will be deemed to be an underwriting commission or discount. The Corporation has agreed to provide indemnification and contribution to Piper Sandler against certain civil liabilities, including liabilities under the Securities Act.

The Offering will terminate upon the issuance and sale of all Offered Shares subject to the Equity Distribution Agreement by Piper Sandler. The Corporation and Piper Sandler may also terminate the Equity Distribution Agreement under the circumstances specified in the Equity Distribution Agreement.

As sales agent, Piper Sandler will not engage in any transactions that stabilize the price of the Common Shares. No underwriter or dealer involved in the Offering, no affiliate of such an underwriter or dealer, and no person or company acting jointly or in concert with such an underwriter or dealer has over-allotted, or will over-allot, Common Shares in connection with the Offering or effect any other transactions that are intended to stabilize or maintain the market price of the Common Shares.

S-13

The Common Shares are listed on the Nasdaq and the TSX under the symbol “IMV”. The Nasdaq has been notified of the Offering, and the TSX has conditionally approved the listing of the Offered Shares offered by this Prospectus Supplement, subject to the Corporation fulfilling all of the listing requirements of the TSX set out in the conditional approval letter.

Piper Sandler and its affiliates may in the future provide various investment banking, commercial banking and other financial services for IMV and its affiliates, for which services they may in the future receive customary fees. To the extent required under the Exchange Act, Piper Sandler will not engage in any market making activities involving the Common Shares while the Offering is ongoing under the Prospectus Supplement.

The Prospectus Supplement in electronic format may be made available on a website maintained by Piper Sandler and Piper Sandler may distribute this Prospectus Supplement and the accompanying Base Shelf Prospectus electronically.

Under no circumstances will any Offered Shares be sold pursuant to the Equity Distribution Agreement after July 5, 2020, which is 25 months after June 5, 2018 (the date that the receipt was issued for the Base Prospectus).

DESCRIPTION OF securities being distributed

IMV’s authorized share capital consists of an unlimited number of Common Shares and preferred shares (the “Preferred Shares”) issuable in series, all without par value. As of September 30, 2019, a total of 50,630,875 Common Shares and no Preferred Shares were issued and outstanding. 1,556,744 Common Shares were issuable upon the exercise of outstanding stock options, 134,766 Common Shares were issuable upon the exercise of outstanding warrants and 323,903 Common Shares were issuable upon the conversion of outstanding deferred share units (“DSUs”).

The Common Shares of the Corporation rank junior to the Preferred Shares with respect to the payment of dividends, return of capital and distribution of assets in the event of liquidation, dissolution or winding-up of the Corporation. Subject to the prior rights of the holders of Preferred Shares, the holders of Common Shares are entitled to receive dividends as and when declared by the Board of Directors of the Corporation. In the event of liquidation, dissolution or winding-up of the Corporation, subject to the prior rights of the holders of Preferred Shares, the holders of Common Shares are entitled to receive all the remaining property and assets of the Corporation. The holders of Common Shares are entitled to receive notice of and to attend and to vote at all meetings of the shareholders of the Corporation and each Common Share, when represented at any meeting of the shareholders of the Corporation, carries the right to one vote.

The Corporation has not paid any dividends to date on the Common Shares. The Corporation does not currently expect to pay any dividends on the Common Shares for the foreseeable future.

The following table sets out the details of the issuance by the Corporation of Common Shares, options to purchase Common Shares, warrants to purchase Common Shares, DSUs, if any, during the 12-month period before the date of this Prospectus Supplement:

| Security | Number | Price | Issuance Date | |||||||

| Common Shares(1) | 4,900,000 | C$ | 5.45 | March 6, 2019 | ||||||

| Common Shares(1) | 504,855 | C$ | 5.45 | March 11, 2019 | ||||||

| Common Shares(2) | 2,187 | C$ | 3.20 | March 29, 2019 | ||||||

| Common Shares(2) | 859 | N/A | (3) | March 29, 2019 | ||||||

| Common Shares(2) | 14,819 | N/A | (4) | June 3, 2019 | ||||||

| Common Shares(2) | 9,375 | C$ | 2.112 | September 11, 2019 | ||||||

| Common Shares(2) | 9,375 | C$ | 2.112 | September 18, 2019 | ||||||

| Stock options(5) | 100,000 | C$ | 3.95 | November 7, 2019 | ||||||

| Common Shares(2) | 37,386 | N/A | (6) | January 28, 2020 | ||||||

| Common Shares(2) | 15,625 | C$ | 2.112 | January 29, 2020 | ||||||

| Common Shares(2) | 2,928 | N/A | (7) | January 29, 2020 | ||||||

| Common Shares(2) | 10,112 | N/A | (8) | January 30, 2020 | ||||||

| Stock options(9) | 245,850 | C$ | 5.98 | January 30, 2020 | ||||||

| Common Shares(2) | 11,213 | N/A | (10) | January 31, 2020 | ||||||

S-14

| (1) | Common Shares issued pursuant to the 2019 Public Offering. |

| (2) | Common Shares issued upon exercise of stock options. |

| (3) | Cashless exercise of 2,344 options. |

| (4) | Cashless exercise of 24,407 options. |

| (5) | Grant of stock options governed by the Corporation’s stock option plan exercisable at a price of C$3.95 per Common Share until November 7, 2024. |

| (6) | Cashless exercise of 62,500 options. |

| (7) | Cashless exercise of 4,688 options. |

| (8) | Cashless exercise of 15,625 options. |

| (9) | Grant of stock options governed by the Corporation’s stock option plan exercisable at a price of C$5.98 per Common Share until January 30, 2025. |

| (10) | Cashless exercise of 17,188 options. |

The Common Shares are currently listed on the TSX under the symbol “IMV” and Nasdaq under the symbol “IMV”.

The following table provides the price ranges and trading volume of the Common Shares on the TSX for the periods indicated below:

| Price Ranges | ||||||||||||

| High | Low | Total Cumulative Volume | ||||||||||

| March 2019 | C$ | 6.00 | C$ | 4.78 | 1,462,493 | |||||||

| April 2019 | C$ | 5.53 | C$ | 3.95 | 1,207,785 | |||||||

| May 2019 | C$ | 6.17 | C$ | 4.86 | 1,167,399 | |||||||

| June 2019 | C$ | 5.91 | C$ | 3.58 | 1,446,270 | |||||||

| July 2019 | C$ | 4.60 | C$ | 3.55 | 592,613 | |||||||

| August 2019 | C$ | 4.20 | C$ | 3.06 | 593,529 | |||||||

| September 2019 | C$ | 4.40 | C$ | 3.22 | 397,164 | |||||||

| October 2019 | C$ | 4.10 | C$ | 3.01 | 689,477 | |||||||

| November 2019 | C$ | 3.95 | C$ | 2.77 | 1,003,585 | |||||||

| December 2019 | C$ | 4.10 | C$ | 3.30 | 748,590 | |||||||

| January 2020 | C$ | 6.52 | C$ | 3.70 | 1,255,811 | |||||||

| February 2020 | C$ | 6.69 | C$ | 2.87 | 2,630,254 | |||||||

| March 1-17, 2020 | C$ | 4.50 | C$ | 2.45 | 1,888,294 | |||||||

On March 17, 2020, the last trading day of the Common Shares on the TSX before the date of this Prospectus Supplement, the closing price of the Common Shares was C$2.90.

The following table provides the price ranges and trading volume of the Common Shares on Nasdaq for the periods indicated below:

| Price Ranges | ||||||||||||

| High | Low | Total Cumulative Volume | ||||||||||

| March 2019 | US$ | 4.37 | US$ | 3.60 | 1,482,792 | |||||||

| April 2019 | US$ | 4.06 | US$ | 2.90 | 480,834 | |||||||

| May 2019 | US$ | 4.57 | US$ | 3.56 | 669,721 | |||||||

| June 2019 | US$ | 4.50 | US$ | 2.69 | 703,778 | |||||||

| July 2019 | US$ | 3.82 | US$ | 2.72 | 305,853 | |||||||

| August 2019 | US$ | 3.13 | US$ | 2.25 | 143,136 | |||||||

| September 2019 | US$ | 3.31 | US$ | 2.48 | 121,673 | |||||||

| October 2019 | US$ | 3.16 | US$ | 2.29 | 109,836 | |||||||

| November 2019 | US$ | 3.19 | US$ | 2.11 | 205,451 | |||||||

| December 2019 | US$ | 3.11 | US$ | 2.52 | 534,473 | |||||||

| January 2020 | US$ | 4.93 | US$ | 2.85 | 1,158,669 | |||||||

| February 2020 | US$ | 5.12 | US$ | 2.13 | 2,055,492 | |||||||

| March 1-17, 2020 | US$ | 3.36 | US$ | 1.76 | 1,922,255 | |||||||

S-15

On March 17, 2020, the last trading day of the Common Shares on Nasdaq before the date of this Prospectus Supplement, the closing price of the Common Shares was US$2.00.

An investment in the Corporation’s securities involves risk. Before you invest in the Offered Shares, you should carefully consider the risks contained in or incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus, including the risks described below and in the AIF and Annual MD&A, which are incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus. The discussion of risks related to the business of the Corporation contained in or incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus comprises material risks of which the Corporation is aware. If any of the events or developments described actually occurs, the business, financial condition or results of operations of the Corporation would likely be adversely affected.

Risks Relating to the Corporation

Risks Related to the Financial Position and Need for Additional Capital

The Corporation has incurred significant losses since inception and expects to incur losses for the foreseeable future and may never achieve or maintain profitability.

Since inception, the Corporation has incurred significant operating losses. The net loss was $21.9 million for the year ended December 31, 2018, $12.0 million for the year ended December 31, 2017 and $8.9 million for the year ended December 31, 2016. As of September 30, 2019, the Corporation had an accumulated deficit of $111.6 million. To date, the Corporation has financed operations primarily through public offerings in Canada, private placements of securities, grants and license and collaboration agreements. The Corporation has devoted substantially all efforts to research and development, including clinical trials. IMV expects to continue to incur significant expenses and increasing operating losses for at least the next several years. The Corporation anticipates that the expenses will increase substantially if and as the Corporation:

| · | initiates or continues the clinical trials of DPX Survivac and other product candidates, such as DPX-SurMAGE, DPX-BRAF and DPX-COVID-19; |

| · | seeks regulatory approvals for the product candidates that successfully complete clinical trials; |

| · | establishes a sales, marketing and distribution infrastructure to commercialize products for which the Corporation may obtain regulatory approval; |

| · | maintains, expands and protects the Corporation’s intellectual property portfolio; |

| · | continues other research and development efforts; |

| · | hires additional clinical, quality control, scientific and management personnel; and |

S-16

| · | adds operational, financial and management information systems and personnel, including personnel to support product development and planned commercialization efforts. |

To become and remain profitable, the Corporation must develop and eventually commercialize a product or products with significant market potential. This development and commercialization will require the Corporation to be successful in a range of challenging activities, including successfully completing preclinical testing and clinical trials of the product candidates, obtaining regulatory approval for these product candidates and marketing and selling those products that obtain regulatory approval. The Corporation is only in the preliminary stages of some of these activities. The Corporation may never succeed in these activities and may never generate revenues that are significant or large enough to achieve profitability. Even if profitability is achieved, the Corporation may not be able to sustain or increase profitability on a quarterly or annual basis. Failure to become and remain profitable would decrease the value of the Corporation and could impair the Corporation’s ability to raise capital, expand the business, maintain research and development efforts or continue operations. A decline in the value of the Corporation could also cause shareholders to lose all or part of their investment.

The Corporation will need substantial additional funding. If the Corporation is unable to raise capital when needed, the Corporation would be forced to delay, reduce, terminate or eliminate product development programs, potentially including the ongoing and planned clinical trials of its products or its commercialization efforts.

The Corporation expects expenses to increase in connection with the ongoing activities, particularly as the Corporation continues the research, development and clinical trials of, and seeks regulatory approval for, the product candidates. In addition, if the Corporation obtains regulatory approval of any of the product candidates, the Corporation expects to incur significant commercialization expenses for product sales, marketing, manufacturing and distribution. Furthermore, the Corporation will need to obtain additional funding in connection with continuing operations. If the Corporation is unable to raise capital when needed or on attractive terms, the Corporation would be forced to delay, reduce, terminate or eliminate the product development programs, potentially including the ongoing and planned clinical trials of DPX Survivac.

As of December 31, 2019, the Corporation had cash and cash equivalents of $14.9 million and working capital of $12.2 million. This amount is preliminary, has not been audited and is subject to change upon completion of the audited financial statements for the year ended December 31, 2019.

The Corporation will need to obtain significant financing prior to the commercialization of any of its products, including funding to complete all of the required clinical trials related to such products. The Corporation does not currently have funds available to enable the Corporation to complete all of the required clinical trials for the commercialization of DPX Survivac and to fund operating expenses through the completion of these trials. The Corporation expects that it will require more than $50 million or more to conduct the clinical trials and fund operating expenses through the completion of these ongoing trials.

The Corporation’s future capital requirements will depend on many factors, including:

| · | the progress and results of the clinical trials of DPX Survivac and other product candidates; |

| · | the scope, progress, results and costs of preclinical development, laboratory testing and clinical trials for other product candidates; |

| · | the costs, timing and outcome of regulatory review of any product candidate; |

| · | the costs of commercialization activities, including product sales, marketing, manufacturing and distribution, for any of the product candidates for which regulatory approval is received; |

| · | revenue, if any, received from commercial sales of the Corporation’s product candidates, should any of the product candidates be approved by the FDA, Health Canada or a similar regulatory authority outside the United States and Canada; |

S-17

| · | the costs of preparing, filing and prosecuting patent applications, maintaining and enforcing the Corporation’s intellectual property rights and defending intellectual property related claims; |

| · | the extent to which the Corporation acquires or invests in other businesses, products and technologies; |

| · | the Corporation’s ability to obtain government or other third party funding; and |

| · | the Corporation’s ability to establish collaborations on favorable terms, if at all, particularly arrangements to market and distribute product candidates on a worldwide basis. |

Conducting preclinical testing and clinical trials is a time consuming, expensive and uncertain process that takes years to complete, and the Corporation may never generate the necessary data or results required to obtain regulatory approval and achieve product sales. In addition, the Corporation’s product candidates, if approved, may not achieve commercial success. The Corporation’s commercial revenues, if any, will be derived from sales of products that the Corporation does not expect to be commercially available for several years, if at all. Accordingly, the Corporation will need to continue to rely on additional financing to achieve the Corporation’s business objectives. Additional financing may not be available on acceptable terms to the Corporation, or at all.

Raising additional capital may cause dilution to existing shareholders, restrict operations or require the Corporation to relinquish rights to its technologies or product candidates.

Until such time, if ever, as the Corporation can generate substantial product revenues, the Corporation expects to finance its cash needs through a combination of equity offerings, debt financings, government or other third party funding, marketing and distribution arrangements and other collaborations, strategic alliances and licensing arrangements. Currently, the Corporation does not have any committed external source of funds. The Corporation will require substantial funding to complete the ongoing and planned clinical trials of DPX Survivac and other product candidates and to fund operating expenses and other activities. To the extent that the Corporation raises additional capital through the sale of equity or convertible debt securities, the shareholders ownership interest will be diluted, and the terms of these securities may include liquidation or other preferences that adversely affect the shareholders rights as a stockholder. Debt financing, if available, may involve agreements that include covenants limiting or restricting the Corporation’s ability to take specific actions, such as incurring additional debt, making capital expenditures or declaring dividends. If the Corporation raises additional funds through government or other third party funding, marketing and distribution arrangements or other collaborations, strategic alliances or licensing arrangements with third parties, the Corporation may have to relinquish valuable rights to its technologies, future revenue streams, research programs or product candidates or to grant licenses on terms that may not be favorable.

Risks Related to the Development and Commercialization of the Corporation’s Product Candidates

The Corporation does not have governmental authorization to begin clinical testing of DPX-COVID-19, and the process of conducting necessary clinical studies, manufacturing and clinical organization, as well as obtaining such governmental authorization from Health Canada is not guaranteed.

The Corporation is at the early stages of developing its proposed vaccine candidate DPX-COVID-19. Creating a new vaccine, testing it for toxicity and efficacy, securing clinical drug supply, scaling production and manufacturing, and establishing supply and distribution logistics are all steps that have significant natural time limitations. We have not received any authorization from Health Canada or any other governmental regulatory authority, to develop or initiate clinical trials for DPX-COVID-19, and although we have identified lead clinical investigators, the Corporation has not entered into any agreements for the establishment of clinical sites. Even if Health Canada were to accelerate the approval processes necessary to permit the Corporation to commence a phase 1 study and subsequent studies and trials to the maximum extent possible, the spread of the Coronavirus pandemic may be faster than its development efforts. There is no guarantee that even if the development of DPX-COVID-19 is successful, the Corporation will secure the necessary regulatory approval for its commercialization or that DPX-COVID-19 will receive market acceptance or reach the population in time. In addition, a number of other biotechnology companies, academic institutions and governmental entities are also researching and developing therapies and vaccines to address the COVID-19 pandemic, and many of these competitors have significantly greater financial and scientific resources than the Corporation. In light of the declaration by the World Health Organization of the pandemic, the third-party clinical investigators and clinical site operators that the Corporation may seek to collaborate with on the development of DPX-COVID-19, as well as governmental entities, may decide to prioritize or rationalize their resources in favor of competing therapies and vaccines. In such event, the Corporation’s efforts to develop DPX-COVID-19 could be delayed, which could harm the viability of this development program.

S-18

The Corporation depends heavily on the success of DPX Survivac and other product candidates. All of the product candidates are still in preclinical or clinical development. Clinical trials of any product candidate may not be successful. If the Corporation is unable to commercialize any product candidate or experiences significant delays in doing so, the business may be materially harmed.

All of the product candidates of the Corporation are still in preclinical or clinical development. The Corporation may never be able to obtain regulatory approval for any of its product candidates. The Corporation has committed significant human and financial resources to the development of DPX Survivac, and the DPX Platform. The ability to generate product revenues, which is not expected to occur for at least the next several years, if ever, will depend heavily on the successful development and eventual commercialization of these product candidates, especially DPX Survivac, the most advanced product candidate. The success of these product candidates will depend on several factors, including the following:

| · | successful completion of preclinical studies and clinical trials; |

| · | receipt of marketing approvals from the FDA, Health Canada and similar regulatory authorities outside the United States and Canada; |